In response to crypto analyst Cas Abbé, Dogecoin’s present motion suggests it’s moving into a brand new growth part after an prolonged interval of accumulation. This growth comes after months of comparatively muted sentiment with robust value help, which now seems to be forming the groundwork for one more robust breakout. Notably, technical evaluation of assorted charts monitoring Dogecoin’s hash fee, CVDD ranges, alpha pricing, and community stress index gives context to this technical outlook, which could see Dogecoin surge to new value highs.

Indicators Of An Enlargement Section In Dogecoin

Taking to the social media platform X, crypto analyst Cas Abbé defined a number of causes as to why the Dogecoin value is about to enter into an growth part. The first being that Dogecoin has been buying and selling inside a large accumulation vary up to now few months. This base has been on the $0.20 value degree because the starting of August.

This kind of extended base-building is usually all the time identified to precede sharp upward strikes, because it displays the gradual buildup of robust demand. Moreover, the analyst famous that the present breakout makes an attempt are backed by rising buying and selling quantity, which he interpreted as institutional accumulation. That is not like previous Dogecoin bull cycles, which had been largely based mostly on retail hype.

Technical momentum indicators such because the Relative Energy Index (RSI) are at the moment in a mid-range place, and which means Dogecoin nonetheless has important room to climb earlier than hitting overbought situations.

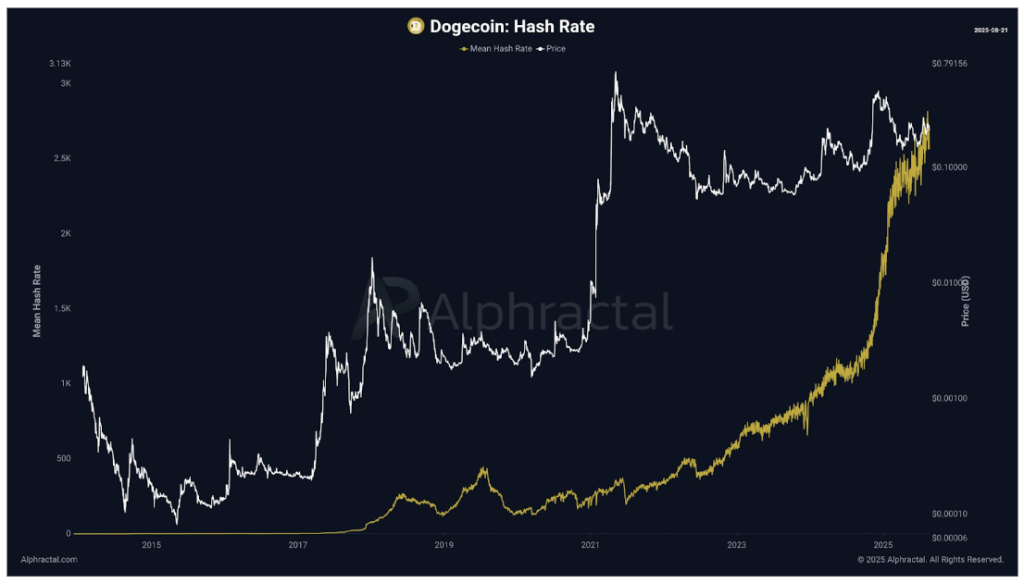

One other issue is the Dogecoin mining hash fee chart. As proven within the picture beneath, the hash fee has been rising massively because the starting of 2025, exhibiting that community energy has been steadily climbing even throughout value consolidations and declines.

Historic Patterns Again Enlargement Outlook

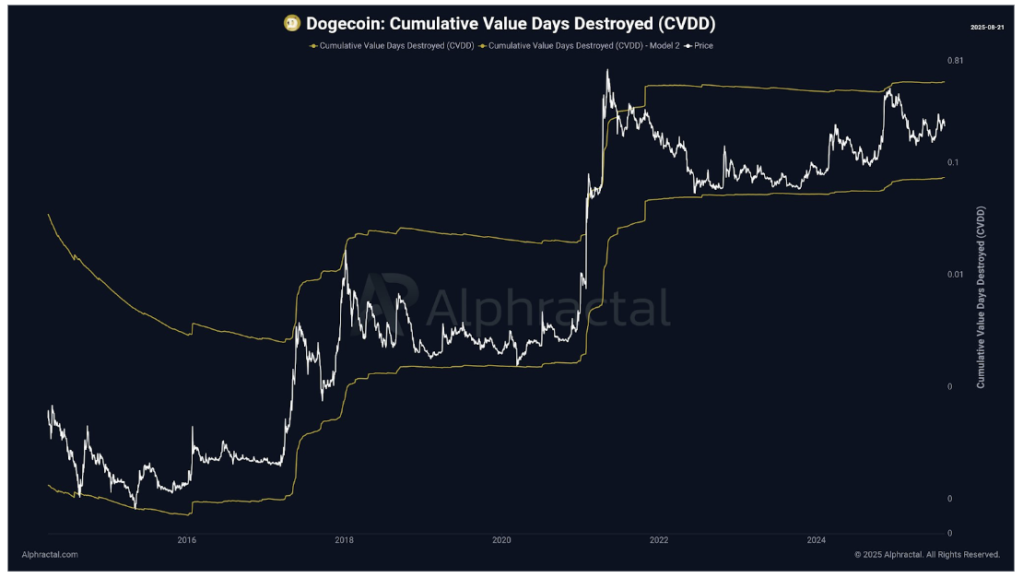

Considered one of Abbé’s key factors is that Dogecoin’s value cycles have constantly adopted an identical sample of lengthy sideways stretches adopted by sudden vertical expansions. This cycle construction will be seen within the cumulative worth days destroyed (CVDD) chart. As proven within the chart beneath, Dogecoin’s value motion stayed properly inside its accumulation zones earlier than breaking increased in 2018 after which in 2021.

Nevertheless, not like the peaks in 2018 and 2021 the place on-chain metrics had been overheated, present situations are calm, which reveals extra of real accumulation reasonably than profit-taking and distribution.

The growth part shouldn’t be about short-lived spikes however reasonably the beginning of a brand new directional development that might redefine Dogecoin’s value construction. Though the analyst didn’t outline a value goal, technical analyses from different analysts level to cost predictions that can take the Dogecoin value properly above its 2021 peak of $0.7316 into the $1 threshold and past. A comparable evaluation by crypto analyst Javon Marks factors to a Dogecoin value goal of $1.25.

On the time of writing, Dogecoin is buying and selling at $0.237, up by 9.5% up to now 24 hours.

Featured picture from Unsplash, chart from TradingView