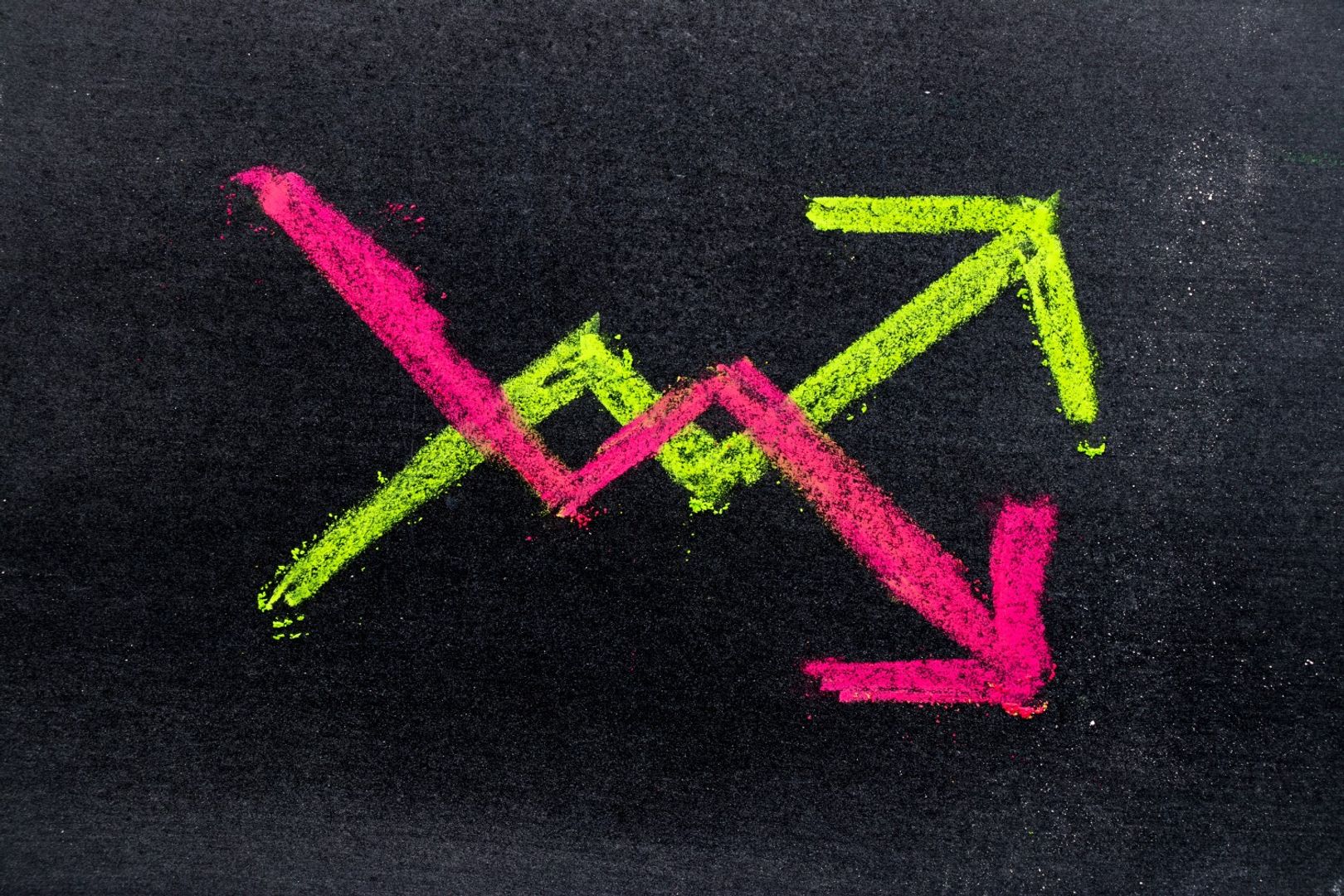

Choices information from Deribit reveals a putting divergence in sentiment for main cryptocurrencies, with bullish positioning in XRP and solana (SOL contrasting with lingering draw back fears in bitcoin (BTC) and ether (ETH).

As of the time of writing, XRP name choices or bullish bets have been pricier than places throughout all tenors, based on information supply Amberdata.Notably, the December expiry calls traded at a premium of 6 volatility factors to places, indicating a bias for a year-end rally. XRP, the payments-focused cryptocurrency, is the third-largest by market worth.

SOL choices additionally exhibited bullishness, with December calls buying and selling at a premium of 10 vol factors to places.

A name possibility provides the client the best, however not the duty, to buy the underlying asset at a predetermined worth on or earlier than a specified future date. It represents a bullish wager in the marketplace, whereas a put possibility insures towards worth slides.

XRP’s optimistic tone is probably going pushed by renewed enthusiasm round potential approval of spot exchange-traded funds (ETFs) within the U.S. No less than six to seven main issuers, together with Bitwise, 21Shares, WisdomTree, CoinShares, Canary Capital and Franklin Templeton, have lively purposes or amendments pending earlier than the U.S. Securities and Change Fee (SEC).

The SEC has delayed choices on these filings, pushing key approvals, equivalent to WisdomTree’s XRP ETF, into late October 2025. As these filings fall inside an identical assessment interval, the market appears to be making ready for a synchronized approval or rejection occasion that might considerably influence XRP’s worth.

The XRP neighborhood is very optimistic, eyeing substantial worth good points by year-end if ETFs are permitted.

“The primary-month stream base case: $5B+. Unbiased market desks peg first-month spot XRP ETF inflows at $5B+ earlier than the reflexive chase. That’s a critical demand shock to a provide that’s partly escrow-locked and concentrated,” standard pseudonymous XRP holder Pimpius stated on X, mentioning $50 because the potential year-end worth for XRP. The cryptocurrency presently trades at round $2.88, based on CoinDesk information.

Optimism from SOL seemingly stems from the rcent approval of its dad or mum blockchain Solana’s Alpenglow improve, which is more likely to enhance the community pace. Bitget’s Chief Analyst Ryan Lee referred to as it “a defining second for the community’s trajectory.”

“The approval of Solana’s Alpenglow improve with greater than 98 % staker help marks a defining second for the community’s trajectory. Decreasing transaction finality from 12.8 seconds to simply 100–150 milliseconds transforms Solana into one of many quickest blockchains in operation, unlocking potentialities that stretch effectively past marginal effectivity good points,” Lee stated in an e mail.

Lee stated that the pace enhance will speed up Solana’s adoption in real-time buying and selling, high-frequency methods and seamless on-chain arbitrage. He defined that Alpenglow’s design matches blockchain settlement speeds with conventional monetary programs, overcoming a serious hurdle for establishments hesitant to undertake decentralized infrastructure. This alignment makes Solana a horny and scalable blockchain possibility for institutional use.

Bearish sentiment in BTC and ETH

The sentiment concerning bitcoin seems decisively bearish, as places are priced greater than requires even the March 2026 expiry commerce.

BTC’s rally has stalled above $100,000, with costs struggling to rally after Friday’s disappointing U.S. jobs report, which heightened expectations for Fed fee cuts. Analysts have blamed the slowdown in ETF inflows, profit-taking by long-term holders and whale rotation into ether for BTC’s dour worth motion.

That stated, choices tied to ether additionally confirmed a bias for places out to the December expiry. ETH has pulled again sharply to $4,300 from the file excessive of practically $5,000 reached final month.