As Ethereum (ETH) fell beneath $4,000 for the primary time since August 8, amid a market-wide pullback, the alternate reserves of the cryptocurrency additionally recorded a pointy decline. Notably, main crypto exchanges like Binance and Coinbase Superior witnessed a pointy enhance in ETH outflows.

Ethereum Reserves On Binance, Coinbase Superior Dwindle

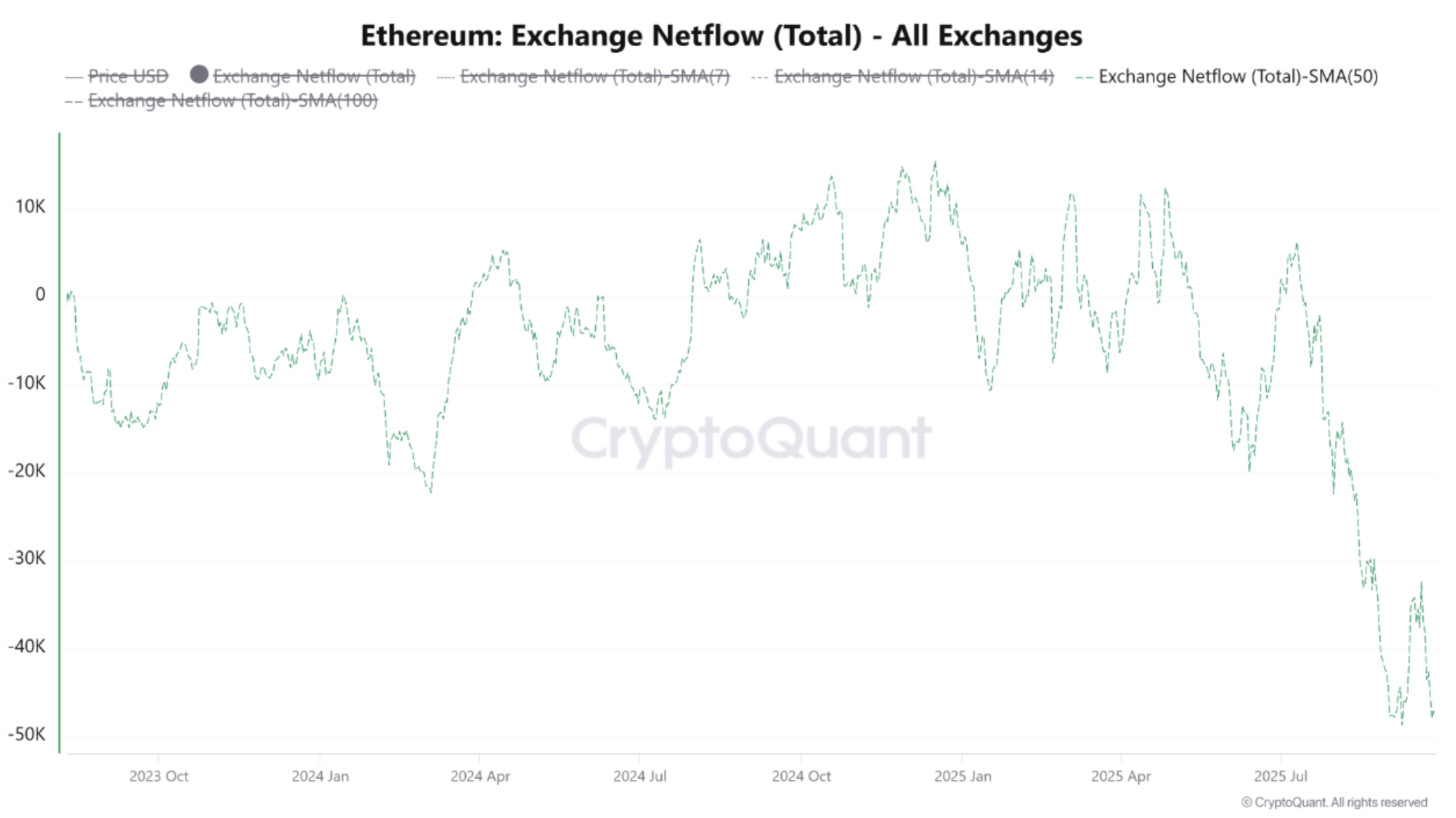

In response to a CryptoQuant Quicktake submit by contributor CryptoOnchain, Ethereum outflows throughout all main crypto exchanges have surged. In August-September 2025, the 50-day Easy Shifting Common (SMA) netflow fell beneath -40,000 ETH per day, the bottom stage since February 2023.

Associated Studying

The 50-day SMA dropping beneath -40,000 ETH per day signified diminished spot market provide and potential upward value stress. The analyst shared the next chart to clarify this dynamic.

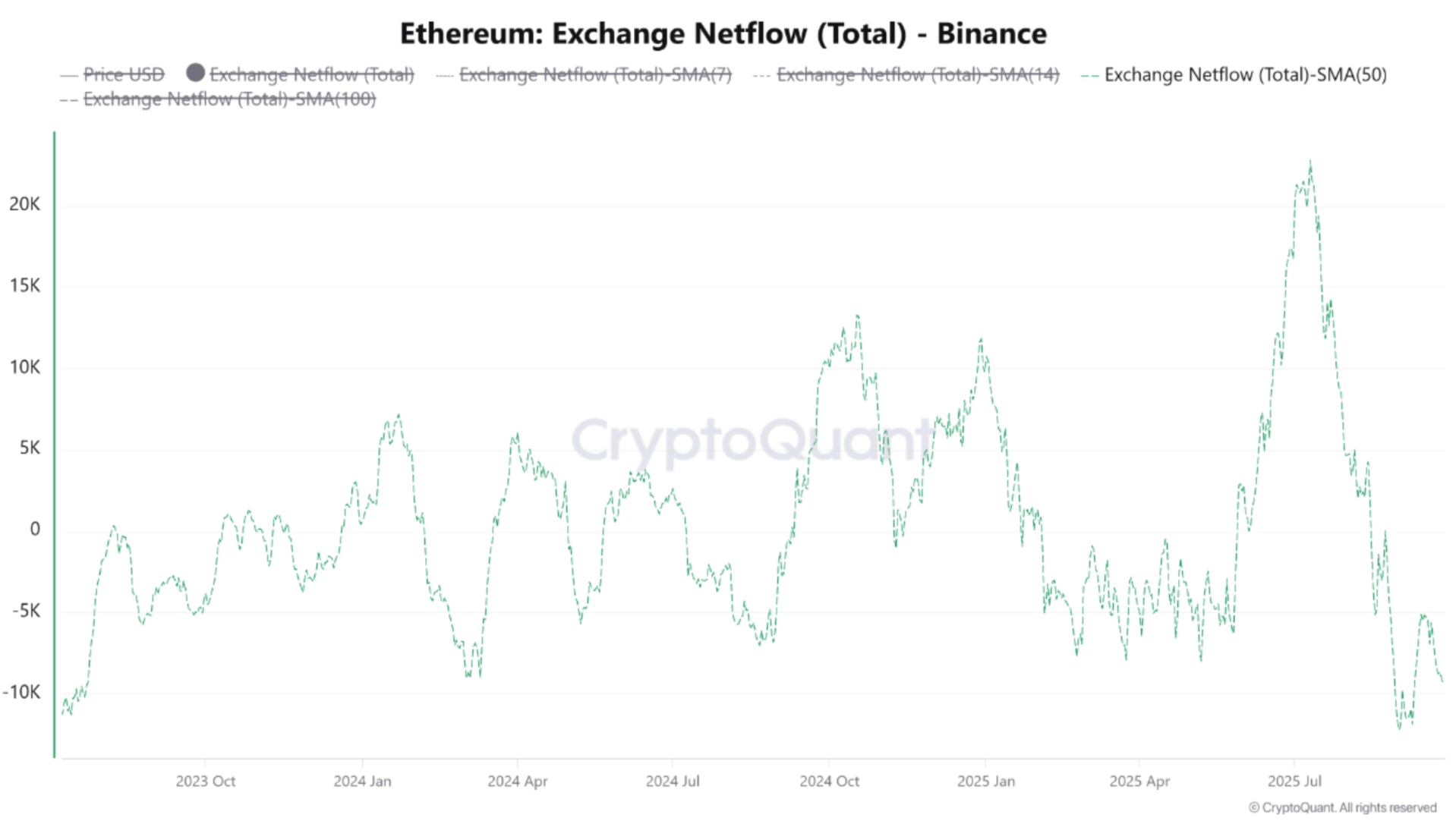

In the meantime, knowledge from Binance crypto alternate reveals netflow fluctuations over the previous two years, oscillating between constructive and detrimental values. Nonetheless, a transparent transfer in direction of heavy outflows has emerged in current months.

The next chart reveals how the 50-day SMA has reached its lowest stage in two years on Binance. This means diminished liquid holdings on Binance, in keeping with the broader market development.

The same development might be noticed on Coinbase Superior, a prime crypto buying and selling platform that primarily serves institutional traders and US-based purchasers. Right here, the 50-day SMA has dropped to round -20,000 to -25,000 ETH, recording the bottom stage ever for this alternate.

The CryptoQuant contributor famous that the numerous decline on Coinbase Superior since early summer time 2025 signifies large-scale asset transfers. Presumably, these are performed by institutional traders into chilly wallets or non-custodial platforms.

CryptoOnchain concluded by saying that the mix of multi-year lows at Binance, coupled with all-time lows at Coinbase Superior, indicators a structural, market-wide development of ETH withdrawals from exchanges. They added:

This sort of liquidity drain sometimes reduces quick provide and units the stage for potential medium‑time period bullish strikes – supplied demand out there rises.

ETH Whales Getting ready For One other Rally?

Though ETH’s momentum has turned bearish over the previous few weeks, on-chain knowledge reveals that ETH whales – wallets with important ETH holdings – are quietly accumulating the digital asset forward of one other potential rally.

Associated Studying

Most not too long ago, crypto analyst Darkfost highlighted that ETH accumulator addresses are rising at an unprecedented fee. Notably, near 400,000 ETH was added to those specialised wallets on September 24.

ETH whales accumulating the digital asset regardless of its subpar value efficiency over the previous few weeks isn’t a surprise, as bullish macroeconomic prospects level towards a possible upcoming rally for the cryptocurrency. At press time, ETH trades at $3,900, down 2.8% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com