By Shaurya Malwa (All instances ET except indicated in any other case)

Bitcoin (BTC) is sitting round $113,00 having didn’t clear $115,000. Not so way back, when it was setting new highs and euphoria referred to as for a push to $135,000, these numbers would have sounded wild.

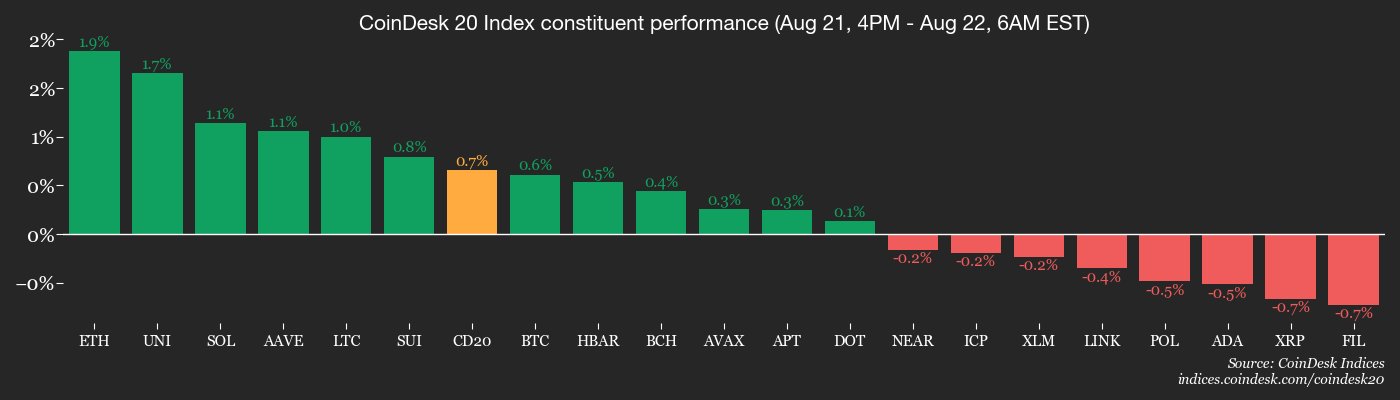

Now issues are extra muted. The CoinDesk 20 Index (CD20), a benchmark for the biggest digital property, slipped to three,996, down 0.46% on the day after opening above 4,012. It touched a low of three,957, exhibiting how the pullback has been broad, not only a bitcoin story.

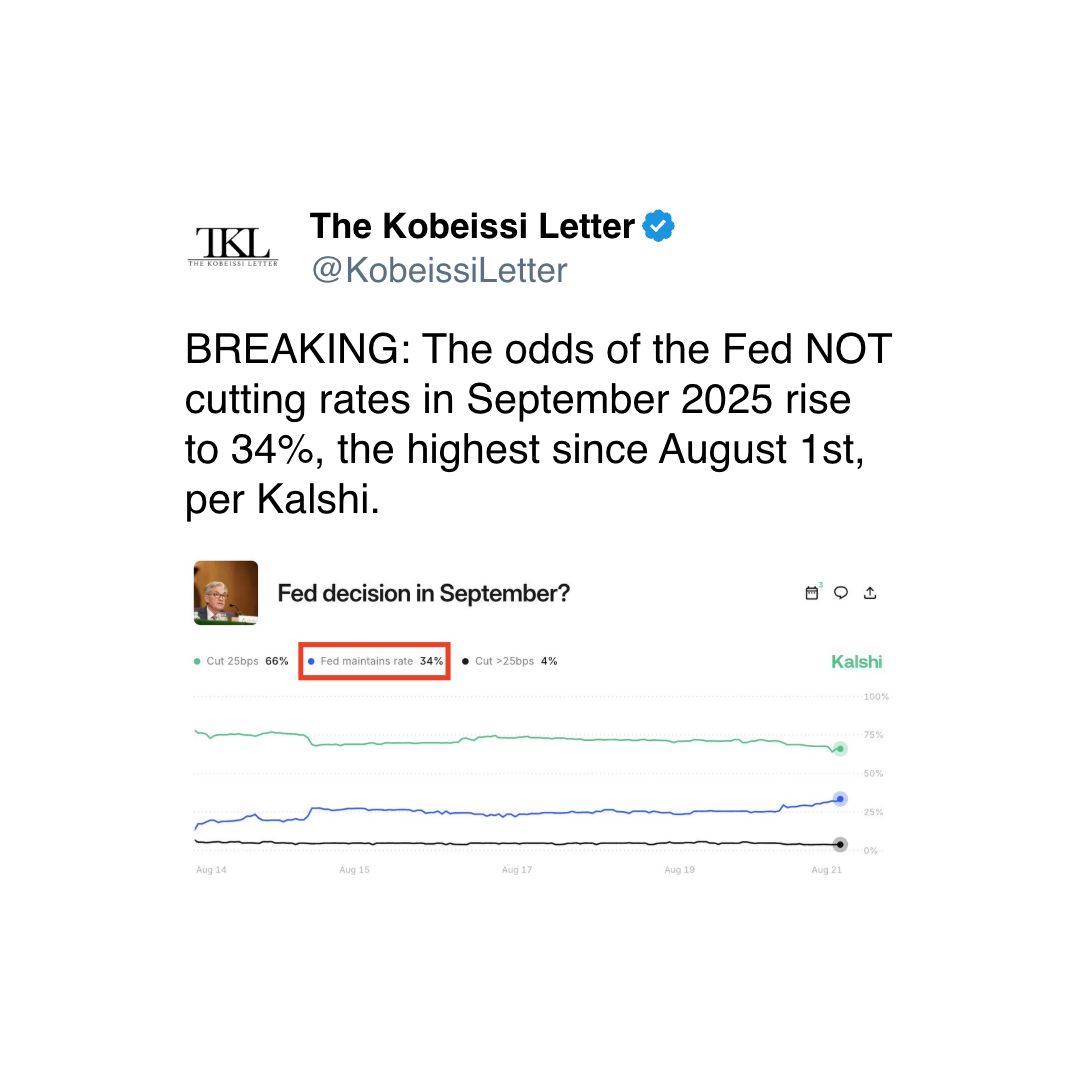

In the interim, the market appears to be ready for Fed Chair Jerome Powell to step as much as the rostrum at Jackson Gap and both calm nerves or shake issues up once more.

The temper isn’t nice. Bitcoin funds have seen over $1 billion pulled in only a few days, in line with SoSoValue information.

Ether ETFs, regardless of seeing internet inflows yesterday, have misplaced one other half a billion {dollars} this week. Name it hedging, name it profit-taking, however cash is flowing out. That’s a transparent signal institutional merchants would moderately be protected than sorry heading into Powell’s speech.

Ether, XRP, and Solana (SOL) are all drifting the identical approach. ETH is caught close to $4,289, down from latest highs as community exercise cools. XRP and SOL are every off greater than 6% this week. None of them are crashing, however no one’s shopping for aggressively both. They’re ready for bitcoin to make the subsequent transfer.

Choices are pricing in a pair % swing across the speech — greater than common, however not panic ranges. That swing may very well be up or down, although the lean feels unfavourable if Powell sounds much less dovish than markets need.

As Pulkit Goyal from Orbit Markets put it, “BTC choices are pricing in a couple of ±2% transfer round Powell’s speech.”

The stakes are easy. If Powell hints at charge cuts, danger property — crypto included — will most likely breathe simpler and bounce. If he stays cautious, the pullback might deepen, probably pushing bitcoin towards the $108,000 assist degree.

That’s why everybody’s watching so intently.

Long term there’s nonetheless bullish chatter, nevertheless. Bitwise says pensions may in the future push BTC to $200,000. Possibly. However that’s not at this time’s story. Right this moment’s story is that bitcoin, like each different danger asset, is hanging on Powell’s phrases. Keep alert!

What to Watch

- Crypto

- Aug. 22, 2 p.m.: Polygon Labs Marc Boiron will maintain a reside AMA on X, sharing the corporate’s future plans and technique whereas answering questions from the neighborhood.

- Aug. 27, 3 a.m.: Mantle Community (MNT), an Ethereum layer-2 blockchain, will roll out its mainnet improve to model 1.3.1, enabling assist for Ethereum’s Prague replace and introducing new options for platform customers and builders.

- Macro

- Aug. 22, 8 a.m.: Mexico's Nationwide Institute of Statistics and Geography releases (last) Q2 GDP development information.

- GDP Development Price QoQ Est. 0.7% vs. Prev. 0.6%

- GDP Development Price YoY Est. 0.1% vs. Prev. 0.8%

- Aug. 22, 10:00 a.m.: Fed Chair Jerome Powell delivers his keynote speech on the second day of the Jackson Gap Financial Coverage Symposium.

- Aug. 22, 5 p.m.: The Central Financial institution of Paraguay pronounces its financial coverage resolution.

- Coverage Price Prev. 6%

- Aug. 22, 8 p.m.: Peru’s Nationwide Institute of Statistics and Informatics releases Q2 GDP YoY development information.

- GDP Development Price YoY Prev. 3.9%

- Aug. 25, 3 p.m.: The Central Financial institution of Paraguay releases July producer value inflation information.

- PPI YoY Prev. 4.8%

- Aug. 22, 8 a.m.: Mexico's Nationwide Institute of Statistics and Geography releases (last) Q2 GDP development information.

- Earnings (Estimates based mostly on FactSet information)

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

- Aug. 28: IREN (IREN), post-market, $0.18

Token Occasions

- Governance votes & calls

- Aavegotchi DAO is voting on a Bitcoin Ben’s Crypto Membership Las Vegas sponsorship: a $1,000/month company membership (brand on sponsor wall, crew entry, publication function, one branded meetup/month) or a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Aug. 22: Polygon (MATIC) to host “ask me something” with Polygon Labs CEO Marc Boiron at 2 p.m.

- Aug. 22: Aptos (APT) to host “ask me something” with Bitso at 2 p.m.

- Aug. 22: Fundamental Consideration Token (BAT) to host an X areas occasion at 17:00 UTC.

- Unlocks

- Aug. 25: Venom (VENOM) to unlock 2.34% of its circulating provide price $9.45 million.

- Aug. 28: Jupiter (JUP) to unlock 1.78% of its circulating provide price $26.36 million.

- Sep. 1: Sui (SUI) to launch 1.25% of its circulating provide price $153.1 million.

- Token Launches

- Aug. 22: XPIN Community (XPIN) to listing on Binance Alpha, KuCoin and Gate.

- Aug. 22: Child Ethereum (BABYTH) to listing on BTSE.

- Aug. 22: Biconomy (BICO) to listing on Bitkub.

- Aug. 22: Swell (SWELL) to listing on Revolut.

Conferences

The CoinDesk Coverage & Regulation convention (previously generally known as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that permits common counsels, compliance officers and regulatory executives to fulfill with public officers chargeable for crypto laws and regulatory oversight. House is restricted. Use code CDB10 for 10% off your registration by way of Aug. 31.

- Day 2 of two: Coinfest Asia 2025 (Bali, Indonesia)

- Aug. 25-26: WebX 2025 (Tokyo)

- Aug. 27: Blockchain Leaders Summit 2025 (Tokyo)

- Aug. 27-28: Stablecoin Convention 2025 (Mexico Metropolis)

- Aug. 28-29: Bitcoin Asia 2025 (Hong Kong)

Token Speak

By Shaurya Malwa

- On-chain investigator Dethective uncovered coordinated pockets exercise throughout YZY and LIBRA launches, exhibiting insiders extracted almost $23 million by way of early entry and pre-seeded trades.

- One pockets purchased $250,000 price of YZY at $0.20 — when most merchants paid above $1 — and flipped it for almost $1 million revenue in eight minutes. Funds have been then funneled to a “treasury pockets” already tied to LIBRA features.

- That very same pockets benefited from LIBRA’s launch six months earlier, the place two addresses used related ways to snipe tokens. One made $9 million, one other $11.5 million, with each dumping rapidly earlier than public consumers might react.

- These wallets appeared solely throughout the YZY and LIBRA launches and invested big sums immediately, habits Dethective mentioned was inconceivable with out insider data.

- Whereas hypothesis has linked the wallets to LIBRA’s founder Hayden Davis, no proof has surfaced. Nonetheless, analysts argue “celeb cash” marketed to followers could in actuality be insider extraction schemes, enriching just a few at the price of retail.

- Analysis by Defioasis discovered greater than 60% of YZY merchants misplaced cash. Out of 56,050 wallets buying and selling YZY, most “solely shopping for” wallets could have been faux, whereas “solely promoting” wallets have been insiders exiting.

- Amongst those that each purchased and offered, 38% profited, however almost all features have been beneath $500. Simply 406 wallets made greater than $10,000, and 5 cleared over $1 million — principally linked to insiders. One dealer misplaced over $1 million in a single day.

- Ripple and SBI Holdings introduced plans to introduce the RLUSD stablecoin in Japan by Q1 2026, aiming to leverage new digital asset rules.

- SBI VC Commerce, a licensed digital cost devices trade service supplier, will distribute RLUSD, in line with a memorandum of understanding signed Friday.

- RLUSD, launched in December 2024, is totally backed by U.S. greenback deposits, short-term Treasuries and money equivalents, with month-to-month attestations from a third-party auditor. Ripple says this offers it regulatory readability and institutional-grade compliance in comparison with friends.

- SBI CEO Tomohiko Kondo mentioned RLUSD will “broaden the choice of stablecoins within the Japanese market” and strengthen belief in digital finance. Ripple executives framed it as a bridge between conventional and decentralized finance.

- The initiative is indicative of Ripple and SBI’s deepening partnership in Asia and comes simply as Japan accepted its first yen-denominated stablecoin earlier this week, signaling a quickly opening market.

Derivatives Positioning

- International futures open curiosity (OI) in BTC and ETH has elevated by 1% up to now 24 hours, suggesting capital is flowing in as costs drop. A minimum of a few of these inflows may very well be bearish bets initiated as hedges in opposition to potential hawkish feedback from Powell later at this time.

- SOL, DOGE, LINK, XRP and ADA all registered a decline in open curiosity, an indication of capital outflows. OI elevated considerably in smaller, less-followed cash similar to MAT, ULTIMA and LUMIA.

- Nonetheless, speculative exercise has cooled considerably, with volumes throughout main tokens, excluding BTC, dropping by 20% or extra. It seems merchants are holding again, ready for Powell earlier than making their subsequent strikes.

- On the CME, OI in commonplace ether futures stays elevated close to 2 million ETH whereas BTC's tally stays nicely beneath July's lows, signaling a scarcity of investor curiosity.

- Choices on CME, nevertheless, are heating up, with ETH open curiosity rising to $1 billion, the best this yr. BTC's possibility OI has jumped to $4.44 billion, essentially the most since Could.

- BTC choices listed on Deribit are suggesting a 2% value swing within the subsequent 24 hours, indicating a barely above-average volatility across the Jackson Gap occasion. Volatility has averaged 1.18% over the previous 30 days.

- BTC places proceed to commerce at a premium to calls, suggesting draw back fears. The identical is true for ETFs tied to the Nasdaq.

- Block flows on the OTC community Paradigm have been blended, that includes outright calls, put spreads and danger reversal methods.

Market Actions

- BTC is up 0.56% from 4 p.m. ET Thursday at $113,062.98 (24hrs: -0.47%)

- ETH is up 2.07% at $4,329.01 (24hrs: +0.69%)

- CoinDesk 20 is up 0.66% at 3,999.94 (24hrs: -0.6%)

- Ether CESR Composite Staking Price is up 3 bps at 2.96%

- BTC funding charge is at 0.0197% (21.5715% annualized) on KuCoin

- DXY is up 0.11% at 98.73

- Gold futures are down 0.32% at $3,370.90

- Silver futures are down 0.26% at $37.98

- Nikkei 225 closed unchanged at 42,633.29

- Dangle Seng closed up 0.93% at 25,339.14

- FTSE is unchanged at 9,312.56

- Euro Stoxx 50 is up 0.28% at 5,477.63

- DJIA closed on Thursday down 0.34% at 44,785.50

- S&P 500 closed down 0.4% at 6,370.17

- Nasdaq Composite closed down 0.34% at 21,100.31

- S&P/TSX Composite closed up 0.63% at 28,055.43

- S&P 40 Latin America closed up 0.47% at 2,661.02

- U.S. 10-Yr Treasury charge is up 0.5 bps at 4.337%

- E-mini S&P 500 futures are up 0.22% at 6,402.00

- E-mini Nasdaq-100 futures are up 0.12% at 23,248.75

- E-mini Dow Jones Industrial Common Index are up 0.29% at 44,986.00

Bitcoin Stats

- BTC Dominance: 59.4% (-0.26%)

- Ether-bitcoin ratio: 0.03826 (1.87%)

- Hashrate (seven-day transferring common): 933 EH/s

- Hashprice (spot): $55.19

- Complete charges: 3.09 BTC / $349,943

- CME Futures Open Curiosity: 145,250 BTC

- BTC priced in gold: 33.9 oz.

- BTC vs gold market cap: 9.56%

Technical Evaluation

- Ether's value (left) stays locked in an ascending channel, characterizing the bull run from April lows. Market chief bitcoin, in distinction, has dived out of the bullish channel, indicating a resurgence of sellers.

- This divergent value setup means scope for greater features in ETH in case Jerome Powell take a dovish tone at Jackson Gap.

Crypto Equities

- Technique (MSTR): closed on Thursday at $337.58 (-1.97%), +0.53% at $339.38 in pre-market

- Coinbase International (COIN): closed at $300.28 (-1.35%), +0.43% at $301.58

- Circle (CRCL): closed at $131.8 (-4.36%), +1.31% at $133.53

- Galaxy Digital (GLXY): closed at $23.89 (-2.53%), +0.71% at $24.06

- Bullish (BLSH): closed at $69.80 (+10.99%), -2.11% at $68.33

- MARA Holdings (MARA): closed at $15.51 (+0.39%), +0.39% at $15.57

- Riot Platforms (RIOT): closed at $12.27 (-2%), +0.49% at $12.33

- Core Scientific (CORZ): closed at $13.79 (-2.06%), unchanged in pre-market

- CleanSpark (CLSK): closed at $9.33 (-1.69%), +0.32% at $0.32%

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $26.88 (-1.43%)

- Semler Scientific (SMLR): closed at $30.1 (-3.56%)

- Exodus Motion (EXOD): closed at $26.15 (+2.75%)

- SharpLink Gaming (SBET): closed at $18.04 (-7.34%), $3.05% at $18.59

ETF Flows

Spot BTC ETFs

- Every day internet flows: -$194.4 million

- Cumulative internet flows: $53.8 billion

- Complete BTC holdings ~1.29 million

Spot ETH ETFs

- Every day internet flows: $287.6 million

- Cumulative internet flows: $12.11 billion

- Complete ETH holdings ~6.2 million

Supply: Farside Buyers

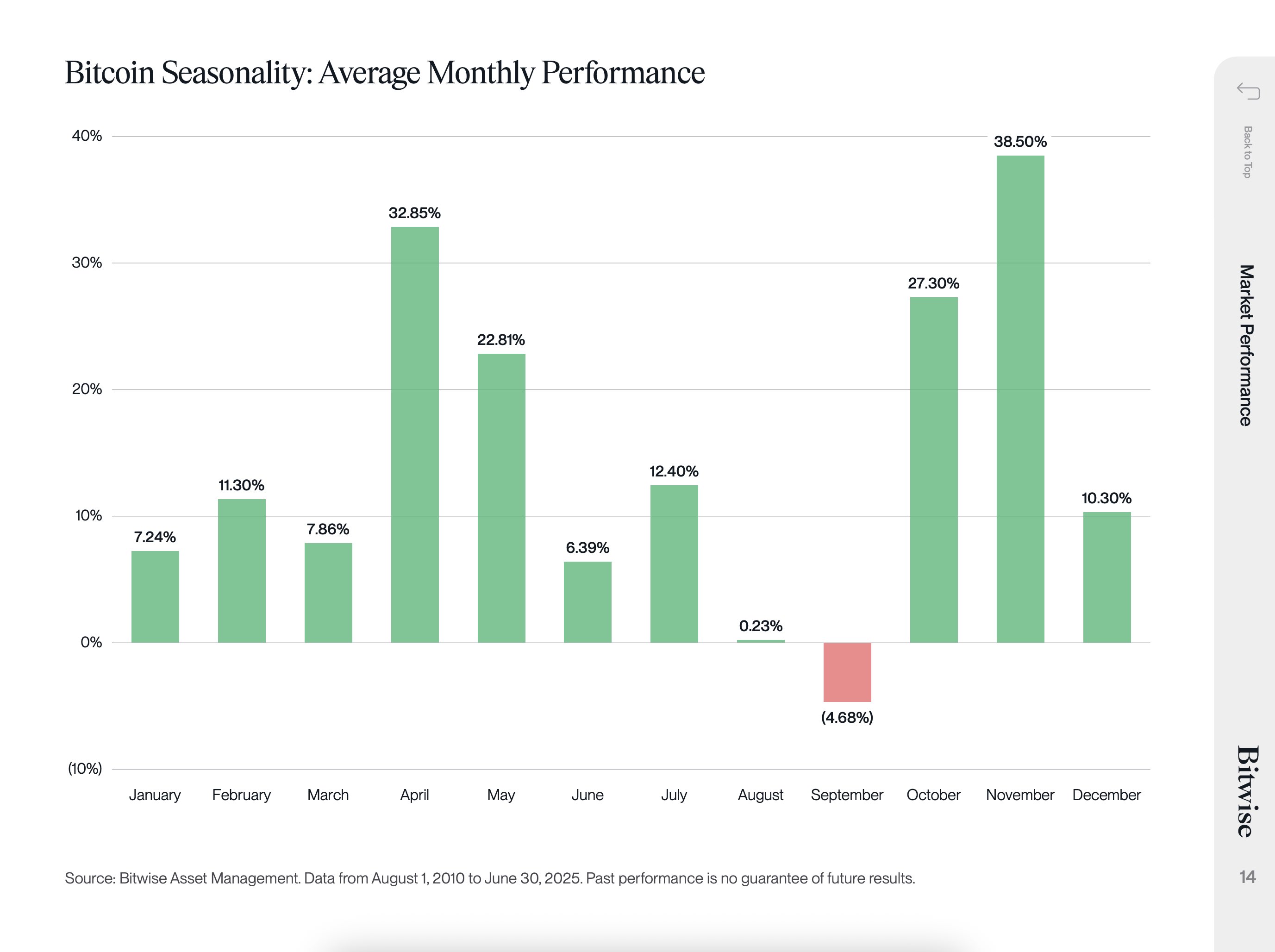

Chart of the Day

- The chart exhibits BTC's historic month-to-month efficiency since 2010, highlighting September as a seasonally bearish interval with a median lack of 4.68%.

- This requires bulls to stay vigilant within the aftermath of Powell's speech later at this time.

Whereas You Had been Sleeping

- Bitcoin's Jackson Gap Take a look at: How Exhausting May Powell's Handle Hit BTC Costs? (CoinDesk): Choices information counsel the Fed chair's speech will spark solely modest bitcoin swings of about 2%, with demand for put choices more likely to improve if his tone dashes rate-cut hopes.

- Peter Thiel Leads Pack of Buyers Piling Into Ether (The Wall Road Journal): Thiel’s Founders Fund owns 7.5% of ETHZilla and 9.1% of Bitmine Immersion Applied sciences, two companies stockpiling ether on the wager that it’s going to profit from the rising adoption of Ethereum in finance.

- EU Speeds Up Plans for Digital Euro After U.S. Stablecoin Regulation (Monetary Instances): The GENIUS Act jolted Brussels into fast-tracking a digital euro, with officers contemplating a public moderately than personal blockchain to curb the dominance of dollar-backed stablecoins.

- Ripple, SBI Plan RLUSD Stablecoin Distribution in Japan by 2026 (CoinDesk): In response to a memorandum of understanding, SBI VC Commerce, a licensed funds supplier and subsidiary of SBI Holdings, will distribute the stablecoin in Japan, aiming for the primary quarter of 2026.

- Japan's SBI Holdings Joins Tokenized Inventory Push With Startale Joint Enterprise (CoinDesk): The monetary conglomerate is working with Singapore-based crypto infrastructure agency Startale Group, which helped Sony develop layer-2 blockchain Soneium, on a 24/7 platform for tokenized shares and different monetary property.

- Japanese 30-Yr Bond Yields Hit Document Excessive on Inflation Woes (Bloomberg): The yield hit 3.21% as cussed inflation and monetary dangers spurred promoting, with international shopping for of JGBs weakening in July. Nonetheless, some life insurers now view super-long bonds as enticing.