Bitcoin value has tumbled to its lowest stage in six months, buying and selling from beneath $92,000 to the $95,000s vary as we speak, solely lower than six weeks from hitting a file highs close to $126,000 in early October.

The roughly 30% decline comes as merchants grapple with renewed uncertainty over whether or not the Federal Reserve will lower rates of interest at its December assembly.

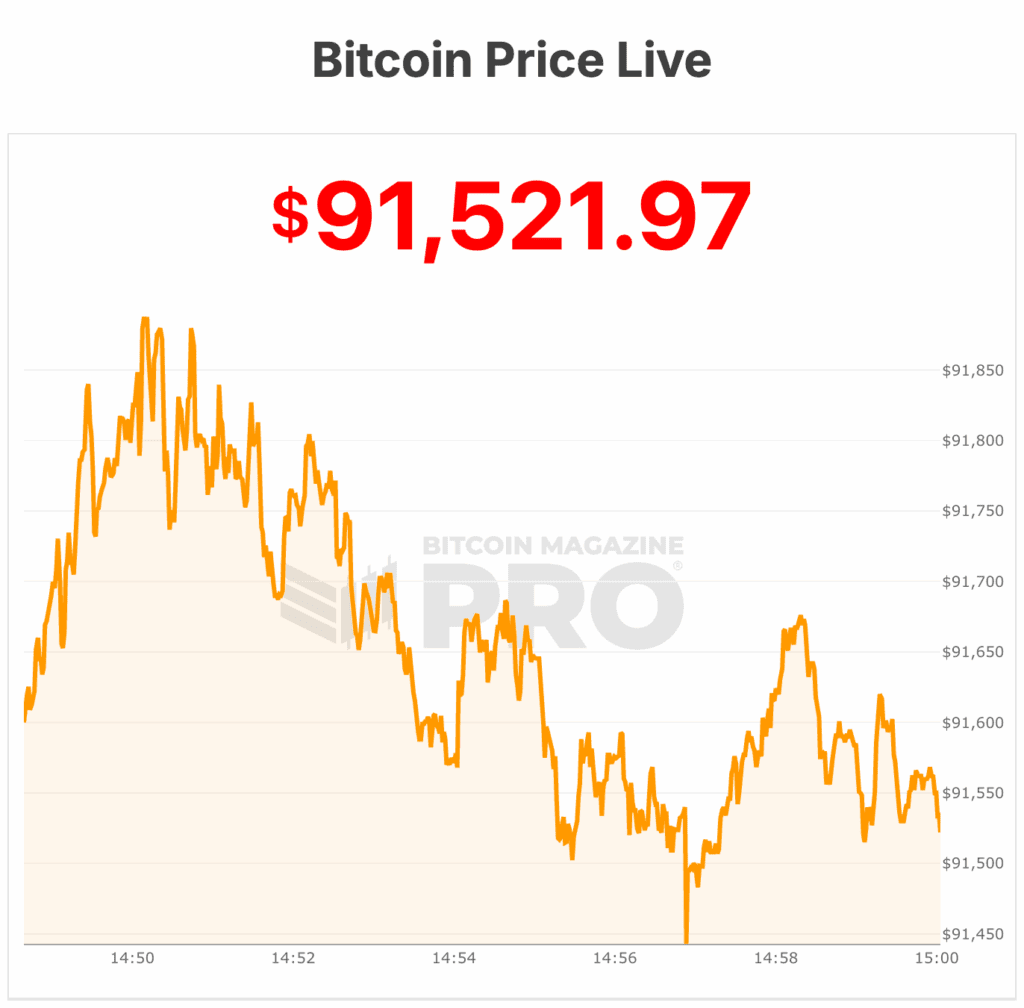

On the time of publishing, the bottom Bitcoin value recorded as we speak was $91,158, per Bitcoin Journal information.

Lacking financial information from final month’s 43-day authorities shutdown has left policymakers in a cautious stance, with Fed Chair Jerome Powell noting that “an additional discount within the coverage charge…is just not a foregone conclusion.”

Boston Fed President Susan Collins echoed the sentiment, suggesting it might be “acceptable to maintain coverage charges on the present stage for a while” to steadiness inflation and employment dangers.

Analysts say a pointy shift in market sentiment is driving the newest crypto downturn. Henry Allen of Deutsche Financial institution warned that buyers shouldn’t “underestimate the affect” of the Fed’s more and more hawkish stance, which has usually lined up with broad market sell-offs.

Huge establishments are pulling again too: crypto ETFs noticed $1.8 billion in outflows final week, together with a hefty $870 million pulled from Bitcoin merchandise on Thursday alone.

Bitcoin value can be dropping steam as pleasure over Donald Trump’s pro-crypto agenda fades. The huge November 2024 rally — pushed by hopes for pleasant regulation and even a proposed Bitcoin treasury — reversed after Trump floated 100% tariffs on Chinese language imports.

That shock triggered one of many largest liquidation occasions in crypto historical past, erasing about half a trillion {dollars} in hours and leaving main belongings struggling to regain momentum.

Technical indicators aren’t serving to sentiment. Bitcoin value flashed a “demise cross” on Sunday, a bearish chart sample the place short-term averages slip beneath long-term traits. Nonetheless, analysts like Benjamin Cowen word that previous demise crosses usually appeared close to market bottoms, hinting a rebound might not be far off.

Altcoins are sliding alongside the Bitcoin value. Ethereum dropped beneath $3,000 as we speak and Solana every dropped roughly a 3rd since early October, feeding right into a broader $1 trillion wipeout throughout the crypto market.

The market’s subsequent key catalyst will doubtless be the Federal Open Market Committee’s December charge determination, which might decide whether or not Bitcoin value sees additional losses or a possible “Santa rally” within the coming weeks.

Bitcoin value and crypto shares proceed slumping

Crypto-linked shares are dealing with vital losses amid broader market turbulence and declining cryptocurrency costs. On the time of writing, Coinbase World Inc (NASDAQ: COIN) is buying and selling at $260.26 USD, down $23.74 (‑8.36%) as we speak, reflecting lowered buying and selling exercise and decrease payment income because the Bitcoin value struggles.

Technique Inc Class A (NASDAQ: MSTR) sits at $191.59 USD, down $8.16 (‑4.09%), exhibiting sturdy correlation with Bitcoin’s latest pullback. Miners are additionally beneath strain, with MARA Holdings Inc (NASDAQ: MARA) down $0.85 (‑7.10%) at $11.14 USD and Riot Platforms Inc (NASDAQ: RIOT) down $0.49 (‑3.55%) at $13.46 USD.

Technique just lately made its largest Bitcoin buy since mid-summer, buying 8,178 BTC final week for roughly $835.6 million. In line with an SEC submitting and a put up by Michael Saylor on X, the purchases have been made at a median value of $102,171 per bitcoin. This brings the corporate’s complete holdings to 649,870 BTC, with a cumulative price of roughly $48.37 billion and a median value of $74,433 per coin. Technique reviews that its Bitcoin yield has reached 27.8% year-to-date.

On the time of the announcement, Bitcoin value was buying and selling close to $94,000, whereas Technique’s inventory ($MSTR) was down about 2% in premarket buying and selling, at $195.86. The latest acquisition was primarily funded by means of the issuance of most well-liked inventory.

Earlier this month, the corporate raised round $715 million through its new euro-denominated most well-liked collection, STRE (“Steam”), which was geared toward increasing its high-yield choices to European buyers. This transfer highlights Technique’s continued dedication to constructing its Bitcoin publicity whereas leveraging monetary devices to help large-scale purchases.