Following a slight stoop yesterday from its current highs, Bitcoin (BTC) is now buying and selling within the low $120,000 vary. In the meantime, BTC’s miner correlation has undergone a major shift over the previous few months, indicating a transparent change in market dynamics between miner conduct and value path.

Bitcoin Miner Correlation Turns Destructive

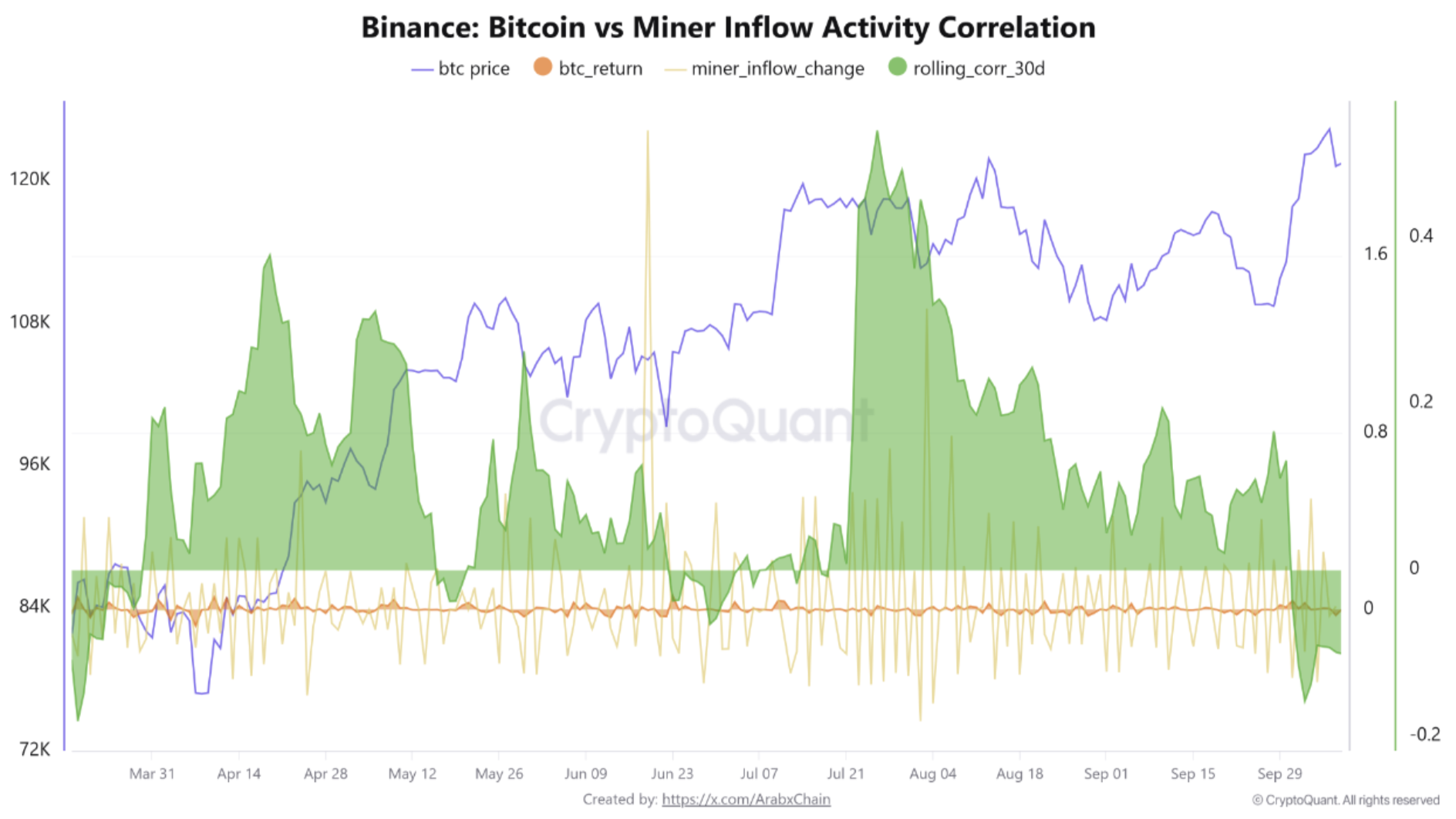

Based on a CryptoQuant Quicktake submit by contributor Arab Chain, recent knowledge from Binance exhibits that Bitcoin value and miner flows to the crypto trade have undergone a major shift in current months.

Associated Studying

Particularly, the 30-Day Rolling Correlation indicator has tumbled to its lowest degree since March 2025. On October 3, this indicator fell to -0.157, its lowest studying in additional than 5 months. Since then, it has remained near the -0.10 vary.

For the uninitiated, the 30-day rolling correlation indicator measures how carefully two variables, resembling Bitcoin’s value and miner flows, transfer collectively over the previous 30 days. A constructive worth means they sometimes rise or fall in tandem, whereas a destructive worth means they transfer in reverse instructions.

It’s value noting that the indicator had beforehand been shifting inside a constructive vary of 0.1 to 0.5 throughout Q2 2025. The shift from constructive rage to destructive means that the current surge in BTC value has not been pushed by miner flows to exchanges.

That is in stark distinction to earlier cycles, the place miner flows to exchanges performed a key function in BTC’s value motion. Nonetheless, the present cycle’s constructive value motion might be attributed to elevated demand from buyers and establishments. Arab Chain added:

In previous cycles, when the value rose, miners usually transferred bigger quantities of Bitcoin to exchanges to promote and take income, making a constructive correlation between value and miner flows – that means that as costs elevated, flows additionally elevated.

Arab Chain added that the decline in correlation signifies a part of “value independence” the place miners decide to carry their BTC somewhat than promote it throughout occasions of value appreciation. A fall in miner sign is often thought-about a bullish sign, because it reduces BTC’s circulating provide.

That stated, if the correlation turns strongly constructive once more, it may sign the return of promoting strain and a medium-term value correction may very well be anticipated. At current, the BTC market is exhibiting a wholesome steadiness between demand and provide.

BTC Wants To Defend This Stage

Following BTC’s fall to the low $120,000 vary, some crypto analysts say that the highest cryptocurrency should defend the $120,600 degree to keep away from additional crash. Nonetheless, not all analysts are bearish on BTC simply but.

Associated Studying

As an illustration, crypto entrepreneur Arthur Hayes predicts that US President Donald Trump may ship BTC to $250,000 by the top of 2025. At press time, BTC trades at $121,375, down 0.8% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com