Market Overview

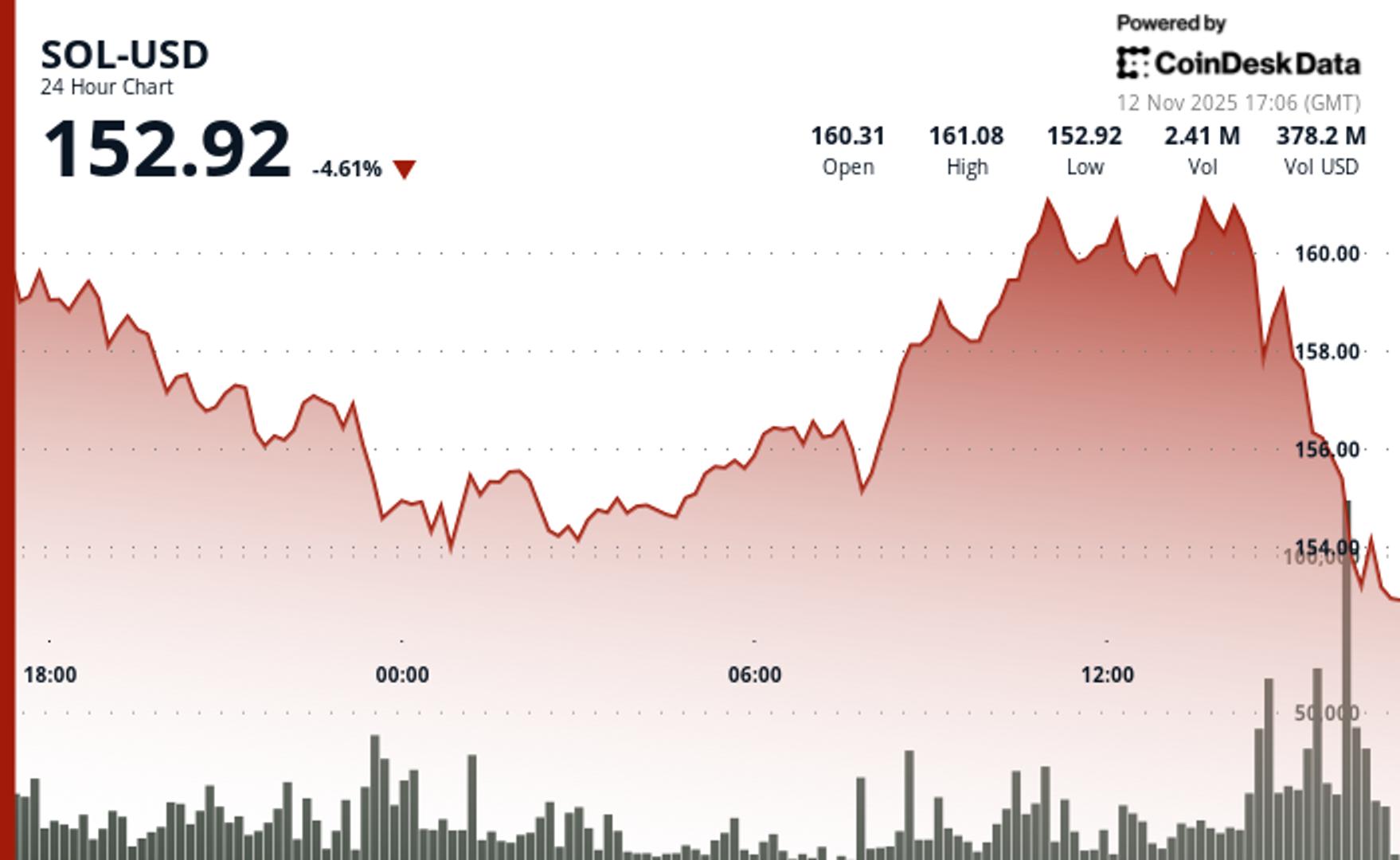

Solana faces renewed promoting strain because the token tumbles from $160.72 to $152.81, posting a 4.9% decline regardless of continued institutional assist by means of exchange-traded fund merchandise. The drop happens on elevated quantity operating 17.25% above the seven-day common. Energetic repositioning dominates somewhat than passive drift.

Promoting intensifies following one other scheduled token unlock from bankrupt Alameda Analysis and the FTX property on November 11. Analyst MartyParty experiences roughly 193,000 SOL tokens value $30 million get launched as a part of ongoing month-to-month vesting. This system has been step by step distributing over 8 million tokens since November 2023. These structured releases, managed underneath chapter oversight, sometimes move to main exchanges for creditor compensation.

Institutional demand stays sturdy with solana spot ETFs recording their tenth consecutive day of inflows totaling $336 million for the week. Main monetary establishments together with Rothschild Funding and PNC Monetary Companies disclosed new holdings in Solana-based merchandise. Grayscale launched choices buying and selling for its Solana Belief ETF (GSOL) to offer extra hedging instruments for institutional merchants.

Provide Strain vs Institutional Demand: What Merchants Ought to Watch

Alameda’s systematic token releases create predictable promoting strain whereas institutional flows present underlying assist. SOL finds itself caught between opposing forces. The chapter property maintains roughly 5 million tokens in locked or staked positions. Smaller month-to-month unlocks proceed by means of 2028 primarily based on pre-2021 funding agreements.

The 60-minute evaluation reveals accelerating bearish momentum as SOL breaks essential assist at $156 amid explosive promoting quantity. The breakdown happens throughout 15:00-16:00 UTC when value collapses from $155.40 to $152.86 on 212,000 quantity—123% above the hourly common.

This technical failure confirms the sooner assist breach and establishes a descending channel concentrating on the $152.50-$152.80 demand zone. Nevertheless, underlying energy in ETF flows suggests institutional accumulation at decrease ranges. Bitwise’s BSOL leads weekly inflows with $118 million whereas sustaining its yield-focused technique by means of staking rewards averaging over 7% yearly.

Key Technical Ranges Sign Consolidation Part for SOL

Assist/Resistance: Main assist establishes at $152.80 demand zone with secondary ranges at $150; rapid resistance at $156 (former assist) and $160

Quantity Evaluation: 24-hour quantity surges 17% above weekly common throughout breakdown, confirming institutional repositioning somewhat than retail capitulation

Chart Patterns: Descending channel formation with decrease highs at $156.71 and $156.13; break above $160 wanted to invalidate bearish construction

Targets & Danger/Reward: Bounce potential towards $160-$165 resistance if $152.80 holds; breakdown under $150 accelerates towards $145 assist ranges

CoinDesk 5 Index (CD5) Drops 1.85% in Unstable Session

CoinDesk 5 Index fell from $1,792.49 to $1,759.24, declining $33.25 (-1.85%) throughout a $74.31 complete vary as robust bearish momentum emerges after failing resistance at $1,824.82, with vital institutional quantity through the 15:00-16:00 selloff confirming the downward break under key assist at $1,767.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.