Native token of oracle community Chainlink declined in tandem with the broader crypto market regardless of a recent partnership with Japanese monetary big SBI Group.

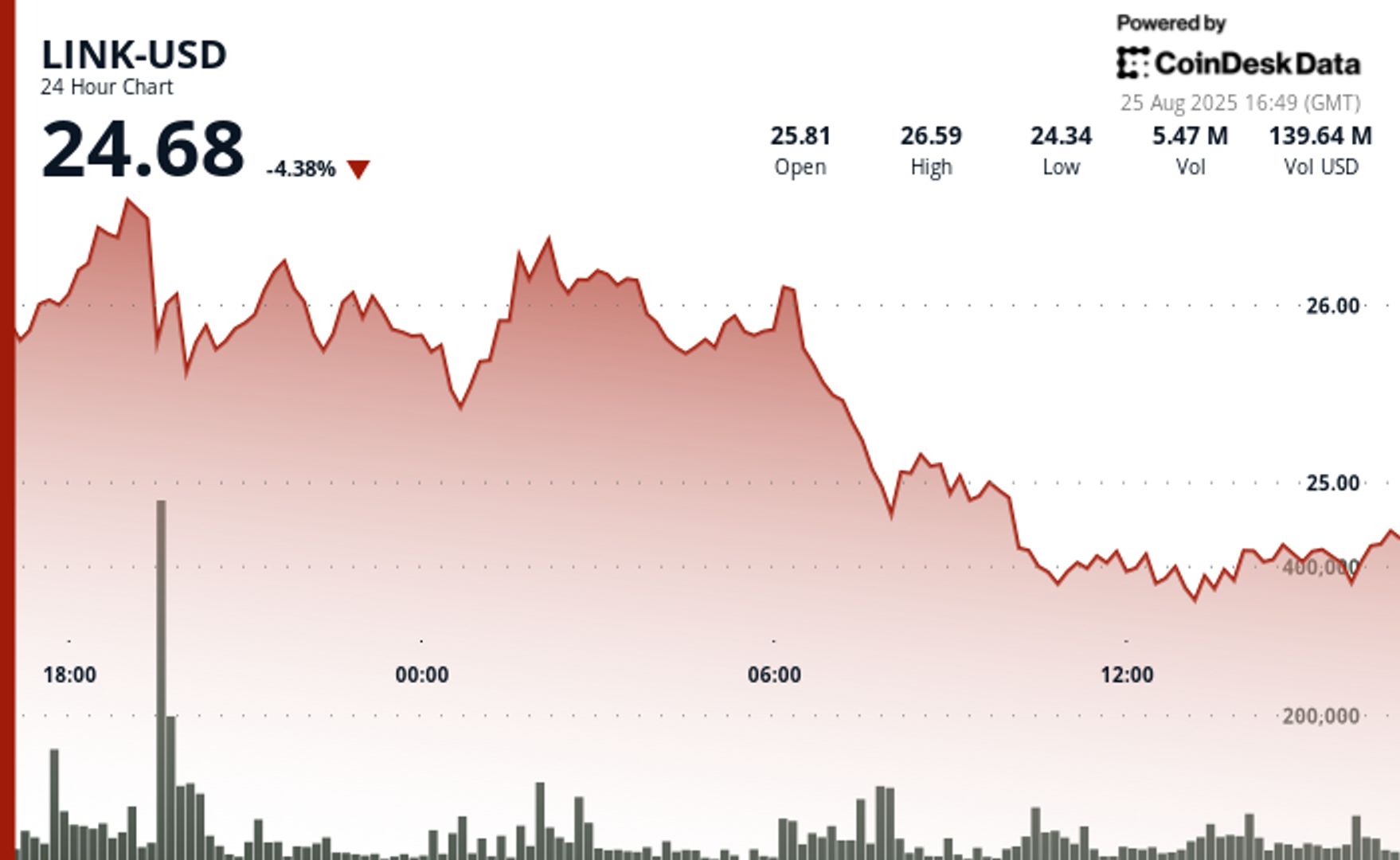

LINK declined to $24.4, down greater than 6% over the previous 24 hours, CoinDesk knowledge exhibits. That is a pointy reversal from the Friday’s year-to-date peak over $27.

The downward trajectory accelerated via successive buying and selling classes with persistent decrease peaks, while the concluding hour exhibited stagnation with negligible quantity, suggesting potential consolidation, based on CoinDesk Analysis’s technical evaluation mannequin.

On the information facet, SBI Group, one in every of Japan’s largest monetary conglomerates, mentioned on Monday it has teamed up with Chainlink to develop tokenized property and stablecoin options in Japan, with future plans to develop into different Asia-Pacific markets.

SBI will use Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to assist transactions throughout totally different blockchains whereas sustaining compliance. The corporations may even take a look at tokenized funds by bringing web asset worth knowledge on-chain and discover payment-versus-payment settlement for international trade and cross-border transactions. Chainlink’s Proof of Reserve will probably be used to confirm stablecoin reserves.

SBI and Chainlink have beforehand collaborated beneath Singapore’s Undertaking Guardian, a Financial Authority of Singapore (MAS) initiative exploring blockchain use in finance.

Technical Indicators Evaluation

- Resistance established at $26.61 with sharp reversal upon elevated quantity exercise.

- Important assist emerged at $24.37 with buying curiosity.

- Extraordinary quantity of seven,850,571 models throughout peak volatility, considerably exceeding 24-hour common of two,687,393.

- Systematic decrease peak formations indicating bearish momentum acceleration.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.