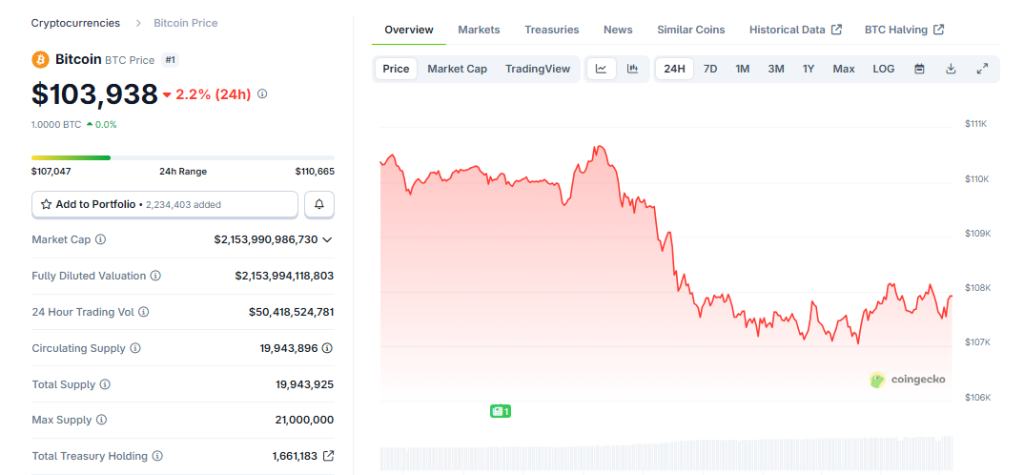

Bitcoin’s pullback on Monday despatched a fast chill by means of crypto markets, pulling sentiment right down to ranges not seen in months. Costs dipped to a 24-hour low of $103,938 after earlier buying and selling above $109,000, and gauges of market temper turned sharply unfavourable as traders reassessed danger.

Associated Studying

Crypto Concern Hits Excessive Readings

In accordance with the Crypto Concern & Greed Index, the rating fell to 21 out of 100 on Tuesday, a transfer that registers as “Excessive Concern.”

That mark is the bottom in practically seven months; the index beforehand hit 18 out of 100 on April 9, when markets reacted to US President Donald Trump’s international tariff measures.

Stories have disclosed that the index has been swinging between calm and alarm because the giant sell-off in early October, when readings tumbled after costs slid from a peak above $126,000 on Oct. 6.

Market members pointed to a mixture of weak institutional flows and macro worries. Primarily based on experiences, Bitcoin-tied exchange-traded funds recorded web outflows of practically $800 million final week.

Analysts stated institutional shopping for just lately fell beneath the quantity of newly mined Bitcoin for the primary time in seven months. These developments cut back the regular inflows that had helped help costs.

Value Motion & Brief-Time period Drivers

Bitcoin recovered above $104,100 after the low, however the sharp intraday swing highlighted fragility. Some merchants blamed cooling exercise on exchanges and wallets, whereas others flagged issues concerning the Federal Reserve’s stance.

The Fed minimize rates of interest for the second time this 12 months on Wednesday, but signaled there will not be extra cuts in 2025. That trace of a less-accommodating outlook appeared to catch traders off guard, prompting fast re-pricing in each inventory and crypto markets.

There are additionally technical factors at play. The Crypto Concern & Greed Index final fell into the “Excessive Concern” zone on Oct. 21 when it hit 25 out of 100, after Bitcoin slid from over $110,000 to beneath $108,000.

Earlier, the index had topped 70 — a “Greed” studying — displaying how briskly sentiment can flip when value strikes speed up.

Associated Studying

What Merchants Are Watching Subsequent

Merchants will probably be watching ETF flows, on-chain exercise, and any recent indicators from US policymakers. Primarily based on experiences, decrease blockchain exercise and fewer giant buys by establishments have been cited as quick causes for the decline.

If inflows return, they may stabilize the market. If outflows proceed, the stress could deepen.

Market bulls, nonetheless, nonetheless level to seasonal historical past. In accordance with historic patterns cited by some analysts, November has typically been a robust month for Bitcoin, with common positive factors above 40% in previous years.

Featured picture from Gemini, chart from TradingView