Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a market replace on August 19 titled “Key Altcoins To Watch Proper Now,” crypto analyst Cryptoinsightuk argues that situations are enhancing for a contemporary leg increased in altcoins as Bitcoin dominance exhibits indicators of easing. “The previous couple of days and within the e-newsletter I’ve mentioned my long-term thesis round Bitcoin dominance dropping [and] that altcoins are going to take the subsequent leg up,” he stated, including that, at present ranges throughout majors, “danger–reward for lengthy positions is superb right here.”

He anchors the view in a recurring intraday construction he says is seen throughout Bitcoin and a number of giant caps: a spread types, the lows are swept, the highs are swept, value returns to the vary lows, and momentum begins to base. On Bitcoin particularly, he notes that “RSI on [the] 4-hourly seems to be prefer it may flip up,” whereas acknowledging that short-term route may nonetheless be formed by the US fairness open and broader macro headlines.

High Altcoins To Watch In Crypto Proper Now

Avalanche (AVAX) tops his tactical checklist. He outlined a limit-bid plan at $22.75, citing an area liquidity pocket right down to roughly $22.70, whereas emphasizing that the extra materials liquidity sits overhead: “There’s extra dense liquidity above us all the best way as much as $27… on the each day… as much as about $28.4, even in direction of $30 for AVAX.” He framed the commerce as asymmetrical as a result of “if we don’t get [the fill] then that’s tremendous,” whereas a push into the higher liquidity bands may speed up.

Dogecoin (DOGE) is his highest-conviction swing. He disclosed two concurrent longs—one in a DOGE perpetual and one versus USDT—with a mean entry round $0.225–$0.227 and modest leverage on the bigger place. The technical map, he argued, has already progressed via the stop-sweep and retest section: “We had this vary… we swept the lows and… back-tested this… little cluster right here, bounced off it as help up to now.”

Associated Studying

Within the close to time period, the crypto analyst is watching the reclaimed vary flooring as resistance that should flip; past that, he sees “far more dense” resting liquidity above present value “all the best way as much as about 30 cent,” with a broader dialogue zone within the mid-$0.40s: “We’ve received purple liquidity all the best way as much as 47 cent, and once we’re as much as that stage, I’ll begin to think about possibly deleveraging.”

His longer-term goal framework references Fibonacci extensions: “My take income [are] on the 1.618 fib… all the best way at like $1.19,” whereas stressing he would alter sizing “relying on what the market seems to be like at a few of these completely different ranges.”

Cryptoinsightuk additionally flagged what he known as a sentiment-sensitive Fartcoin lengthy carried with increased leverage. The stake is deliberately small given volatility—“we’re 10x on Fartcoin, so we may get liquidated if we come down to love 86 cent… 81 cent I believe is a liquidation”—and meant just for a transfer again to vary highs.

On XRP, the crypto analyst describes the same range-construction to DOGE and AVAX with an preliminary goal on the prime of the band. “Major goal can be like this high quality… construction is analogous,” he stated, noting that his focus there stays on reactions as prior highs and visual liquidity are approached.

Cardano additionally made the checklist with seen liquidity round prior swing highs “up right here at this $1–$1.10,” implying a primary checkpoint close to the $1.10 space, with continuation danger skewed to the upside “when you get to that swing excessive.”

Associated Studying

He devoted extra structural nuance to Flare (FLR), calling out a doubtlessly accomplished or growing corrective sequence that might seed a stronger impulse. “This may very well be the beginning of an impulsive transfer. This may very well be one, two, three, 4, 5. This may very well be like an ABC correction or W-X-Y-Z… triangle… in wave twos… which may then clearly result in a wave three which might be fairly aggressive,” he stated, framing FLR as an “attention-grabbing construction” quite than a name for speedy participation.

Ethereum, he argued, is making an attempt to restore short-term pattern alerts whilst a close-by liquidity pocket lurks under. “ETH is making an attempt to interrupt this short-term downtrend… difficult this key cluster… You may see… bullish divergences on the hourly timeframe,” he stated, citing a sequence of decrease lows in value in opposition to increased lows on RSI. That constructive micro-setup underpins his broader positioning stance: if Bitcoin rotates to the highest of its vary and retests all-time highs, “you’re most likely going to see essentially the most aggressive a part of the cycle transfer while you enter value discovery.”

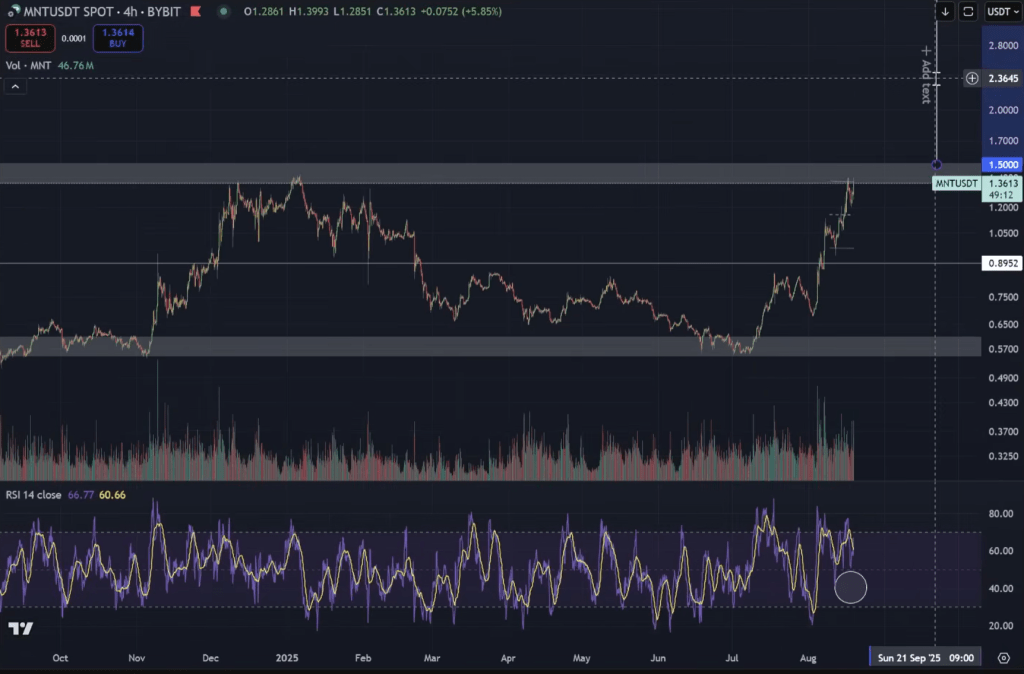

He rounded out the watchlist with Mantle (MNT), noting he holds a spot allocation and would think about taking income close to $2 if a clear vary break materializes. “MNT is on the prime of a spread… if we do get that vary break, it may very well be fairly an aggressive transfer to the upside. I shall be taking income possibly across the $2 mark,” he stated.

At press time, ETH traded at $4,175.

Featured picture created with DALL.E, chart from TradingView.com