October examined crypto markets as BTC and ETH held agency whereas most altcoins dropped over 80% amid volatility. Whales raised BTC and ETH allocations to 50.1%, added $2.8 billion in stablecoins, and shifted about 300,000 BTC as assist moved to $108,000.

Abstract

- October was a wild month for crypto as Bitcoin hit $126,000 earlier than dropping 13% in a day and shutting round $115,000, whereas Ethereum stayed close to $4,600 and most altcoins misplaced over 80%.

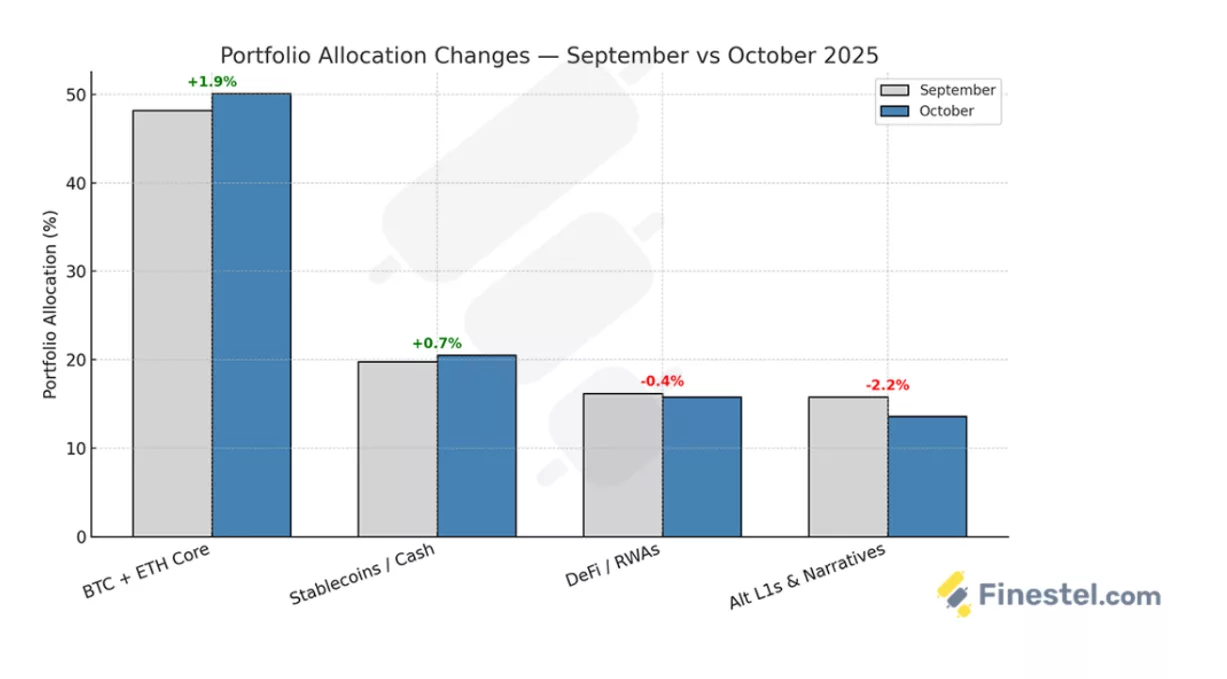

- Professionals pulled again from dangerous bets, elevating BTC and ETH allocations from 48.2% to 50.1%, stablecoins from 19.8% to twenty.5% with $2.8 billion inflows, and trimmed altcoins to 13.6%.

- Even with large swings, about 300,000 BTC modified arms, assist ranges moved as much as $108,000-$110,000, and establishments saved shopping for strategically throughout dips.

Crypto markets went in all places in October as skilled traders pulled again from dangerous bets and targeted on Bitcoin (BTC) and Ethereum (ETH) whereas uncertainty constructed up.

Bitcoin began the month at $126,000 earlier than falling 13% in at some point, its greatest drop in six months, which analysts at Finestel referred to as the “greatest liquidation occasion in historical past.”

In a month-to-month analytical analysis report shared with crypto.information, Finestel famous that even with the sell-off, the market ended October a bit greater. Bitcoin closed round $115,000, up 4.5% for the month, whereas Ethereum stayed close to $4,600, up 3%. But, most altcoins bought hit exhausting, with some shedding greater than 80% in corrections.

Macro indicators

sThe month had loads of combined indicators because the U.S. authorities shutdown, ongoing since Sept. 30, bumped into Trump‘s tariff threats, regional financial institution issues, and altering Fed coverage.

“The whipsaw was brutal. For those who felt confused this month, that’s as a result of the market was genuinely pricing in contradictory indicators.”

Finestel

Early October was tough as Trump focused Chinese language edible oils with tariffs whereas denying broader 100% tariff reviews. In the meantime, monetary lenders like Zions and Western Alliance reported fraud losses and worries about credit score unfold throughout threat belongings.

Bitcoin wasn’t resistant to this and fell together with shares. Nevertheless, reduction got here slowly as a Gaza ceasefire on Oct. 14, China-U.S. commerce talks on Oct. 18, and China shopping for U.S. soybeans on Oct. 28 eased promoting strain.

Finally, Trump instructed chopping fentanyl-related tariffs by 50% and the Fed reduce charges 25 foundation factors on Oct. 29, hinting at ending quantitative tightening sooner, which might put more cash again into threat markets. As Finestel notes, September CPI got here in at 3%, which is under the three.1% anticipated, with markets now anticipating two extra cuts in 2025, although the federal government shutdown nonetheless leaves gaps within the knowledge.

Crypto trenches

Beneath the floor, the market held up higher than the worth strikes confirmed. Lengthy-term Bitcoin holders barely moved, whereas short- and medium-term holders who purchased close to $108,000-$124,000 bought in the course of the crash.

Consequently, about 300,000 BTC modified arms in busy buying and selling ranges, whereas assist ranges moved up from $104,000-$112,000 early within the month to $108,000-$110,000 by late October. As Finestel mentioned, this reallocation is bullish as a result of the correction “reset construction at greater ranges moderately than breaking it.” On the identical time, Bitcoin dominance rose from 58% to 59.48%.

Ethereum stayed regular largely because of staking, as yields of 608% with 30% participation gave a flooring throughout corrections. Platforms like Lido and EigenLayer saved seeing inflows, whereas tokenized real-world belongings on Ethereum, particularly by way of Pendle, nearing $7 billion whole worth locked, gave establishments a technique to earn yield safely.

Based on knowledge shared in Finestel’s report, core BTC and ETH holdings rose from 48.2% to 50.1% of portfolios, whereas stablecoins went as much as 20.5% from 19.8%, with $2.8 billion inflows. The decentralized finance market and tokenized belongings fell barely to fifteen.8% from 16.2%, conserving yield however chopping riskier bets.

Altcoins dropped to 13.6% from 15.8%, with a give attention to Solana (SOL) and Avalanche (AVAX). As threat limits tightened, max loss per place held at 7-9% and portfolio value-at-risk stayed below 9%, with the analysts including that “after watching 82% of liquidations hit lengthy positions in the course of the correction, leverage ratios fell to yearly lows whilst costs recovered.”

What’s subsequent

Institutional exercise stayed regular as spot Bitcoin ETFs had $1.4 billion in inflows early October, the second-highest weekly whole ever. Company treasuries added about 15,000 BTC by way of Bitdeer and Hut 8, with the analysts saying that the sample is evident as establishments preserve accumulating Bitcoin as a “treasury asset, however doing it tactically throughout dips moderately than chasing highs.”

Nevertheless, Finestel expects extra ups and downs round financial knowledge and commerce information. U.S. reviews on Nov. 7, together with jobs, commerce, and manufacturing facility numbers, might be watched carefully after the shutdown, whereas delayed PCE inflation might have an effect on Fed plans. Aside from that, China-U.S. talks might additionally convey a deal or summit and carry threat urge for food, whereas EU and UK stablecoin guidelines may additionally assist markets.

Bitcoin staying above $108,000 might let it transfer again towards $120,000 or greater, however tariffs or weak labor knowledge might push it down. Skilled positioning requires about 52% BTC/ETH, 19-20% stablecoins, 16% DeFi/RWA yield belongings, and 12-13% selective altcoins, together with Solana, Avalanche, and AI-linked tokens.

As Finestel defined, October “examined resilience and professionals responded by concentrating capital in high quality belongings, constructing money positions, and utilizing defined-risk methods moderately than leverage,” including that the correction possible removed further hypothesis and reset assist greater.