Changpeng “CZ” Zhao has thrust a fast-escalating on-chain thriller into the middle of Bitcoin’s information cycle, amplifying an investigation that alleges a single Hyperliquid dealer—lengthy rumored to regulate greater than 100,000 Bitcoin—each catalyzed and profited from final Friday’s violent deleveraging. “Unsure of validity. Hope somebody can cross verify,” CZ wrote on X as he quote-posted a 12-part thread by pseudonymous researcher Eye that makes an attempt to tie the “Hyperliquid/Hyperunit whale” to former BitForex chief government Garrett Jin.

Unsure of validity. Hope somebody can cross verify. https://t.co/SPN26EXtaw

— CZ BNB (@cz_binance) October 12, 2025

This Is The Notorious Bitcoin Whale

The timing and profitability aren’t in dispute. A number of market dashboards point out the whale’s brief guess—opened on Hyperliquid solely minutes earlier than the US–China tariff headlines hit—was closed for roughly $192 million in revenue, after which a recent ~$160 million notional Bitcoin brief was reportedly opened over the weekend.

What Eye provides is a series of attribution. The thread claims that, throughout August–September, the whale rotated greater than $4.23 billion value of Bitcoin into ETH on Hyperliquid utilizing each spot and perpetuals, then funneled over 570,000 ETH into staking, finally interacting with a customized deposit contract.

Eye additional asserts that charge funding for the handle that positioned the now-famous ~$735 million Bitcoin brief will be traced—through a set of middleman wallets and a Binance deposit handle—to an ENS identification, “ereignis.eth,” which Eye says resolves to a second ENS, “garrettjin.eth,” and finally to Jin’s public X account.

In Eye’s telling, the Bitcoin provenance followers out to outdated withdrawals from HTX/Huobi, OKX, ViaBTC, Bixin and Binance from seven to eight years in the past, a interval overlapping Jin’s early-crypto resume. None of this, Eye concedes between the strains, is a signed confession; it’s a linkage map constructed from handle reuse, ENS pointers and funding paths.

Jin successfully acknowledged he’s the person in Eye’s crosshairs—whereas rejecting essentially the most explosive insinuations. “Hello @cz_binance, thanks for sharing my private and personal data. To make clear, I’ve no reference to the Trump household or @DonaldJTrumpJr — this isn’t insider buying and selling,” he wrote on Monday.

Hello @cz_binance, thanks for sharing my private and personal data. To make clear, I’ve no reference to the Trump household or @DonaldJTrumpJr — this isn’t insider buying and selling.

— Garrett (@GarrettBullish) October 13, 2025

He adopted with a multi-part rationalization of the group’s bearish posture going into the transfer, arguing that the crash was telegraphed by a mix of macro, cross-asset correlation and structural leverage alerts fairly than privileged political intel.

“From a technical evaluation perspective, US tech shares, A-shares tech shares, and main cryptocurrencies have all proven overbought alerts, resembling MACD divergence,” Jin posted, including that “cryptos and US tech shares traditionally have a excessive optimistic correlation,” and that his inner fashions had thrown “danger alerts” amid rising US–China commerce frictions since late September.

He additionally contended that excessive retail leverage on non-cash-flowing crypto property made a liquidity spiral inevitable, and proposed that exchanges adopting “a stabilization fund-like mechanism, just like US equities, [to] present liquidity assist throughout crises” would scale back repeat blow-ups.

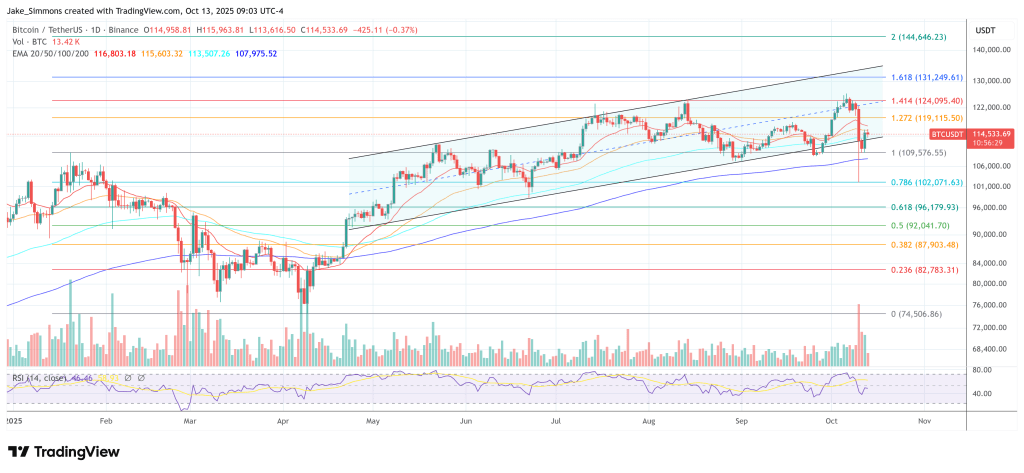

At press time, Bitcoin traded at $114,533.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.