October appears on the verge of canceling Uptober as crypto costs retraced after a latest multi-billion-dollar liquidation. However even with that, analysts say regular ETF demand can nonetheless help a rebound.

Abstract

- October began sturdy for Bitcoin, with ETF inflows and institutional demand pushing crypto costs to new all-time highs, following historic traits that make the month the most effective for the cryptocurrency.

- That momentum was rapidly shaken when a $19 billion liquidation occasion, amplified by skinny order books and crowded derivatives.

- However analysts say the seasonal rally isn’t lifeless but.

October began like a typical Uptober, with ETF inflows pushing crypto costs greater and loads of consumers available in the market, however a sudden liquidity squeeze and a political shock rapidly knocked the rally off track.

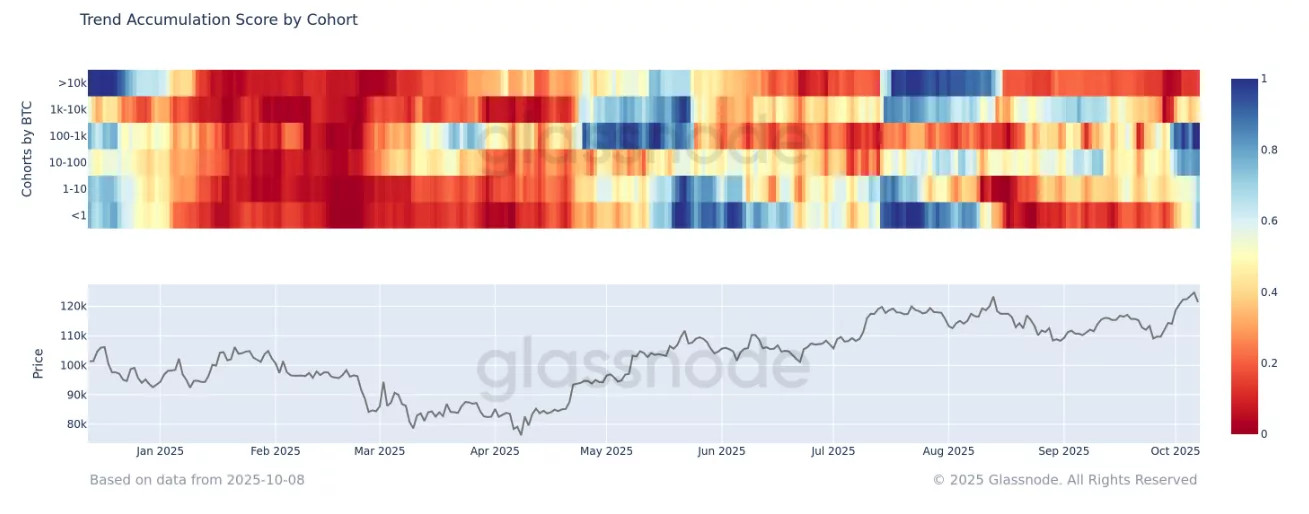

Early within the month, Bitcoin (BTC) climbed into recent territory, with its worth hitting new highs above $126,000. Analysts at Glassnode famous in a analysis report that Bitcoin “broke by the $114k–$117k provide zone to succeed in a brand new all-time excessive close to $126k, backed by sturdy ETF inflows and renewed mid-tier accumulation.”

October has lengthy been dubbed “Uptober” within the crypto world, a month traditionally recognized for sturdy positive factors. Knowledge from CoinGlass exhibits that since 2013, Bitcoin has averaged a return of greater than 46% in October, making it one of many best-performing months for the cryptocurrency.

However after the excessive got here a shock. On Oct. 11 the market suffered the most important single-day liquidation occasion on file as roughly $19 billion was wiped from leveraged positions, pushing BTC as little as roughly $102,000 earlier than a partial bounce.

Liquidity, leverage and the quick squeeze

One factor some analysts seen was that Bitcoin’s worth swings weren’t simply from promoting as skinny order books made the strikes means worse. Kaiko’s mid-October be aware summed up the market-making facet of it:

“Volumes spiked on Friday as panic swept by crypto markets, exposing a stark liquidity hole throughout BTC order books. As promoting accelerated, there merely wasn’t sufficient resting depth to soak up the circulation; order books on a number of exchanges thinned out to the purpose of showing empty for a number of minutes throughout main BTC venues.”

Kaiko

Even after the flash crash, some analysts say the seasonal case isn’t over. K33 Analysis famous in a analysis piece that after this huge deleveraging, they’re turning “more and more optimistic” since extreme leverage is gone and structural dangers are decrease, with the market setup “now seems far more healthy.”

“We view the approaching weeks as an opportune window for capital deployment into BTC, anticipating the reset in perps and the normalization of funding dynamics to offer a constructive basis for renewed upside momentum.”

K33 Analysis

Glassnode pointed that previous to the liquidation drama, institutional demand was fairly wholesome as greater than $2.2 billion in U.S. spot-ETF inflows was detected in a brief span and regular mid-tier accumulation made “practically all circulating provide again into revenue,” which traditionally marks late-stage however sturdy rallies.

To this point, Uptober exhibits two issues without delay: huge institutional flows pushed costs greater, however a single liquidity occasion — made worse by skinny order books and crowded derivatives — can erase that progress quick.

What occurs subsequent relies upon much less on hype and extra on whether or not market makers, institutional consumers, and possibility sellers rebuild depth. In the event that they do, Uptober may nonetheless end sturdy. But when not, October shall be remembered because the month the rally hit a liquidity wall and acquired knocked again.