Bitcoin value hovered above $87,000 at this time as market sentiment and the Crypto Concern and Greed Index plunged to 11 out of 100, a stage signaling excessive concern amongst traders.

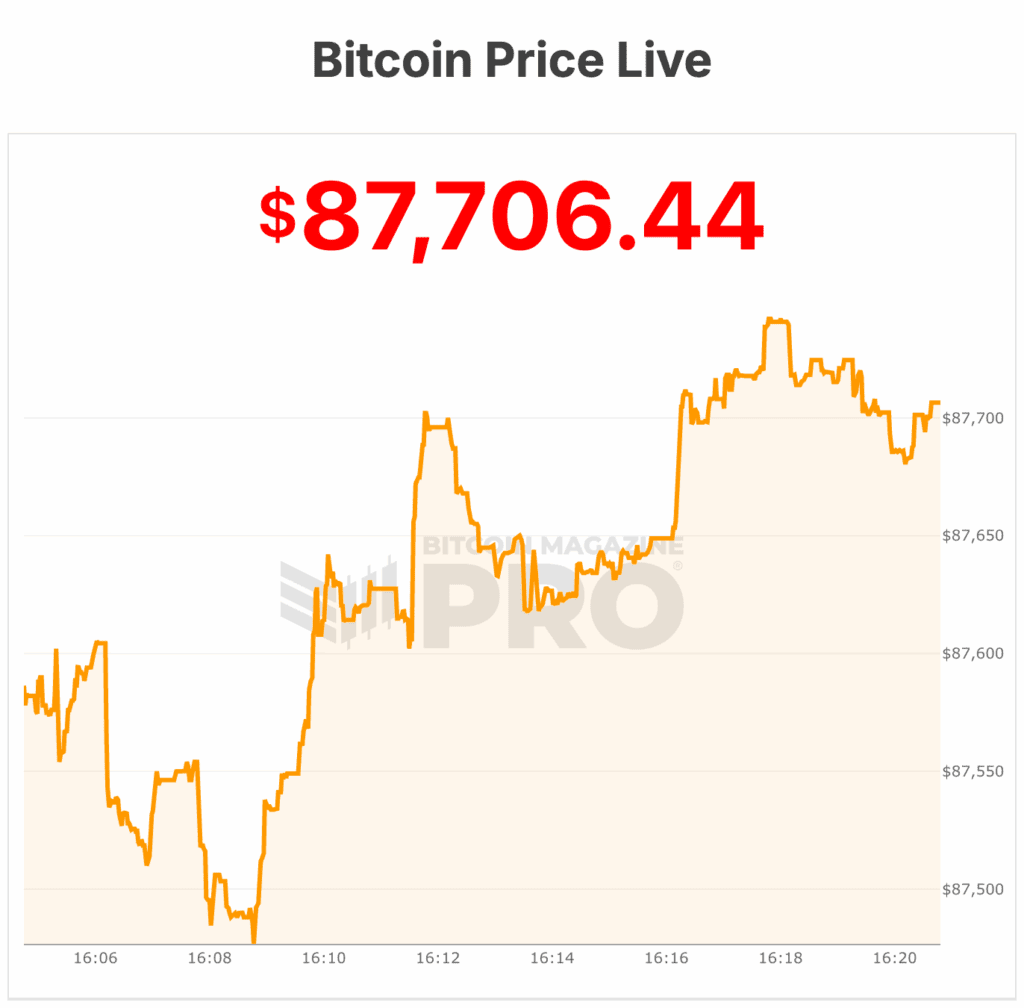

On the time of writing, the bitcoin value is buying and selling at $87,696, up roughly 2% over the previous 24 hours, in keeping with market knowledge. Regardless of the modest rebound, BTC stays trapped in a uneven consolidation vary, sitting simply 0.2% under its seven-day excessive of $87,918 and a pair of% above its weekly low close to $85,575.

Yesterday, the bitcoin value cratered from near $90,000 to the mid $85,000s.

Buying and selling quantity over the previous day totaled roughly $51 billion, suggesting continued participation however little conviction on both aspect of the market. Bitcoin’s whole market capitalization stood at $1.75 trillion, reflecting a 2% enhance over the prior 24 hours, in keeping with Bitcoin Journal Professional knowledge.

The uneasy value motion comes as sentiment has turned decisively bearish. The Concern and Greed Index—a composite indicator that includes volatility, quantity, social media traits, and momentum—has fallen deep into its lowest class, traditionally related to panic-driven promoting and heightened emotional decision-making.

Excessive concern hits crypto markets

A studying of 11 locations the market firmly in “excessive concern,” a zone sometimes marked by heightened draw back anxiousness and danger aversion. Traditionally, such situations have typically coincided with native bottoms, although timing stays unsure.

The index operates on a 0–100 scale, the place readings under 25 point out excessive concern and ranges above 75 counsel excessive greed.

At present ranges, traders seem extra involved about additional draw back than lacking potential upside, reinforcing the defensive tone seen throughout digital asset markets.Market contributors typically view excessive concern as a contrarian sign, arguing that widespread pessimism can create favorable long-term entry factors.

Skinny liquidity amplifies draw back strikes

Bitcoin value’s latest slide under the $90,000 stage occurred throughout sometimes illiquid weekend buying and selling, exacerbating volatility as sellers encountered restricted buy-side help. Costs fell from the low-$92,000 vary late final week to weekend lows close to $87,000, marking one of many sharpest short-term pullbacks since October’s all-time excessive.

The broader crypto market mirrored bitcoin’s weak spot. Main altcoins continued to submit double-digit month-to-month losses, whereas bitcoin dominance climbed towards 57%, underscoring a flight to relative security throughout the digital asset advanced.

Muted volumes counsel the transfer decrease displays warning quite than capitulation, with merchants reluctant to deploy contemporary capital forward of key macroeconomic occasions.

Globally, consideration can be turning to Japan, the place the Financial institution of Japan is broadly anticipated to boost rates of interest. Such a transfer may stress yen-funded carry trades which have supported international danger belongings over the previous 12 months, probably including one other headwind for crypto markets.

Bitcoin value ranges in focus

From a technical perspective, analysts are carefully watching the mid-$80,000 vary as near-term help. A sustained break under this zone may open the door to a deeper retracement towards the low-$80,000s or under.

Conversely, holding present ranges would reinforce the view that the bitcoin value stays range-bound quite than getting into a chronic bearish part.

Regardless of the gloomy temper, long-term narratives stay intact for a lot of traders, significantly as institutional participation continues to increase by means of spot bitcoin ETFs and broader regulatory readability.

For now, nonetheless, bitcoin’s value motion displays a market caught between structural optimism and short-term concern—an uneasy steadiness that has pushed sentiment to one in every of its most pessimistic readings of the 12 months.

Regardless of all this, earlier at this time, asset supervisor Bitwise launched a brand new report that argues that bitcoin is poised to interrupt from its historic four-year market cycle, setting new all-time highs in 2026 whereas changing into much less risky and fewer correlated with equities.

On the time of writing, the bitcoin value is $87,706.