Disclosure: The views and opinions expressed right here belong solely to the writer and don’t symbolize the views and opinions of crypto.information’ editorial.

Institutional traders poured round $50 billion into crypto ETFs this 12 months. Fortune 500 blockchain adoption hit 60%. Main exchanges like Coinbase reported file income. The narrative is evident: crypto has lastly achieved mainstream legitimacy.

Abstract

- Web3 progress is inflated: As much as 70% of reported customers and advertising and marketing spend are bots or Sybil wallets, not actual people.

- The economics are damaged: True consumer acquisition prices are 2–5× greater than reported, and most airdrops reward faux or extractive actors.

- Verification is now important: Web3’s subsequent winners will probably be tasks that show actual human utilization, not these optimizing self-importance metrics.

However there’s a quantity lacking from that story: one that ought to terrify everybody betting on web3’s progress. Solely 30% of web3 advertising and marketing budgets truly attain actual people. The remaining 70% evaporates into bot farms, Sybil networks, and automatic arbitrage schemes.

And right here’s what makes it worse: 65% of customers who enroll by no means turn into actual customers in any respect. They’re pockets downloads, automated transactions, and faux engagement — the digital equal of paying for a live performance the place 70% of the viewers is cardboard cutouts.

Institutional traders aren’t simply betting on blockchain know-how anymore. They’re betting on consumer metrics that don’t exist.

The disaster no one needs to debate

When Web3Quest analyzed verification information throughout main crypto tasks in 2025, we found one thing that contradicts each bullish narrative within the business.

The verification hole is catastrophic:

| Consumer acquisition stage | Whole customers recorded | Verified actual customers | Pretend/bot customers |

| Preliminary signup | 100% | 35% | 65% |

| Pockets related | 70% | 28% | 58% |

| First transaction | 42% | 22% | 48% |

| 7-day energetic | 20% | 15% | 25% |

| 30-day retained | 8% | 7% | 12.5% |

What this implies: A mission that stories a million customers has truly acquired roughly 350,000 real people. The opposite 650,000 are bots, duplicate wallets, and automatic engagement programs.

However mission founders aren’t mendacity of their decks to traders. They genuinely imagine their metrics, as a result of no one’s measuring actual customers. Everybody’s measuring reported customers.

This isn’t fraud. It’s a systematic delusion at scale.

The actual value of faux adoption

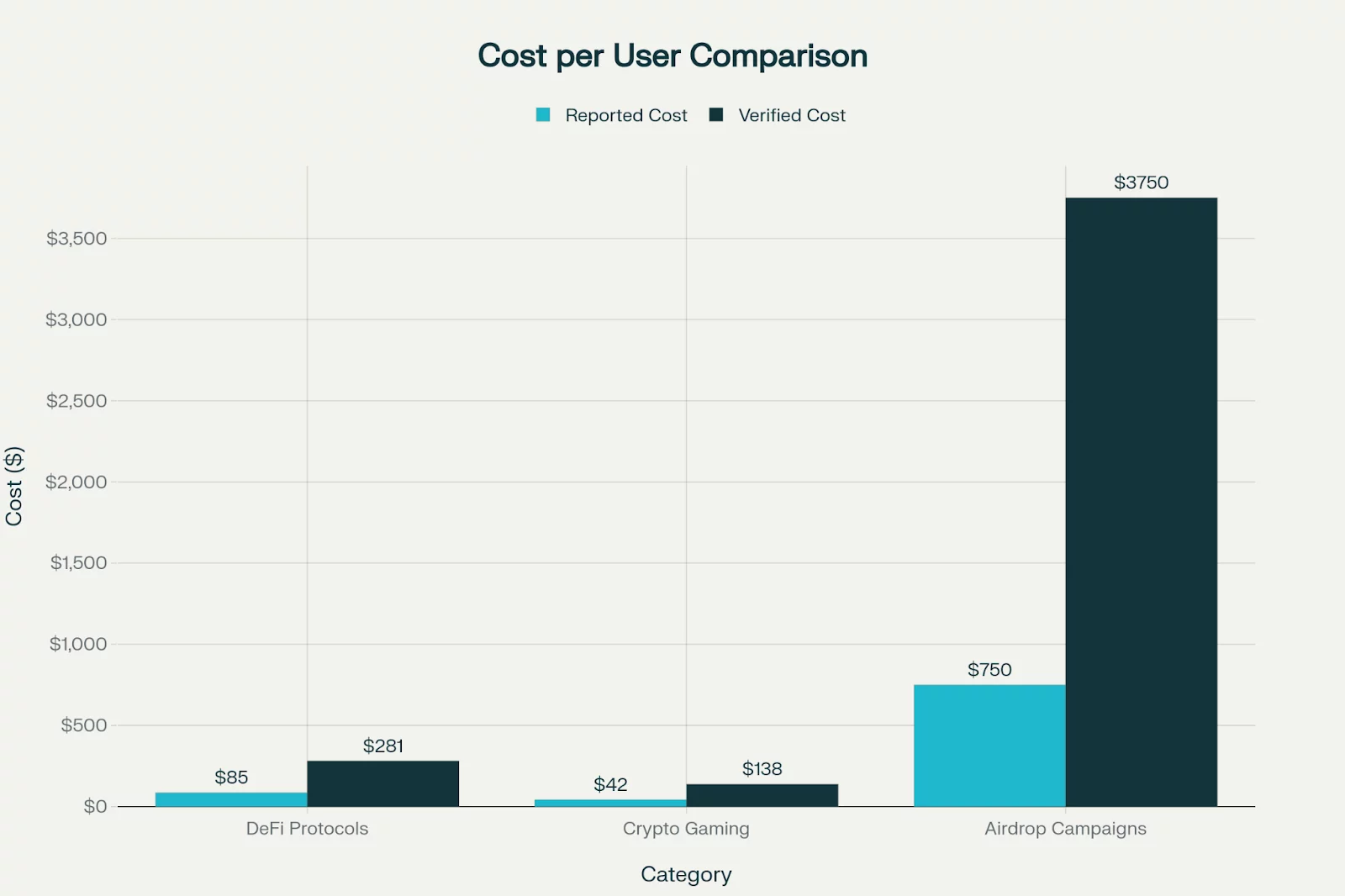

Right here’s the place it will get costly for institutional capital. If you alter consumer acquisition value (CAC) to account for verification, the economics of web3 turn into nearly unrecognizable:

| Class | Reported value per consumer | Verified consumer value (post-filtering) | True CAC multiplier |

| DeFi protocols | ~$85 per consumer | ~$281 per verified consumer | +230% |

| Crypto gaming | ~$42 per participant | ~$138 per verified participant | +228% |

| Airdrop campaigns | $500–$1,000 per consumer | $2,500–$5,000+ per human | +400–500% |

Initiatives aren’t overspending on acquisition. They’re undercounting their true spend by together with non-human metrics within the denominator.

When Coinbase stories a consumer milestone, it’s counting pockets installs. When a VC fund evaluates a protocol’s progress, they’re seeing whole signups. No one’s asking: What number of of those are actual?

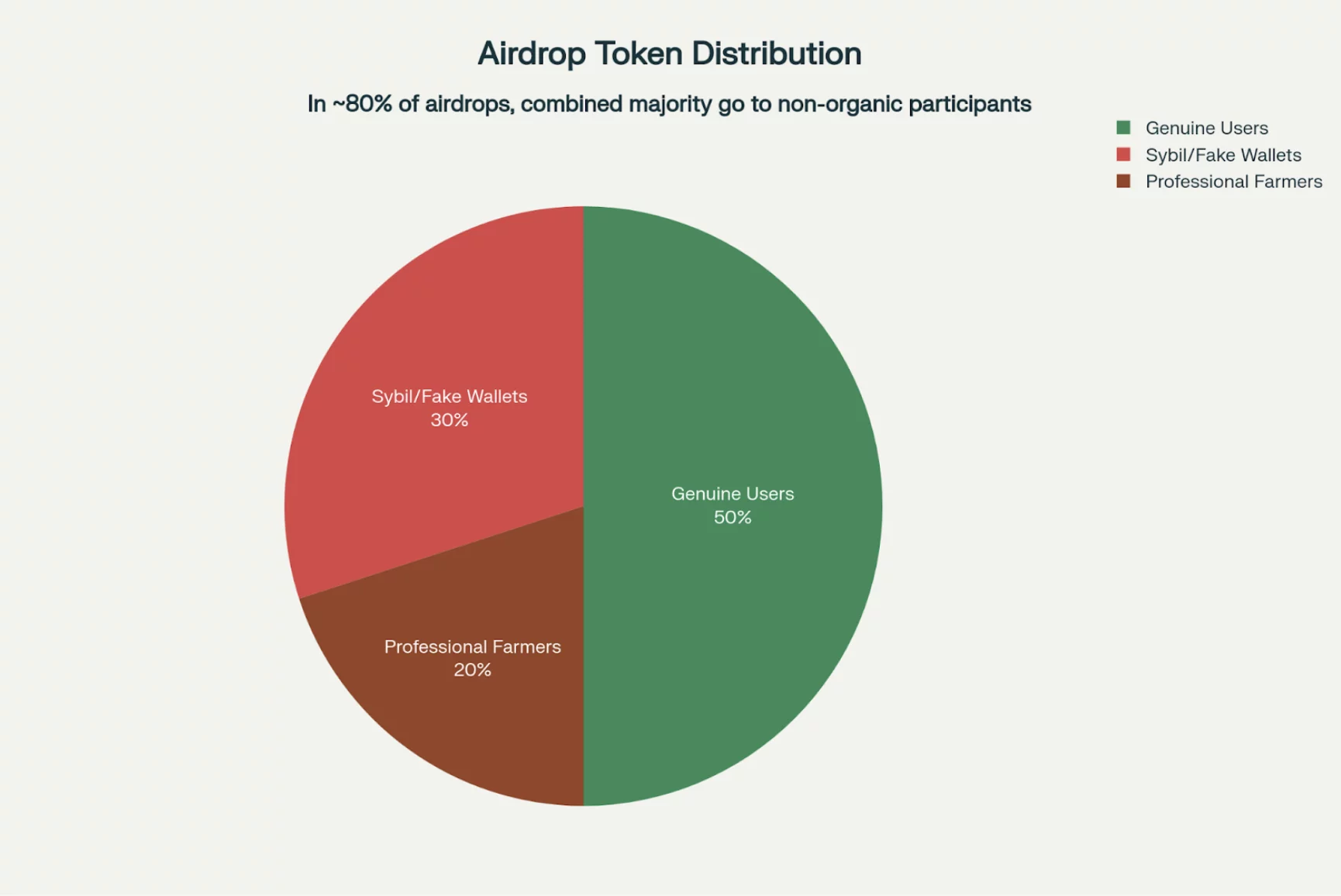

The place tokens truly go

The airdrop market has turn into a very grotesque window into this drawback. Our monitoring of main 2025 airdrops reveals:

| Recipient class | % of tokens distributed | Actuality |

| Real customers | ~50% | Meant group recipients; actual financial worth |

| Sybil/faux wallets | ~30% | Bot networks with zero engagement intent |

| Skilled farmers | ~20% | Subtle hunters who dump instantly |

In roughly 80% of airdrops, the mixed majority of tokens go to non-organic individuals. Initiatives aren’t constructing communities. They’re subsidizing bot infrastructure and funding arbitrage networks — and paying for the privilege.

In the meantime, institutional capital sees “consumer acquisition” and thinks “group constructing.” They see “token distribution” and assume “ecosystem alignment.”

They see metrics. They don’t see actuality.

Why establishments needs to be terrified

Right here’s the factor that ought to get up each Fortune 500 CFO writing blockchain checks: Initiatives with out real-time verification waste 65–70% of acquisition budgets on bot exercise and Sybil farms. But solely 5–10% of onboarded customers turn into repeat dApp customers inside 30 days.

This implies:

- The headline progress metric is a mirage.

- The precise engaged consumer base is 1/seventh of the reported measurement.

- The true value of buying an actual consumer is 2–5x greater than acknowledged.

- Retention disaster suggests most onboarded customers have been by no means human to start with.

When a GameFi mission stories two million downloads however fewer than 50,000 are each day energetic customers after 30 days (a 97.5% drop-off), that’s not a product drawback. That’s a metric drawback.

And institutional capital can’t make assured choices on compromised metrics.

The verification crucial: A second of reality

The web3 business stands at a crossroads — and 2026 will decide which path it takes.

Possibility A: Proceed the theater. Challenge groups hold reporting metrics that assume each pockets is human. VCs hold utilizing these metrics to benchmark efficiency. Establishments hold allocating capital based mostly on numbers that don’t mirror actuality. The house continues to develop, however no one — not even founders — truly is aware of what’s actual.

Possibility B: Embrace verification. Initiatives implement real-time consumer verification infrastructure. Airdrops are distributed to verified people. Retention metrics begin which means one thing. Institutional traders lastly have dependable information. The 2026 crypto cycle rewards tasks that clear up verification, not simply progress hacking.

The tasks profitable in 2025 aren’t these spending essentially the most on consumer acquisition. They’re those distinguishing actual people from synthetic engagement earlier than the advertising and marketing funds bleeds out.

Hyperliquid didn’t airdrop tokens. It constructed an infrastructure so robust that actual customers migrated there naturally. And it has decrease bot-to-human ratios than tasks that spent 10x extra on acquisition.

That’s not luck. That’s the distinction between measuring engagement and faking engagement.

The institutional query

Right here’s what each Fortune 500 govt and institutional investor needs to be asking proper now: If I can’t confirm that 70% of a crypto mission’s reported customers are literally human, why am I assured in my capital allocation? The reply is: You shouldn’t be.

The web3 house has achieved mass adoption of reporting metrics with out attaining mass adoption of verifying them. And institutional capital is flowing into this hole at $50 billion per 12 months. That hole wants to shut — not as a result of crypto is sweet or unhealthy, however as a result of confidence in infrastructure requires auditability. You wouldn’t spend money on a financial institution that couldn’t show its deposits have been actual. You shouldn’t spend money on a blockchain ecosystem that may’t show its customers are actual.

The subsequent part of web3 adoption gained’t be led by tasks spending essentially the most on advertising and marketing. It will likely be led by tasks that clear up this: How do you purchase verified customers at scale? How do you measure their actual engagement? How do you show it onchain?

And those profitable in 2026 will probably be these daring sufficient to start out by admitting their present metrics aren’t.