Bitcoin’s implied volatility (IV) gauge has climbed to a 2.5-month excessive, in keeping with the seasonal traits.

Volmex’s bitcoin implied volatility index, BVIV, which represents the annualized anticipated worth turbulence over 4 weeks, has topped 42%, the very best since late August, in keeping with information supply TradingView.

IV measures the market’s expectations for future worth swings primarily based on choices pricing. Increased IV suggests merchants are anticipating bigger worth actions forward.

The BVIV rose early this month alongside an upswing in BTC’s worth and has continued to climb regardless of the newest pullback from the report excessive of over $126,000 to round $120,000.

Bullish seasonality

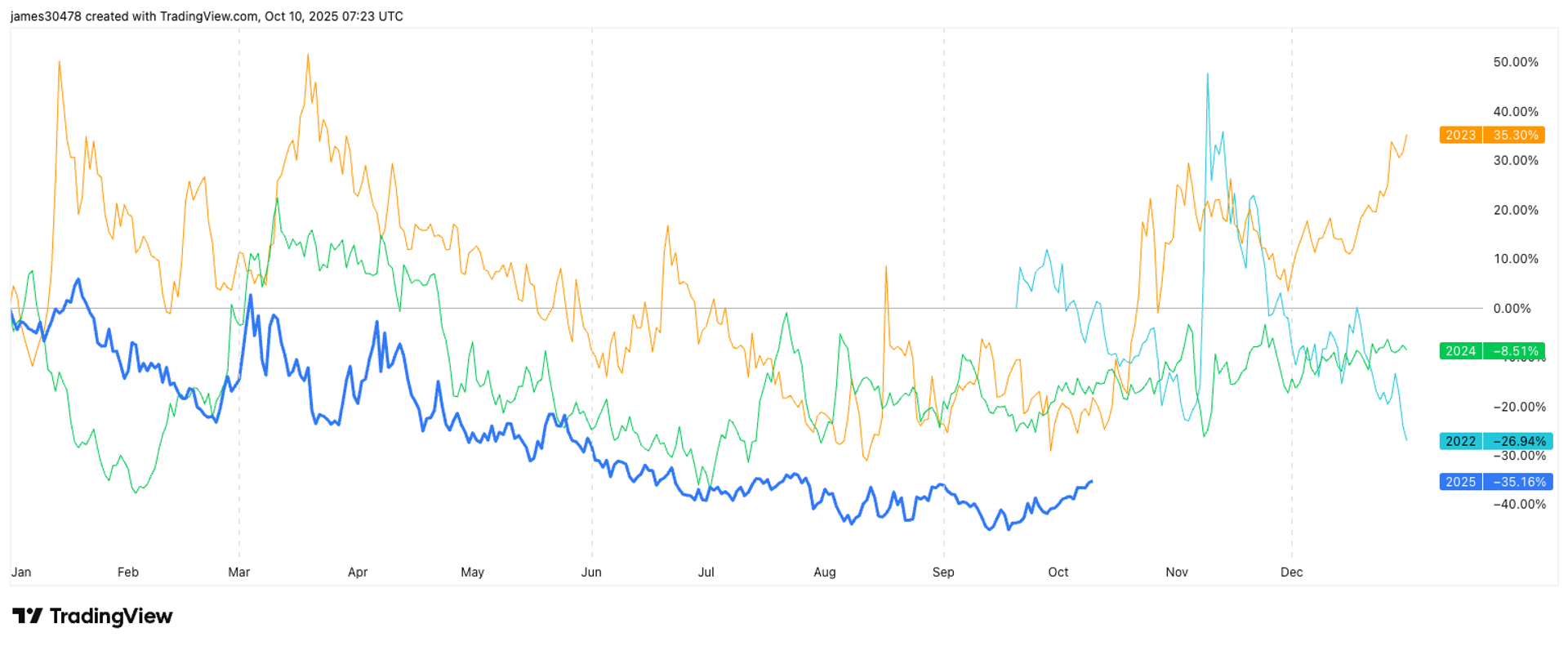

BVIV’s historic information exhibits that the index tends to spike round this time of 12 months. Each 2023 and 2024 noticed important volatility will increase in October, highlighting a recurring seasonal sample.

CoinDesk Analysis notes that 2025’s volatility setup carefully mirrors 2023, when it wasn’t till the second half of October that IV started its subsequent main leg increased, rising from an annualized 40% to over 60%.

It is the identical for the spot worth. Traditionally, the second half of October delivers stronger returns than the primary.

In accordance with information from Coinglass, bitcoin has averaged roughly 6% features every week over the following two weeks, that are among the many most bullish intervals of the 12 months. November is usually one of the best performing month, traditionally delivering greater than 45% returns on common.

Expectation over the approaching weeks is that IV will increase from this present vary.

Broader inverse relationship

Since late final 12 months, BTC’s IV has tended to rise as a rule throughout worth pullbacks in a basic Wall Avenue like dynamics. The inverse relationship is obvious from the persistent downtrend in IV since late final 12 months and the broader uptrend in costs.

As bitcoin matures as an asset, the regulation of diminishing returns suggests worth features will step by step shrink, and volatility may also decline over time. Zooming out, the BVIV mannequin exhibits a transparent long-term downtrend in implied volatility for the reason that metric was first launched.