Bitcoin is presently consolidating under the $125,000 stage after a pointy correction that pushed the value right down to $120,000, a key psychological and technical space of help. Regardless of the latest volatility, bulls are exhibiting resilience, holding value ranges that recommend the broader uptrend stays intact. Nonetheless, uncertainty persists as some analysts warn {that a} deeper correction towards decrease demand zones might nonetheless happen earlier than the following leg larger.

Apparently, onchain information offers a extra optimistic sign. Metrics point out that Bitcoin miners are usually not in a rush to promote, suggesting sturdy conviction out there’s long-term trajectory. This stability from miners — traditionally one of many largest sources of promoting stress — displays rising confidence within the sustainability of present value ranges.

Because the market navigates this part of consolidation, merchants are watching whether or not Bitcoin can reclaim $125K and set up a brand new base for continuation. For now, the mix of miner confidence and secure demand suggests the market is getting ready for its subsequent decisive transfer somewhat than signaling exhaustion.

Bitcoin Miners Stay Sturdy

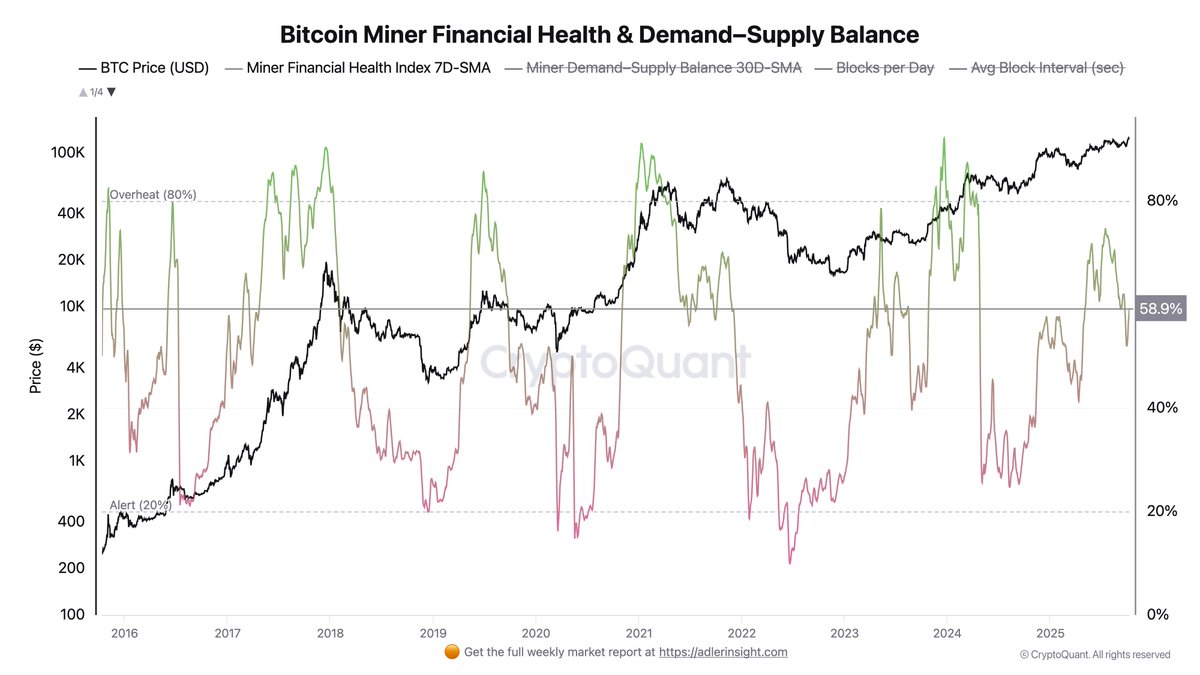

High onchain analyst Axel Adler shared new insights into the state of the Bitcoin mining financial system by means of the Miner Monetary Well being Index — a composite metric designed to measure the monetary situation of miners by accounting for hashprice, block revenue, price share, and total money circulate. In response to Adler, the index presently stands at 59%, which represents a wholesome, neutral-to-bullish mining financial system.

This studying signifies that miners are working in a secure setting with balanced profitability and no indicators of misery. Importantly, the absence of extreme stress or euphoria means that miners are usually not underneath stress to liquidate holdings, an element that usually contributes to market stability. Traditionally, durations when the index stays throughout the 50–65% vary have coincided with regular value progress, as miners are inclined to accumulate or maintain their rewards somewhat than promoting into rallies.

Adler notes {that a} sharp rise above 80% would mark the start of a distribution part, usually related to elevated miner promoting as earnings peak. For now, the reasonable studying highlights that the present cycle nonetheless has room for progress earlier than reaching overheated ranges.

This perception aligns with different onchain indicators exhibiting sturdy community exercise and powerful miner confidence, reinforcing the notion that Bitcoin’s latest correction stays a wholesome consolidation part somewhat than an indication of structural weak spot. So long as miners proceed to function profitably and chorus from large-scale promoting, Bitcoin’s underlying market basis stays agency — setting the stage for potential renewed momentum as soon as value volatility subsides.

Bitcoin Worth Evaluation: Bulls Defend $120K Help

Bitcoin (BTC) is buying and selling round $121,400, consolidating after a quick pullback from the $126,000 all-time excessive. The each day chart exhibits BTC holding above key help ranges, with the 50-day (blue) and 100-day (inexperienced) transferring averages trending upward — confirming that the broader construction stays bullish.

The $120,000–$121,000 zone is rising as a short-term help space, the place patrons have stepped in to defend in opposition to additional draw back. A sustained transfer above $123,500 might open the door for a retest of $125,000, whereas a breakdown under $120,000 would possible expose BTC to a deeper correction towards the $117,500 stage, a serious horizontal help that beforehand acted as resistance in September.

Momentum indicators recommend the market is in a cooling part after an prolonged rally, permitting for potential re-accumulation earlier than the following main transfer. The latest consolidation aligns with on-chain information exhibiting miners sustaining confidence and no vital promoting stress.

Bitcoin stays structurally bullish, so long as value holds above $117,500. Merchants will look ahead to a breakout above $125,000 to substantiate renewed momentum and probably push BTC into value discovery territory as soon as once more.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.