Bitcoin is trying to push increased after weeks of consolidation and sustained promoting strain that adopted the sharp October 10 crash. The market stays in a fragile restoration section, with volatility compressing as merchants await the following main catalyst. This week may show decisive, as all eyes flip to Wednesday’s Federal Reserve assembly, the place policymakers are anticipated to announce their subsequent transfer on rates of interest — a call that would form world danger sentiment for the rest of the yr.

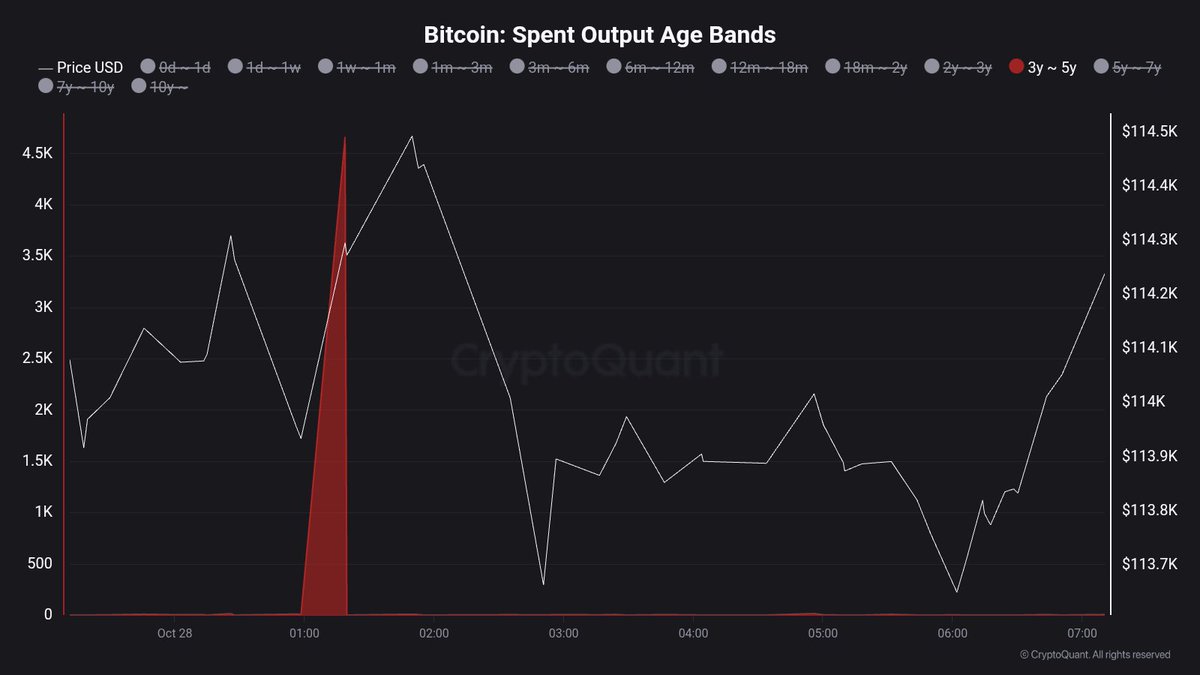

On-chain information provides one other layer of intrigue to the present setup. In line with CryptoQuant, Bitcoin’s dormant provide is waking up, with long-inactive cash — held between three and 5 years — displaying important motion in current blocks. Such exercise usually indicators renewed engagement from long-term holders, typically previous key market inflection factors.

Whereas the short-term outlook stays blended, analysts observe that the reactivation of outdated cash amid tightening macro circumstances suggests rising investor anticipation. If the Fed indicators a softer stance on financial coverage, Bitcoin may see renewed capital inflows. Nonetheless, one other hawkish shock would possibly prolong the consolidation section, retaining BTC locked beneath resistance till clearer macro circumstances emerge.

Lengthy-Time period Holders Make A Transfer

High analyst Maartunn shared information revealing that Bitcoin’s 3–5 yr dormant provide has seen a sudden spike in exercise, with 4,657.48 BTC spent in a single current block. This metric tracks cash which have been untouched for a number of years — a cohort usually related to early bull-cycle buyers or strategic long-term holders. When such cash transfer, it usually indicators renewed exercise from buyers who’ve weathered a number of market phases.

Within the historic context, comparable awakenings in long-term provide have preceded main shifts in market construction. For example, throughout previous consolidation durations, outdated cash had been reactivated as buyers ready for volatility — both to take earnings close to native highs or to reposition forward of a pattern reversal. The magnitude of this current motion means that seasoned holders are as soon as once more reassessing their allocations amid tightening macro circumstances and elevated expectations for the Federal Reserve’s fee determination this week.

What makes this notably attention-grabbing is the distinction with present sentiment. Regardless of the spike in long-term holder exercise, on-chain indicators such because the Bull-Bear Construction Index and Unified Sentiment Index stay in mildly bullish territory. This suggests that whereas some early buyers are realizing earnings or reallocating, broader market conviction is bettering — particularly as Bitcoin holds above the $113,000–$114,000 vary.

This motion shouldn’t be interpreted as panic promoting however as wholesome on-chain rotation. Lengthy-term holders transferring cash after years of dormancy usually sign the start of liquidity redistributions that accompany the following section of market progress. If Bitcoin maintains its present help ranges and macro circumstances stay steady, these shifts may gas the liquidity wanted for a brand new impulse section towards increased costs.

BTC Bulls Regain Momentum

Bitcoin is displaying renewed power on the 3-day timeframe, presently buying and selling close to $114,485, because it makes an attempt to recuperate from the sharp sell-off seen earlier in October. The chart reveals BTC holding firmly above each the 50-day (blue) and 100-day (inexperienced) transferring averages — a key structural sign suggesting that the medium-term pattern stays intact regardless of current volatility.

The subsequent main resistance stage sits at $117,500, a zone that has repeatedly capped Bitcoin’s advances over the previous two months. A profitable breakout and each day shut above this stage may open the door for a retest of $125,000, marking the potential begin of a brand new bullish impulse. Nonetheless, rejection right here may sign one other short-term consolidation, as merchants take earnings and reassess danger amid macroeconomic uncertainty.

On the draw back, rapid help lies close to $111,000–$112,000, whereas the 200-day transferring common (purple) round $96,000 continues to offer long-term structural backing.

Momentum indicators and on-chain information, together with a rebound in sentiment and steady liquidity circumstances, counsel that purchasing curiosity is progressively returning. If the broader market stays calm following the upcoming Federal Reserve fee determination, Bitcoin may affirm its restoration and purpose increased towards the $120,000–$125,000 vary.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.