XRP’s newest downswing has dragged value right into a cluster of long-term quantity and mean-reversion ranges, with one distinguished market technician flagging Korea because the epicenter of near-term spot promoting.

XRP Faces Essential Help

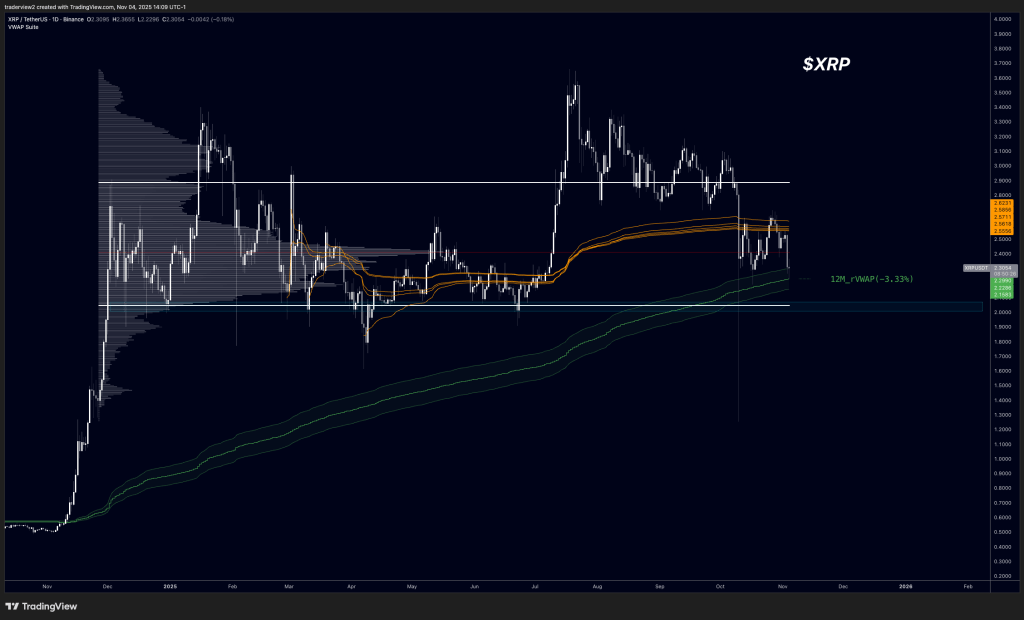

In charts shared over the previous 24 hours, dealer Dom (@traderview2) stated XRP has “reached the 12M rVWAP for the primary time this 12 months,” including that it “actually isn’t a stage we wish to be buying and selling beneath for awhile.” He warned that if bulls lose that 12-month rolling VWAP, “we’re wanting on the vary low of $2 as the subsequent space of curiosity,” whereas a swift restoration would require “$2.50 [to] regain to get out of hazard space.”

Dom additionally pointed to order-book composition: “Spot orderbooks are skewed in the direction of bids proper now which is constructive, however snapping the native low will seemingly ship us again to $2 the place the remainder of the bids sit.”

Dom’s VWAP-suite chart locations spot value urgent immediately into the 12-month rolling VWAP ribbon after failing to maintain above the prior distribution shelf, a configuration that always separates trending from mean-reverting phases. Testing this line for the primary time this 12 months is notable as a result of multi-month rVWAPs act as dynamic fair-value proxies; sustained closes under them traditionally coincide with additional probing of high-volume nodes beneath.

Associated Studying

Korea Dictates The XRP Value Transfer As soon as Once more

The geographic focus of promoting has amplified the danger of a deeper tag of that vary. Dom stated the majority of the spot stress was exchange-specific: “They do NOT look pleased over there in Korean… 84% of all of the spot promote stress over the past 2 days has got here from Upbit.”

A cumulative quantity delta (CVD) breakdown by change corroborates the outsized function of the Korean venue, with Upbit’s CVD line deeply destructive whereas Binance, Coinbase, Bybit, OKX, Kraken and Bitstamp hover comparatively flat close to the zero line. In sensible phrases, that blend signifies real-coin distribution flowed predominantly by means of the KRW hall whilst different USD- and USDT-based venues confirmed much less aggressive internet promoting.

Associated Studying

A separate high-timeframe chart from IncomeSharks frames the draw back magnet with easy readability. The analyst posted a every day XRP/USD view with a broad demand zone centered slightly below $2.00 and commented: “XRP — When you missed it beneath $2 you’ll most likely have an opportunity to bid it once more.”

The chart highlights how the late-summer impulse didn’t retake overhead resistance and the way subsequent decrease highs left a clear air pocket towards the December–March worth space that begins across the psychologically dense $2.00 deal with. The analyst expects a retracement as little as $1.80-$1.70 if the psychological vital $2 mark doesn’t maintain.

At press time, XRP traded at $2.21.

Featured picture created with DALL.E, chart from TradingView.com