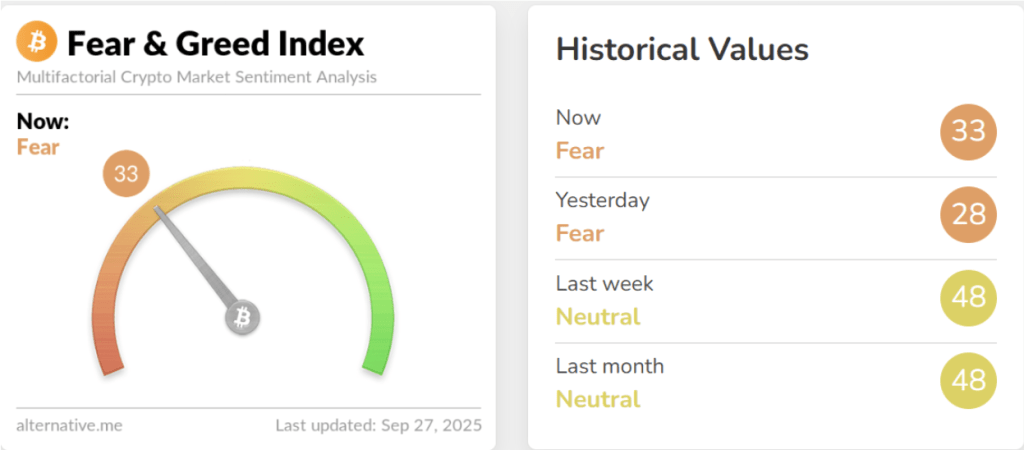

The cryptocurrency market is in a tense temper after Bitcoin misplaced necessary value ranges this week, and investor sentiment has taken a beating. This prompted the Bitcoin Worry & Greed Index to plunge by 16 factors in a single day, sinking to twenty-eight yesterday, its lowest stage since March. On the time of writing, the index has recovered barely to 33, however it nonetheless within the Worry zone. This will unsettle many buyers, however historical past exhibits that fearful circumstances could also be blessings in disguise for Bitcoin buyers.

Associated Studying

Bitcoin Worry & Greed Index Drops To twenty-eight

This week has been powerful for a lot of cryptocurrencies, particularly Bitcoin. Bitcoin, which began the week above $115,000, entered into an prolonged decline that noticed it break beneath $110,000, which in flip led to liquidations of over $1 billion value of positions throughout the trade. This transfer additionally noticed Ethereum break beneath $4,000, alongside altcoins likes XRP, Solana extending to the draw back.

Taken collectively, these strikes erased the cautious optimism of final week, when the index sat at a impartial stage of 48. As a substitute, Bitcoin’s Worry and Greed Index fell to as little as 28, which is a dramatic 16 level plunge in a single day.

This crash within the Bitcoin Worry and Greed Index exhibits simply how briskly sentiment can reverse when necessary value thresholds fail to carry. Nevertheless, whereas the fearful temper would possibly seem like a bearish trace, these circumstances may very well be a possibility for long-term merchants. The Worry and Greed Index has traditionally been a contrarian indicator, with excessive concern ranges sometimes showing earlier than vital rebounds.

Earlier in March, when the index final reached comparable depths, Bitcoin was buying and selling at a relative low round $83,000. In the present day, even after breaking beneath 30 on the index once more, Bitcoin is about $27,000 increased than it was in March.

Bitcoin Worry And Greed Index. Supply: Various.me

Constructive Outlook For The Coming Weeks

The broader takeaway from this sentiment shift is that the crypto market could also be nearer to its subsequent restoration part than many count on. The index’s slight rebound to 33 in the present day from yesterday’s low of 28 exhibits that some merchants are already positioning for a turnaround. For one, Bitcoin’s present costs may give savvy buyers the possibility to build up Bitcoin at low cost costs.

Bitcoin hardly ever sustains rallies in circumstances of overwhelming greed. As a substitute, consolidations and corrections reset sentiment and make room for more healthy development. As an example, crypto analyst Michael Pizzino mentioned in a put up on X, that the newest concern may very well be the turning level Bitcoin and crypto has been ready for.

Associated Studying

On this sense, the fearful setting could also be setting the stage for Bitcoin, Ethereum, and different altcoins to construct bullish momentum as soon as promoting strain eases.

Now, an important factor is for the Bitcoin value to reestablish itself above $110,000. On the time of writing, Bitcoin is buying and selling at $109,220.

Featured picture from Unsplash, chart from TradingView