Crypto mining agency TeraWulf (WULF) is planning to boost $3 billion in debt to develop its information heart operations in a deal supported by Google, because the AI infrastructure arms race intensifies.

The corporate, Bloomberg reviews citing TeraWulf CEO Patrick Fleury, is working with Morgan Stanley to rearrange the funding, which might launch as early as subsequent month by way of high-yield bonds or leveraged loans.

Credit standing businesses are evaluating the deal, and Google’s help could assist it safe a stronger credit standing than could be typical for the agency.

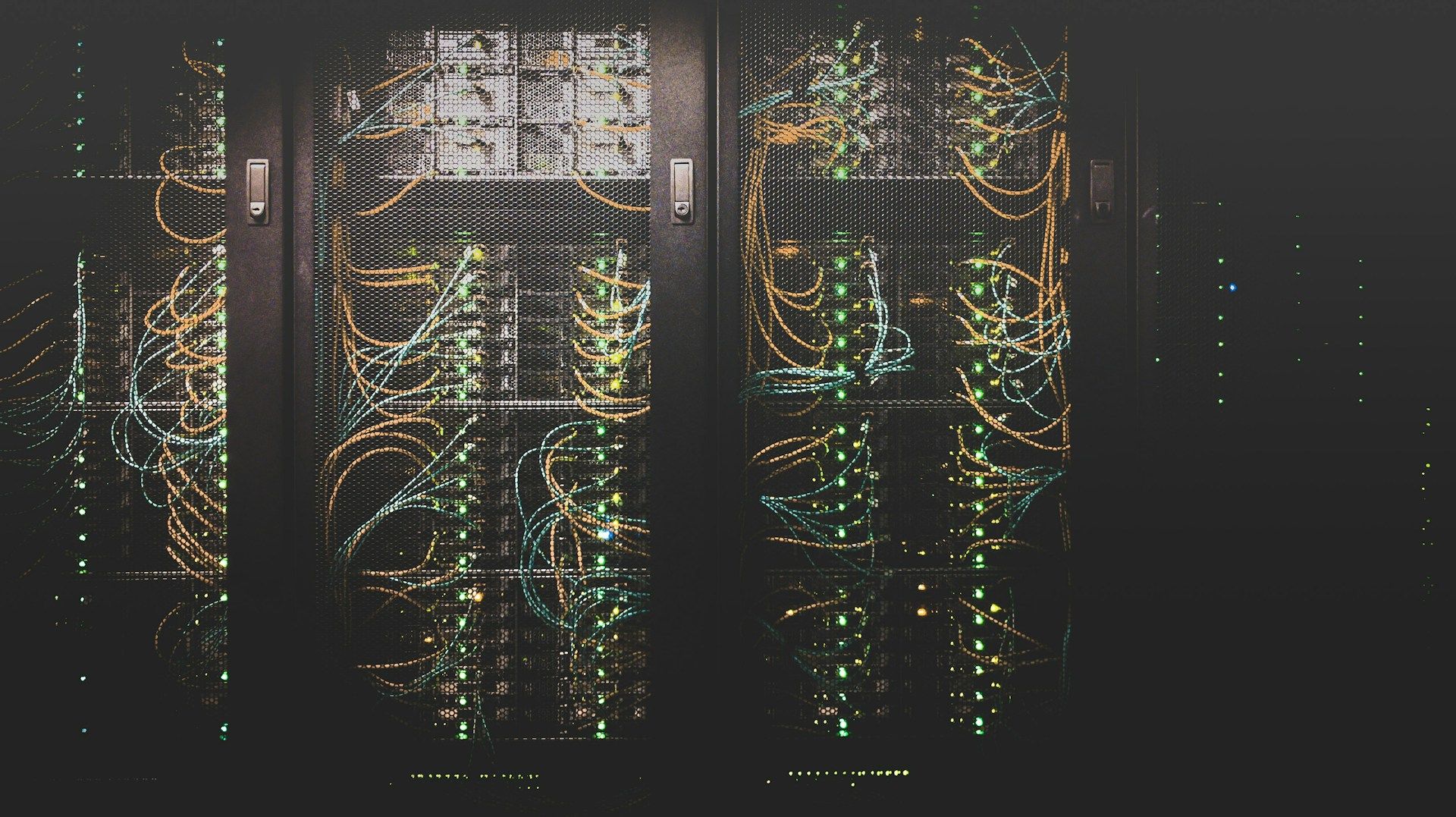

The AI trade’s starvation for information heart house, chips, and electrical energy has attracted crypto miners unlikely companions, which already management power-intensive infrastructure that may be repurposed for AI workloads.

Google, which lately elevated its backstop for TeraWulf to $3.2 billion, now holds a 14% stake within the firm. That help helped AI cloud platform Fluidstack develop its use of a TeraWulf-run information heart in New York in August.

Different crypto-native companies are following go well with. Cipher Mining struck an identical settlement with Google and Fluidstack this week. Google may even backstop $1.4 billion in obligations tied to that deal and take an fairness stake in Cipher.

TeraWulf shares dropped round 1.3% in Friday’s buying and selling session and had been unchanged in after-hours buying and selling.