Bitcoin started 2026 with some renewed energy, climbing roughly 8% for the reason that begin of the yr as institutional inflows, derivatives positioning and geopolitical developments have come collectively to raise sentiment throughout crypto markets.

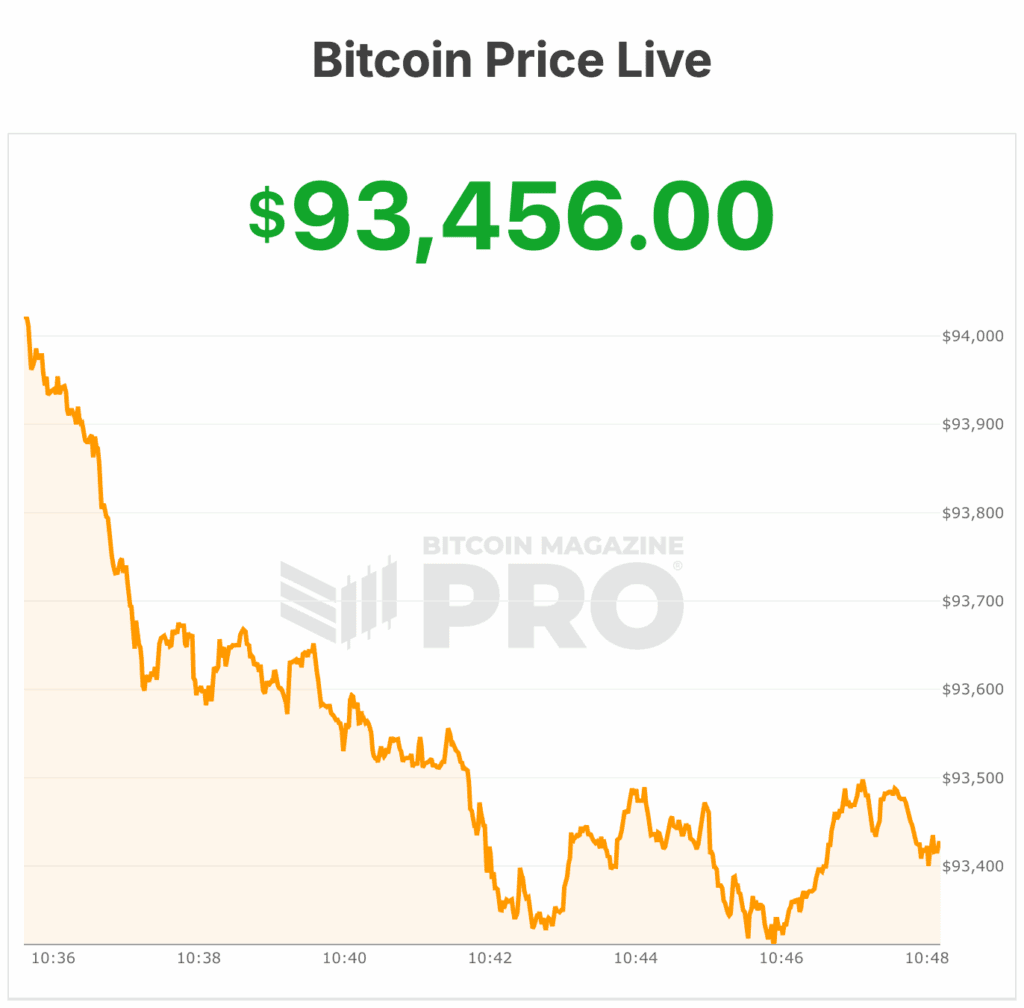

The bitcoin value is buying and selling close to $94,100 immediately, reaching ranges final seen in early December. The worth briefly touched an intraday excessive of $94,352 after opening the yr close to $87,400 on Jan. 1, per Bitcoin Journal Professional knowledge.

As of this morning, bitcoin was altering arms round $94,000, in keeping with market knowledge, placing it inside 1% of its current seven-day excessive.

The rally pushed bitcoin’s market capitalization to roughly $1.87 trillion, with each day buying and selling quantity hovering close to $51 billion. Bitcoin’s circulating provide stands just below 20 million cash, out of a set cap of 21 million.

The transfer larger adopted a interval of sideways buying and selling by means of late December, when the bitcoin value struggled to interrupt above resistance close to $91,000. That stage has since became short-term help, opening the door to a renewed check of the $94,000 – $98,000 vary that capped costs for a lot of the previous two months.

Geopolitics and the hedge narrative

Bitcoin’s rebound coincided with weekend reviews that america had captured Venezuelan President Nicolás Maduro, a improvement that rippled throughout commodity and crypto markets.

Oil shares jumped on expectations that Venezuela’s vitality sector might reopen beneath new management, whereas crypto-linked equities reminiscent of Coinbase and Technique every rose greater than 4%.

Analysts cautioned that the occasion itself was not a direct catalyst for bitcoin. As a substitute, it bolstered bitcoin’s function as a hedge towards geopolitical pressures and sanctions danger.

“Escalating strain with out direct army battle is supportive of bitcoin,” stated Dean Chen, an analyst at crypto derivatives change Bitunix. He pointed to historic patterns during which tighter sanctions, capital controls or restrictions on the worldwide banking system have coincided with elevated real-world bitcoin utilization.

Bitcoin value choices market targets six figures and ETF inflows return

Derivatives markets recommend merchants are positioning for additional upside. On Deribit, the world’s largest crypto choices change, open curiosity has surged in January name choices with a $100,000 strike value.

The $100,000 January name has develop into the preferred contract on the platform, with whole notional open curiosity reaching about $1.45 billion.

Spot bitcoin exchange-traded funds have additionally reemerged as a key driver. U.S.-listed bitcoin ETFs recorded practically $700 million in internet inflows on Monday, the strongest single-day whole since October, in keeping with trade knowledge.

That demand represents greater than 7,000 BTC, far exceeding each day new issuance from miners. Sustained ETF shopping for can tighten out there provide and help larger costs, significantly when paired with declining balances on exchanges.

On-chain knowledge exhibits roughly $1.2 billion value of bitcoin was withdrawn from exchanges over the previous 24 hours, an indication that traders are transferring cash into self-custody slightly than getting ready to promote.

Bitcoin value technical ranges

From a technical perspective, bitcoin value’s breakout from a multi-week consolidation has shifted consideration to resistance close to $98,000. A transfer above that stage might convey the psychological $100,000 mark again into play, a threshold bitcoin failed to carry throughout late-2025 rallies.

Help for bitcoin value now sits close to $91,400, with stronger backing round $87,000 if costs pull again. A failure beneath $84,000 would weaken the bitcoin value near-term construction, although longer-term bulls argue that rising yearly lows proceed to outline bitcoin’s broader uptrend.

For now, merchants enter the brand new yr with momentum on their aspect. Whether or not bitcoin value can flip the early-January surge right into a sustained breakout will depend upon continued ETF demand, choices market dynamics and the way international macro dangers evolve within the weeks forward.