Lengthy-term holders (LTH) of bitcoin have shifted again into accumulation for the primary time since July.

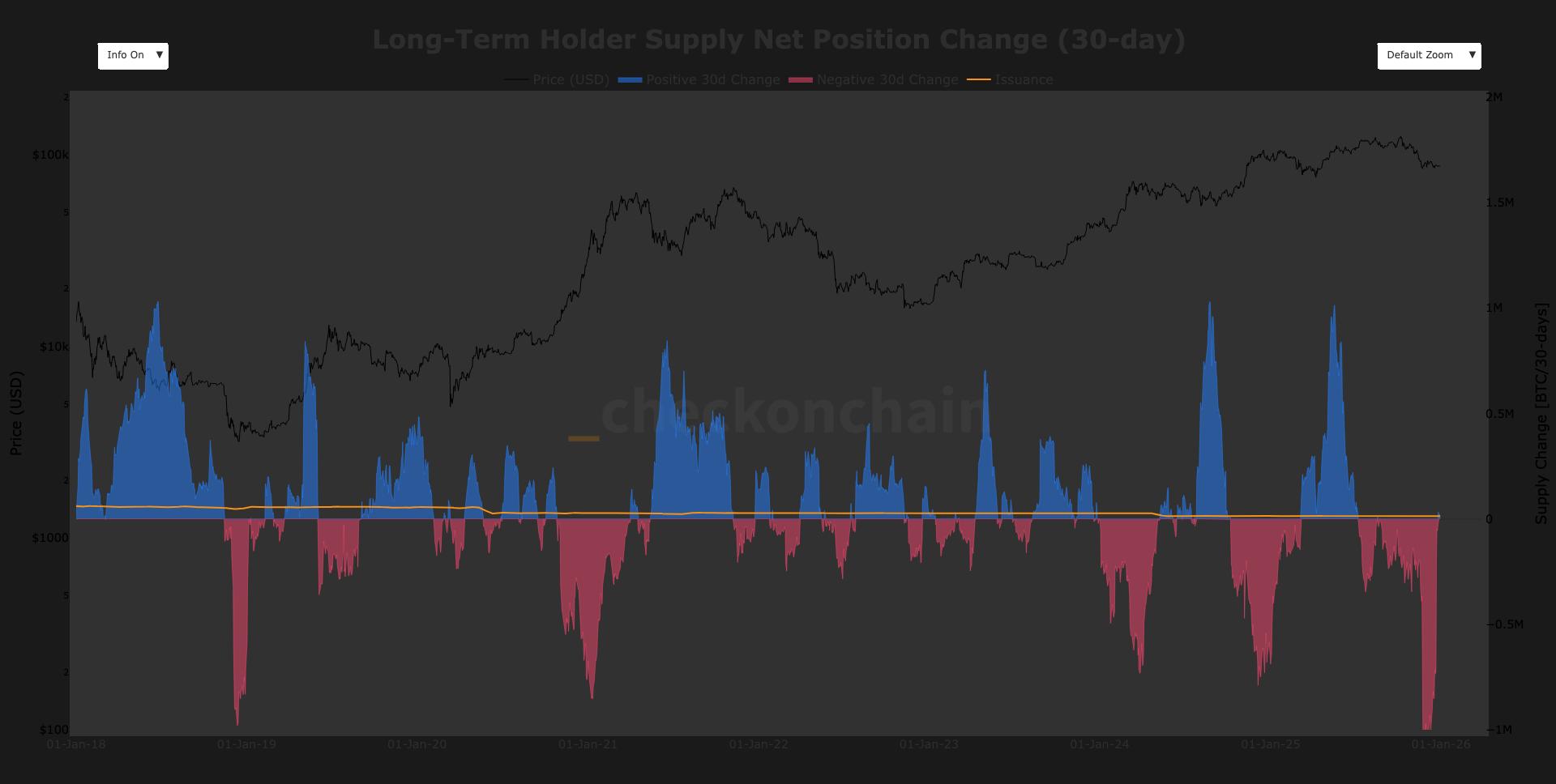

LTHs, outlined as entities which have held bitcoin for a minimum of 155 days, have collected roughly 33,000 BTC on a 30-day web foundation, in line with onchain information analysts checkonchain.

Promoting from LTHs has been one of many two of the biggest sources of promote strain this yr together with miner capitulation.

LTHs had been a serious supply of distribution, whereas miners are sometimes compelled to promote bitcoin whereas mining at a loss.

Because it takes 155 days for short-term holders to transition into long-term holders, this implies that patrons from the previous six months are actually turning into long-term holders and are outpacing the distribution.

LTHs offered greater than 1 million BTC throughout the 36% correction from October, marking the biggest sell-pressure occasion from this cohort since 2019, a interval that in the end coincided with the bear market low that yr, with bitcoin at round $3,200.

The October sell-off was the third LTH distribution section because the present cycle started in 2023. The primary occurred in March 2024 when bitcoin reached $73,000 and over 700,000 BTC had been offered, whereas the second happened that November when bitcoin reached $100,000 and greater than 750,000 BTC had been distributed by LTHs.