On-chain information exhibits the highest 100 whales on the Chainlink community have once more began accumulating the asset not too long ago, retracing their earlier distribution.

High Chainlink Addresses Have Been Including Since The Begin Of November

In a brand new submit on X, on-chain analytics agency Santiment has mentioned concerning the newest pattern within the holdings of the highest Chainlink addresses. Santiment defines “high addresses” because the 100 largest wallets on the community.

This class would naturally embrace the biggest of whales on the blockchain, who carry some extent of affect as a result of sheer dimension of their holdings. As such, the conduct of those buyers could also be value monitoring.

Now, right here is the chart shared by Santiment that exhibits how the Chainlink provide held by the highest addresses has modified over the previous couple of months:

As displayed within the above graph, the mixed provide of the 100 largest Chainlink wallets witnessed a decline in October, implying that these huge entities had been taking part in distribution.

The promoting from the highest addresses first started as LINK’s worth went by means of a pointy crash. The selloff continued till the beginning of November, when the indicator lastly arrived at a backside.

Shortly after, the provision of the 100 largest LINK buyers noticed a reversal, signaling the return of accumulation. In keeping with Santiment, these whales have collectively added 20.46 million tokens (about $263 million) to their holdings. This has not solely retraced the October drawdown of their provide, but additionally in actual fact taken it to a good greater stage.

Whereas the highest Chainlink addresses have proven web accumulation for the reason that begin of November, the tempo of shopping for hasn’t been fixed. From the chart, it’s obvious that many of the accumulation occurred in November, with not a lot coming in December to date.

It now stays to be seen what pattern the 100 largest LINK buyers will present subsequent, and whether or not it would have any affect on the place the cryptocurrency heads subsequent.

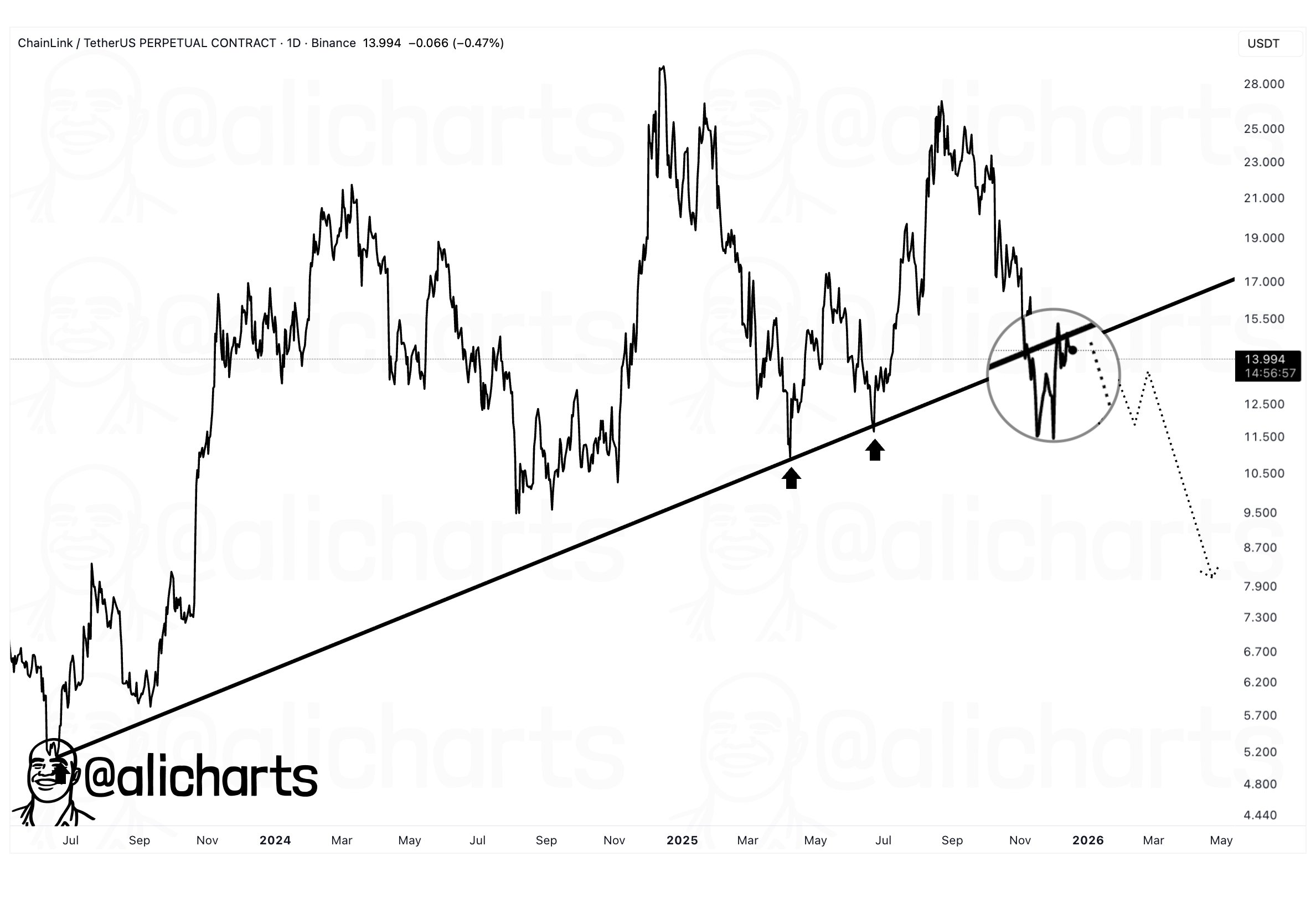

In another information, Chainlink not too long ago misplaced a multi-year technical assist line, as analyst Ali Martinez has highlighted in an X submit.

As is seen within the above chart, Chainlink made two retests of this line throughout the first half of 2025 and every time, it discovered assist. The retest that occurred after the newest worth downtrend, nonetheless, ended up in failure, with the asset dropping beneath this line for the primary time since 2023.

After the breakdown, LINK tried to retrace it, however the retest from beneath additionally resulted in rejection, a possible signal that the assist might have flipped into resistance.

LINK Worth

Following its most up-to-date drop, Chainlink is buying and selling round $12.96.