As Bitcoin (BTC) tries to recuperate from its weekend sell-off that noticed it virtually crash to $100,000, some crypto analysts assume that the BTC market probably “misplaced its pulse.” Consequently, the main cryptocurrency could also be on the cusp of shedding its bullish momentum.

Bitcoin At The Threat Of Dropping Momentum?

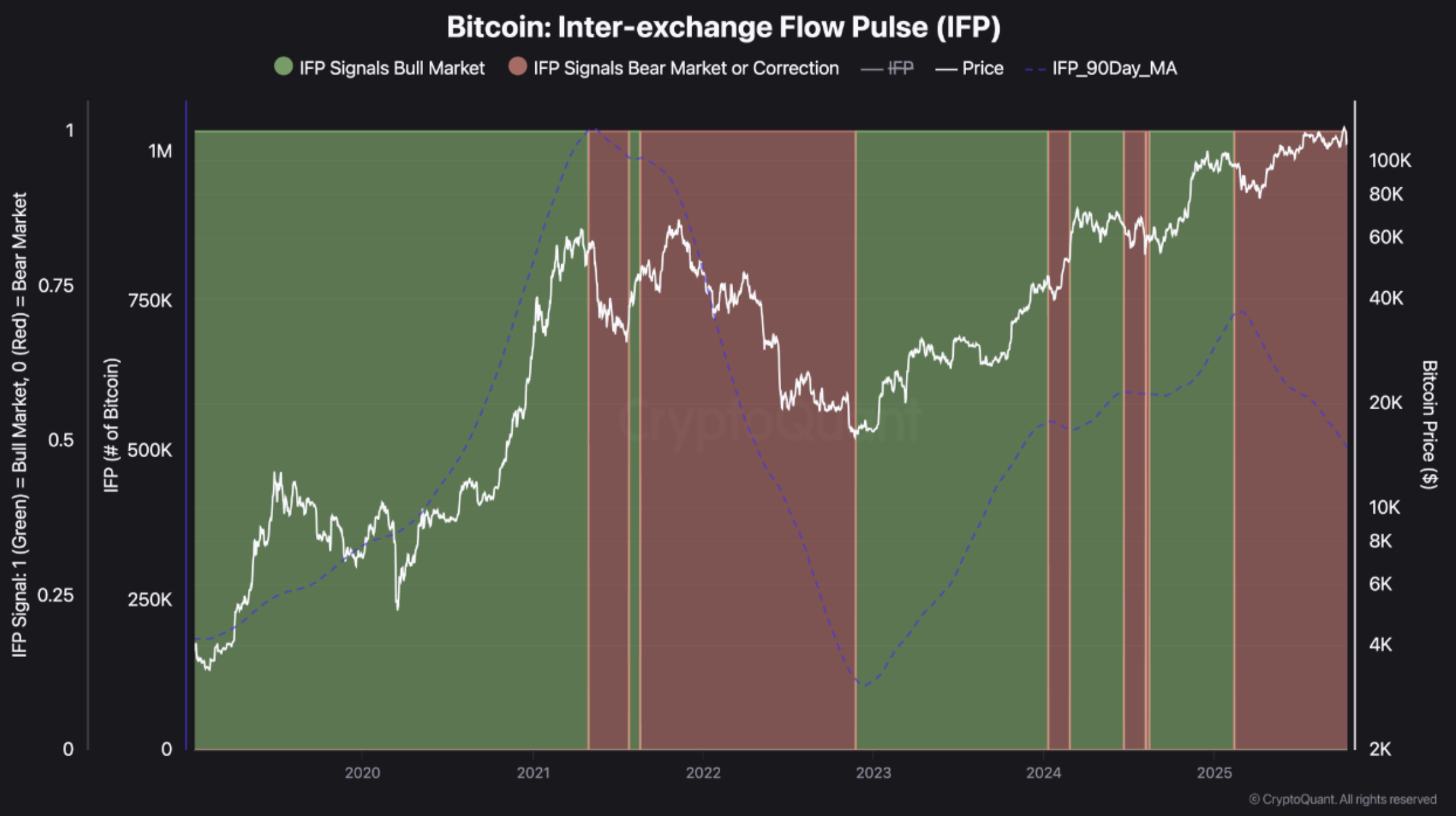

In accordance with a CryptoQuant Quicktake put up by contributor TeddyVision, Bitcoin’s Inter-Alternate Movement Pulse (IFP) has been trending decrease, confirming that inter-exchange exercise is slowly fading.

Associated Studying

For the uninitiated, the IFP measures liquidity because it strikes between crypto exchanges. In essence, it may be thought of a proxy to find out how lively arbitrage and market-making actually are.

To elucidate, arbitrage refers back to the observe of shopping for an asset for a lower cost on one platform and promoting it at the next value on one other, thus benefiting from the worth differential. In easy phrases, arbitrage refers to benefiting from inefficiencies.

When such inefficiencies exist out there and are literally executable, liquidity tends to start out transferring quick. On the identical time, buying and selling bots start shuttling funds throughout platforms, market spreads start to realign once more, and the market begins to really feel “alive.”

That is when the IFP rises. Though there may be larger market volatility on account of a rising IFP, it’s typically thought of wholesome for the market because it confirms that BTC is probably going experiencing a bullish momentum.

Nonetheless, for the reason that IFP studying has turned decrease in latest weeks, merchants are discovering it more durable to arbitrage value discrepancies regardless that they could nonetheless be showing. TeddyVision famous:

Worth discrepancies nonetheless seem, however they’re more durable to arbitrage – liquidity is thinner, latency is greater, and risk-adjusted alternatives are drying up. Merchants discover fewer setups value taking, and fewer capital circulates between venues.

The analyst emphasised that liquidity will not be leaving the market, it’s simply not circulating like earlier. Whereas such a slowdown in liquidity doesn’t crash the market, it does drain the power out of it.

To conclude, the market will not be collapsing, it’s simply “too environment friendly” in the meanwhile for merchants to seek out any significant arbitrage alternatives that they will profit from. When inefficiencies depart the market, the underlying asset is probably going prone to shedding its momentum.

A Wholesome Correction For BTC?

The market crash on October 9 led to the biggest single-day liquidation ever within the historical past of the crypto business, totalling a mammoth $19 billion. Whereas the general optimism has receded, some analysts are nonetheless hopeful of a fast sentiment turnaround.

Associated Studying

Fellow crypto analyst EtherNasyonaL acknowledged that BTC has maintained its upward trajectory regardless of the latest market crash, and {that a} transfer to a brand new all-time excessive (ATH) could also be on the horizon. At press time, BTC trades at $111,731, down 2.3% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com