Aster token worth motion stays decisively bullish off the $1.80 help area because it rallies inside its established buying and selling channel. The continued uptrend is supported by sturdy technical confluences and optimistic funding charges, indicating sustained market confidence.

Abstract

- Aster stays in a robust uptrend, supported by high-volume confluence on the 0.618 Fibonacci, VWAP, and POC.

- Value consolidation close to the range-mid indicators a growing bullish pennant sample.

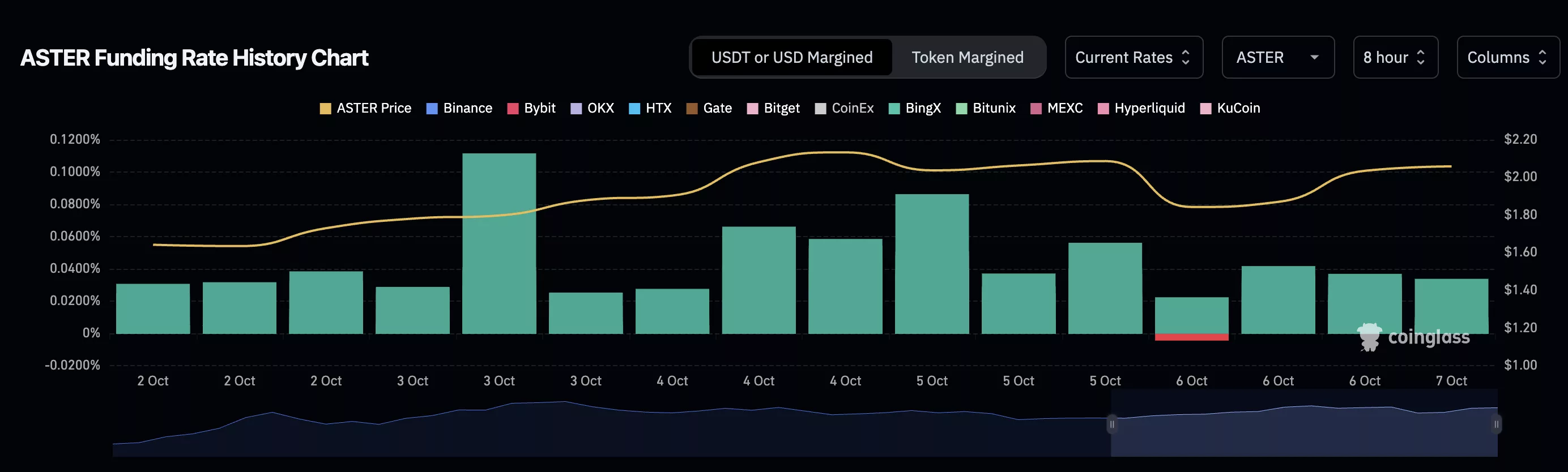

- Optimistic funding charges throughout exchanges reinforce purchaser management and help a continuation towards $2.95.

Following an impulsive rebound from the $1.80 help, the Aster (ASTR) token worth continues to point out bullish market habits. The restoration stems from a high-volume, high-confluence area, the place patrons stepped in on the 0.618 Fibonacci retracement degree, strengthened by VWAP help and the purpose of management.

These technical parts type the muse of the present rally, as worth motion consolidates close to the channel midpoint. Including to the momentum, Binance listed Aster regardless of circulating wash buying and selling allegations inside the crypto neighborhood, drawing additional consideration to the token’s latest power.

Aster token worth key technical factors

- Sturdy Help Confluence: The 0.618 Fibonacci degree, VWAP help, and POC acted as a launch zone for the latest rally.

- Bullish Construction Formation: Value is buying and selling close to the vary midpoint, exhibiting indicators of forming a bullish pennant with consecutive greater lows.

- Optimistic Funding Charges: Throughout main exchanges, funding charges stay optimistic, reinforcing the bullish bias as lengthy positions dominate.

After bottoming close to $1.80, Aster’s worth motion has been characterised by sturdy impulsive strikes supported by growing quantity. This rally originated from a clearly outlined high-timeframe help area, the place liquidity absorption confirmed renewed purchaser power. The regular respect for VWAP and the 0.618 Fibonacci retracement underlines that institutional and algorithmic patrons proceed to help the development.

Value is presently hovering across the midpoint of its buying and selling channel, a zone that always precedes consolidation earlier than the following leg greater. A minor decrease timeframe rejection right here could be technically wholesome, permitting the market to type a tighter consolidation or bullish pennant construction. This formation, supported by consecutive greater lows, would sign power even when worth briefly revisits the purpose of management.

Structurally, the buying and selling channel stays strong, having been validated by three distinct touchpoints, confirming its integrity as a dependable information for short-term market motion. Ought to worth proceed to respect this construction, the following logical section could be an apex breakout towards the higher boundary of the vary.

One other essential issue strengthening Aster’s bullish case is the constant positivity in funding charges. Merchants sustaining lengthy publicity are presently paying shorts to carry positions—typically an indication of continued optimism and a market imbalance favoring patrons. The uniformity of those optimistic funding charges throughout exchanges additional helps the case for ongoing bullish sentiment.

What to anticipate within the coming worth motion

With Aster sustaining sturdy technical construction and optimistic funding charges, the quick outlook stays bullish.

A brief-term consolidation close to the vary midpoint may full a pennant formation, setting the stage for a breakout towards the $2.95 upper-channel goal. So long as worth holds above the $1.80–$1.90 help area, the broader uptrend stays intact.