On November 2, 2025, crypto analyst Ignas | DeFi distilled crypto’s present standoff right into a clear ledger of execs and cons.

The Bearish Case For Crypto

The primary bear pillar is the “AI bubble” overhang. Late-October headlines crystallized the controversy as Nvidia briefly breached a $5 trillion market worth, a milestone that sharpened concern that fairness valuations tied to AI infrastructure spending could also be operating forward of realized returns.

Level two—“bullish information fail to pump”—was on show as “Uptober” ended with a whimper for the crypto market. Regardless of intermittent coverage tailwinds and robust ETF inflows mid-month, each Bitcoin and Ethereum pale into month-end, and US spot ETF flows turned sharply unfavourable over the ultimate three buying and selling days of October, a sample in line with danger aversion after the Oct. 10–11 shock.

Associated Studying

That shock, the “10/10 crash,” is the third bear lever. The 2-day downdraft adopted a sudden tariff escalation risk from the White Home and produced one of many largest one-day liquidations in crypto historical past, spurring a rush for draw back hedges and leaving the market probing for “useless entities” and hidden impairments.

Cycle timing is Ignas’ fourth bear observe. The fourth Bitcoin halving occurred on April 20, 2024 (block 840,000). Prior cycles don’t map one-for-one, however the post-halving window is a sample which will get quite a lot of consideration in the mean time. If the “cycle shouldn’t be useless,” a Bitcoin high could already be in or is looming by the top of the 12 months.

“Outdated OG wallets promoting” is the fifth bear claimant—and, for as soon as, the chain tells a transparent story. Since mid-October, long-term holders have materially elevated internet distribution, with Glassnode and different trackers flagging outflows on the order of tens of 1000’s of BTC, alongside headline-grabbing awakenings of Satoshi-era wallets. This doesn’t show panic, but it surely does inject provide at a fragile second.

Unfavourable ETF flows spherical out the bear listing. Farside’s fund-by-fund ledger reveals pronounced outflows on October 29–31 throughout a number of US spot Bitcoin ETFs, with whole each day internet redemptions exceeding $470 million on October 29 and $488 million on October 30, earlier than one other hit on October 31 (191 million). Whereas October closed with a influx whole of three.424 billion, the message: the “quick cash” cohort that chased the summer season breakout was, at the very least briefly, in retreat.

Buffett’s warning is the macro bear exclamation level. Berkshire Hathaway’s third-quarter print revealed a document $381.7 billion money pile and a twelfth straight quarter as a internet vendor of equities—a posture that telegraphs wariness about broad danger property and liquidity circumstances at the same time as working earnings rise. For crypto, this isn’t a direct circulate, however it’s a bellwether for world danger urge for food.

The Bull Case For Crypto

The bull case, nevertheless, shouldn’t be hand-waving. Begin with “liquidity easing & curiosity cuts.” The ECB has already delivered substantial easing this 12 months and paused; the Financial institution of England has begun slicing; and within the US, the Federal Reserve can also be anticipated to shut out the 12 months with two extra cuts whereas ending quantitative tightening.

Associated Studying

Ignas additionally says “no clear euphoria,” and—empirically—he’s proper. The Crypto Concern & Greed Index spent the previous week toggling between “Concern” and low “Impartial,” printing within the mid-30s to low-40s as of November 3. That’s a great distance from the 80s–90s “excessive greed” that usually units up blow-off tops, and it helps the concept that positioning shouldn’t be but dangerously crowded.

Institutional adoption stays the quiet compounding power within the bull ledger. With $30.2 billion year-to-date inflows, spot Bitcoin ETFs are fueling many of the market energy.

On coverage, the US did greater than chatter in 2025: the Senate handed, and President Trump signed, a bipartisan stablecoin legislation in July. A broader market-structure invoice stays in play, however even the stablecoin win is non-trivial for on-chain liquidity and funds rails.

Seasonality additionally favors endurance. Since 2013, This autumn has been Bitcoin’s strongest quarter on common, with a number of cycles posting outsized November–December runs.

Then there’s the stablecoin plumbing. Regardless of October’s chaos, combination stablecoin float sits round $307–308 billion and notched recent all-time highs in mid-October—an indication that dry powder inside crypto’s personal rails stays ample and able to mobilize if confidence stabilizes. As of right now, DefiLlama pegs the whole at roughly $307.6 billion.

Lastly, the US–China commerce conflict has seen extraordinarily constructive progress. “That is the BIGGEST de-escalation but. Beneath the brand new US-China commerce deal, President Trump made a HUGE settlement with China: China will droop ALL retaliatory tariffs introduced since March 4th. And, China will droop or take away ALL retaliatory non-tariff countermeasures taken since March 4th. This isn’t getting almost sufficient consideration,” The Kobeissi Letter wrote through X on Sunday.

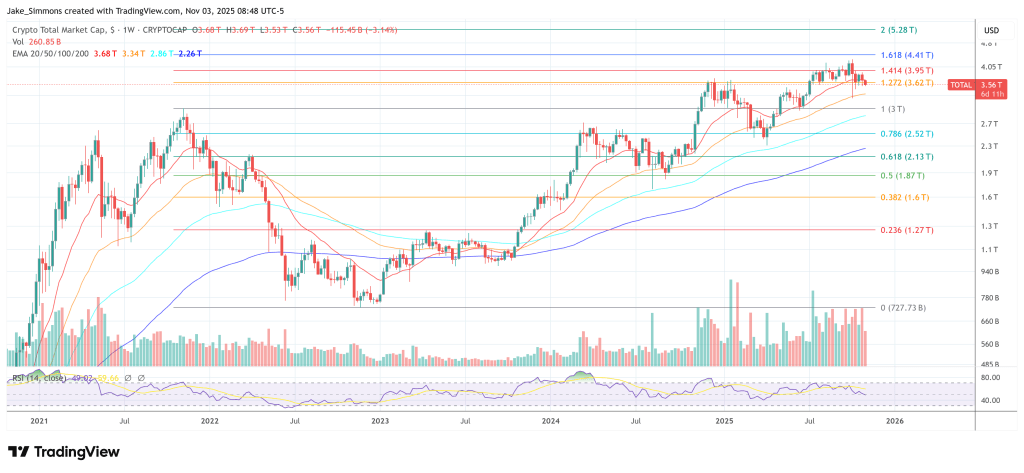

At press time, the whole crypto market cap stood at $3.56 trillion.

Featured picture created with DALL.E, chart from TradingView.com