Ethereum is struggling to push above the $4,000 stage, as market sentiment stays unsure and volatility retains traders cautious. Regardless of a number of makes an attempt, bulls have did not maintain momentum, suggesting hesitation at key resistance ranges. Nevertheless, new on-chain knowledge is drawing consideration to probably large-scale liquidity strikes that might affect Ethereum’s subsequent path.

Associated Studying

In response to Lookonchain, an Ethereum OG holding 736,316 ETH (price roughly $2.89 billion) lately deposited $500 million USDT into the vaults launched by ConcreteXYZ and Steady, simply earlier than their official announcement. This has sparked important curiosity throughout the crypto neighborhood, because the transaction seems strategically timed and will sign preparation for main yield or liquidity exercise.

ConcreteXYZ is a next-generation liquidity protocol designed to attach institutional and DeFi capital by tokenized vaults. It permits customers to allocate stablecoins and crypto belongings into yield-bearing methods whereas sustaining full transparency and composability inside the Ethereum ecosystem.

The whale’s large deposit — previous the general public reveal — suggests potential insider positioning or high-conviction participation in these vaults. Such giant inflows typically act as early indicators of shifting liquidity dynamics, significantly when aligned with tasks positioned on the intersection of DeFi infrastructure and institutional finance.

Whale Dominance in Aave and Stablecoin Vaults Raises Strategic Questions

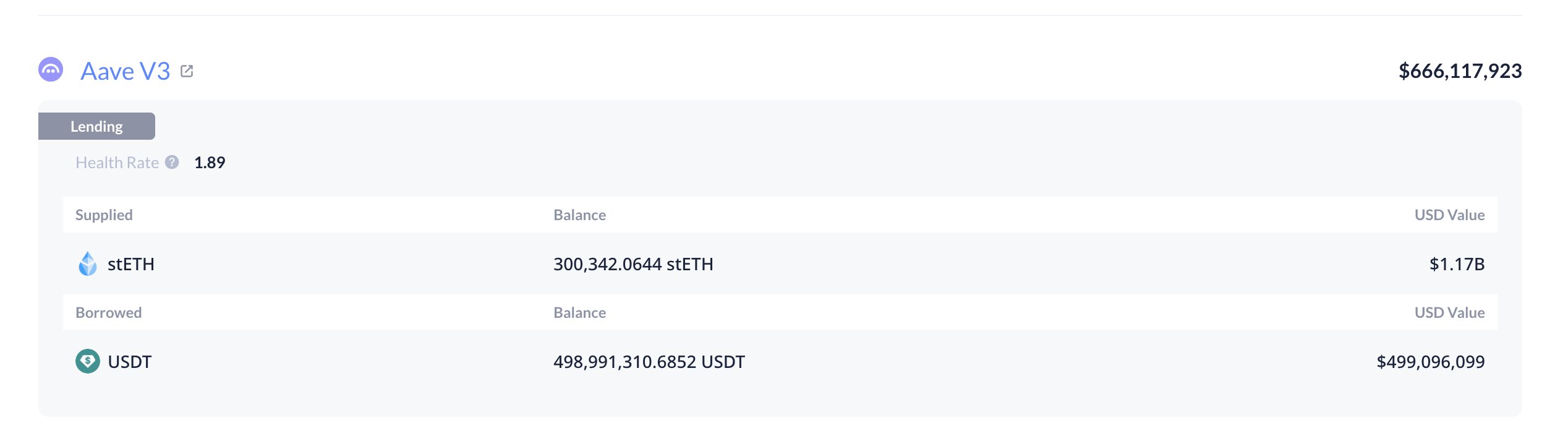

In response to Lookonchain, the identical Ethereum OG who lately interacted with ConcreteXYZ and Steady deposited 300,000 ETH into Aave and borrowed $500 million USDT. Out of the entire $775 million USDT deposited throughout the brand new vaults, this single whale accounted for 64.5% of the entire liquidity, underscoring their dominant function on this sudden market exercise.

This transfer represents a classy on-chain technique typically seen amongst skilled whales. By supplying ETH as collateral on Aave — one of many largest decentralized lending protocols — and borrowing USDT in opposition to it, the whale successfully unlocks liquidity with out promoting their Ethereum holdings. This enables them to deploy giant sums into yield alternatives, such because the newly launched ConcreteXYZ vaults, whereas retaining publicity to ETH’s long-term upside.

Such a focus of liquidity from one entity can have a number of implications for the broader market. On one hand, it highlights rising confidence amongst deep-pocketed gamers within the DeFi ecosystem’s stability and profitability. Then again, it raises questions on market affect and systemic threat, since a single participant holds such a big portion of capital inflows.

Associated Studying

If this borrowed liquidity is used for yield farming or strategic positioning somewhat than short-term hypothesis, it might reinforce Ethereum’s ecosystem fundamentals by rising DeFi exercise and on-chain engagement. Nevertheless, if market situations deteriorate and collateral values fall, liquidations might amplify volatility.

In essence, this large Aave–ConcreteXYZ transaction demonstrates how whales leverage DeFi infrastructure to keep up dominance, optimize liquidity, and affect ecosystem-wide capital flows — making this probably the most important on-chain strikes of the quarter.

Ethereum Rebounds however Faces Resistance Close to $4,000

Ethereum’s value is at the moment buying and selling round $3,964, exhibiting indicators of a modest rebound after latest volatility. The day by day chart signifies that ETH has been trying to recuperate from its October lows. However stays trapped under key resistance at $4,000–$4,200, the place each the 50-day and 100-day transferring averages converge. This can be a zone that usually acts as a powerful rejection space throughout consolidation phases.

Regardless of short-term positive aspects, Ethereum’s broader construction nonetheless displays uncertainty. The 200-day transferring common, sitting close to $3,200, continues to supply robust dynamic assist, stopping a deeper breakdown. Nevertheless, the lack to interrupt above $4,000 has left the asset susceptible to renewed promoting strain if momentum weakens.

Associated Studying

Quantity patterns counsel restricted conviction amongst consumers, as every rally try has been met with fading power. To regain a sustainable bullish outlook, Ethereum wants a decisive shut above $4,200. This may sign a possible continuation towards $4,500 and better. Conversely, failure to reclaim that vary might result in a retest of $3,600–$3,500.

Featured picture from ChatGPT, chart from TradingView.com