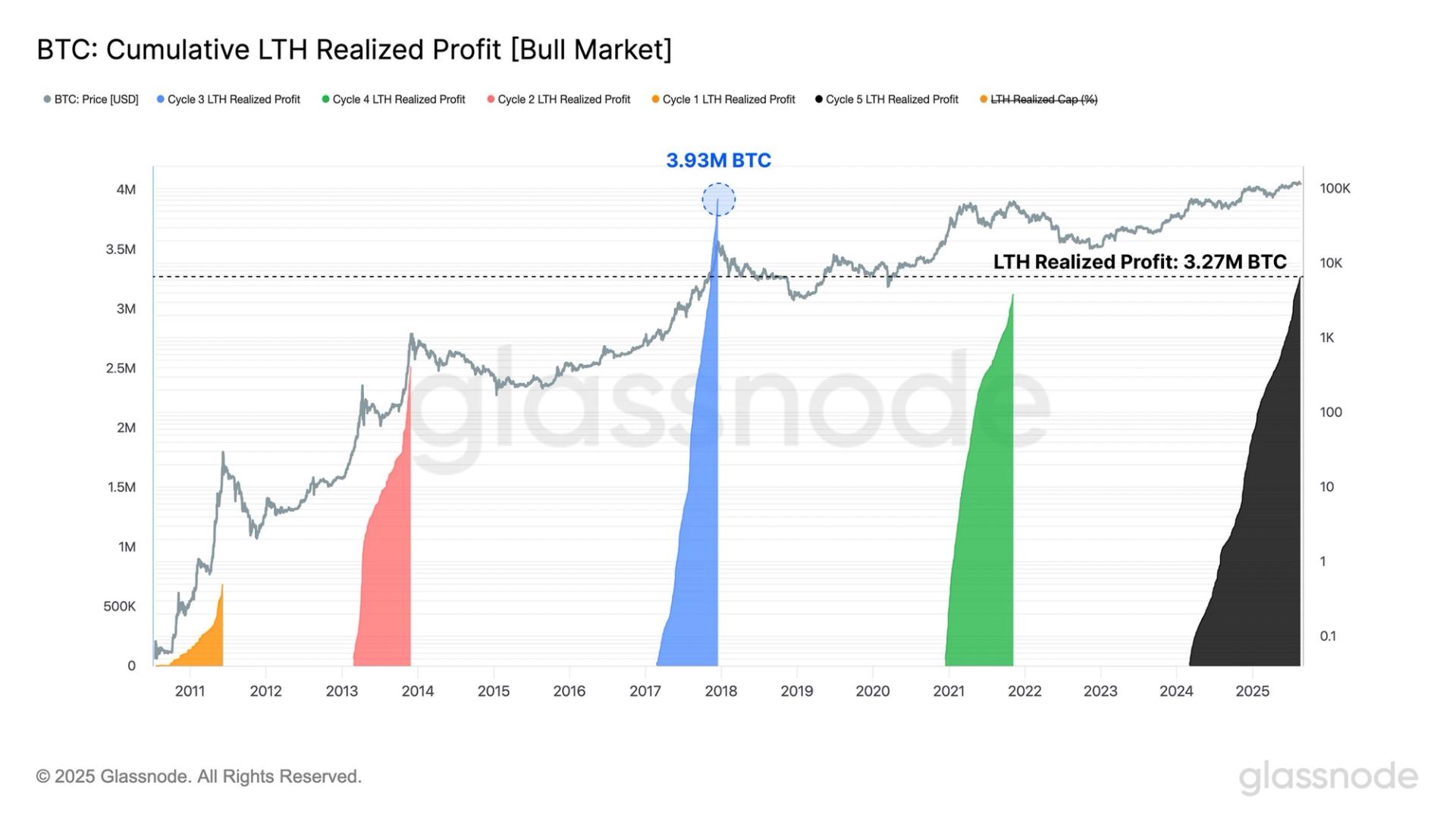

Bitcoin long-term holders (LTHs) have already realized extra revenue on this cycle than in all however one earlier cycle (2016 to 2017), in keeping with knowledge from on-chain analytics platform Glassnode.

This underscores elevated sell-side stress and, when mixed with different alerts, suggests the market has entered the late part of the cycle”.

For the reason that begin of 2024, LTHs (outlined as buyers who’ve held bitcoin for at the least 155 days) have realized 3.27 million BTC in income. This determine has now surpassed the 2021 bull run (simply over 3 million BTC) and is much forward of the 2013 cycle. Nevertheless, it nonetheless trails the 2017 bull run, when realized income reached 3.93 million BTC.

For context, bitcoin’s common value was round $1,000 in 2015, in contrast with at the moment’s ranges that are roughly 100 occasions larger. This highlights that the market has absorbed a considerably bigger greenback worth of realized income. The sell-side provide has been huge, with ongoing rotation of capital, together with from long-dormant “OG” cash.

Latest market exercise illustrates this dynamic: roughly 80,000 BTC was listed on the market at Galaxy, whereas one other 26,000 BTC lately grew to become lively.

Altogether, about 100,000 BTC has come up on the market and the market has seen a slight correction, which reveals how liquid the market has change into. Trade-traded funds (ETFs) have performed a task in facilitating this rotation, whereas buying and selling volumes have additionally expanded broadly throughout the market.