Lava, the Bitcoin-backed loans software program firm, sparked controversy amongst Bitcoin CEOs just lately, after a sequence of bulletins following a $200 million fundraise. The corporate, led by Shehzan Maredia, had beforehand been marketed as a self-custody pockets and platform, mirroring the performance of DeFi or decentralized finance merchandise. The brand new replace to the Lava app modified the custody mannequin to a completely custodial and trusted fintech platform, elevating questions concerning the lending firm’s authorized standing.

The announcement concerning the fund increase drew the eye of Bitcoin trade leaders, who raised questions concerning the nature of the funding and the implications of the change in custody mannequin, which Shehzan confirmed in follow-up X posts.

“The safety of our customers and their funds is our high precedence. Each change we’ve made is guided by that. Lava not makes use of DLCs — discrete log contracts — for loans as a result of the expertise doesn’t meet our safety requirements. Our group constructed the most important utility utilizing DLCs, however we found vulnerabilities that we weren’t comfy having (ex., client-side key threat, sizzling keys).”

Shezhan added that “Dangers we beforehand thought had been unattainable, similar to considering oracles couldn’t be manipulated to liquidate particular person customers, we discovered had been doable in apply. We’re unwilling to compromise on safety for our customers at any stage, and we take a really holistic view on eradicating belief, dependencies, and counterparty threat.”

DLCs are a type of Bitcoin good contract that may anchor the spendability of a bitcoin steadiness to an exterior occasion, similar to the value of bitcoin in greenback phrases, via using a third-party “oracle”. Oracle-based decentralized finance expertise (DeFi) was just lately exploited, leading to a 20 billion greenback liquidation occasion, particularly focusing on Binance’s stablecoin orderbook.

Their earlier expertise, which Shehzan says remains to be utilized by customers who didn’t select to replace to the brand new model of the software program, gave finish customers cryptographic management over a part of the account through 2 of two multi-signature DLC good contracts, limiting how the Bitcoin put up by customers as collateral may transfer.

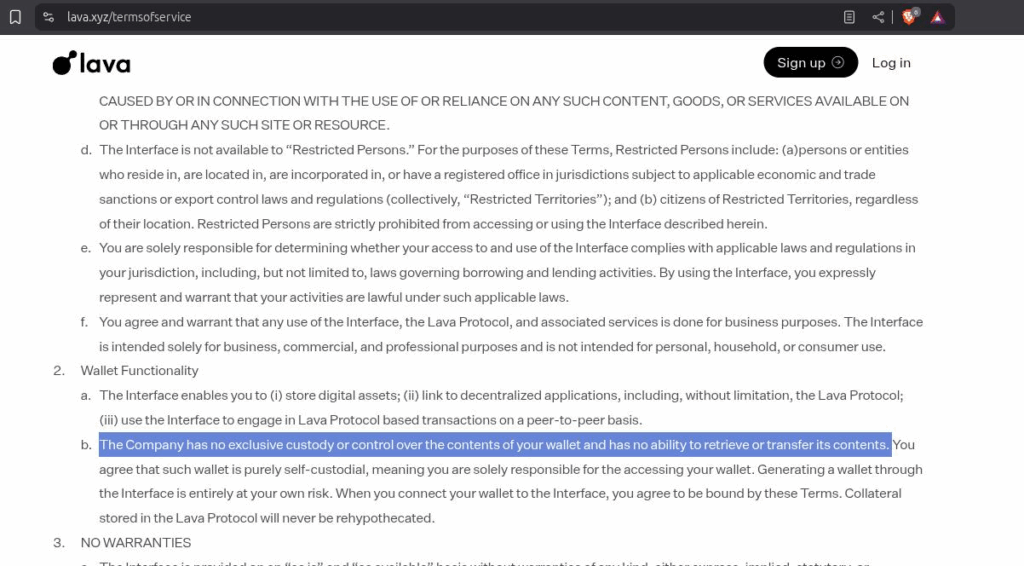

Lava’s phrases of service nonetheless declare — as of the time of writing — that the corporate has “no unique custody or management over the contents of your pockets and has no potential to retrieve or switch its contents.” But this contradicts statements made by Shehzan in latest days relating to the corporate’s pivot to a chilly storage custody mannequin.

Regardless of Shehzan’s clarification and posts on X, critics had been skeptical of the reasoning. Some customers had been alarmed on the basic change within the custody mannequin, which caught many unexpectedly and was communicated poorly, if in any respect.

One consumer, Owen Kemeys of Basis gadgets, wrote, “Did Lava get my knowledgeable consent?” sharing a sequence of screenshots of the app replace messaging, which says nothing concerning the change in custody mannequin.

Will Foxley of Blockspace media complained, “Why did they roll legacy loans over with out contact first. Plus, how did they do that if it was DLCs? Did I signal a bunch of pre-signed transactions that gave them management over your entire mortgage?”

The pivot has additionally raised questions concerning the firm’s regulatory standing and licenses, as centralized and custodial bitcoin-backed mortgage suppliers are arguably regulated below extra conventional frameworks. Such rules have a tendency to not apply to DeFi-style self-custody merchandise, exactly as a result of consumer funds stay below consumer management, moderately than below the entire management of a 3rd occasion. With belief custodial belief changing into the Lava mannequin in a single day, what regulatory standing does the corporate fall below?

Jack Mallers, CEO of Strike — a competing Bitcoin firm with a Bitcoin-backed loans product line and a market chief — questioned the transfer, significantly when it comes to licensing, which Strike has been working to amass for years:

“In the event that they’re custodial, how is what they’re doing authorized?

Strike has been buying licenses for years. You possibly can’t simply “flip a change” from non-custodial to custodial and begin providing brokerage, buying and selling, or lending companies. That’s unlicensed exercise, and it’s very unlawful.

What licenses does Lava even have that permit them to do what they’re doing?”

Bitcoin Journal has not independently verified Lava’s licensing standing. When requested for touch upon the authorized technique and standing of Lava, Shezhan pointed Bitcoin Journal to the corporate’s FAQ, which doesn’t seem to handle the questions straight in any respect.

The character of the funding introduced by Lava was additionally referred to as into query final week, as Cory Klipsten, CEO of Swan — a probable competitor to Lava — has additionally been actively participating the story, suggesting it’s particularly a line of credit score settlement moderately than an equity-style VC funding into the corporate. When requested, Shehzan informed Bitcoin Journal, “we raised each enterprise and debt,” referring to the 200 million increase announcement, although he didn’t go into particulars.

Whereas the story remains to be growing and principally entails discussions and debate on Bitcoin Twitter, the drama highlights the excessive worth Bitcoiners place on self-custody and the danger of closed-source crypto functions, which could be up to date with out correct transparency or data being delivered to customers about how their capital is secured.