In line with Fundstrat analysis, Ether may climb a lot greater earlier than the top of 2025, with value targets starting from $10,000 to as excessive as $15,000.

Associated Studying

Reviews present Ether jumped about 60% over the previous 30 days and hit a four-year excessive close to $4,770 in early buying and selling, whereas different protection put the token at $4,694 and famous a 78% surge over an eight-week stretch.

These strikes have pushed Ether near its all-time peak, and fund managers are taking discover.

Fundstrat Targets And Rationale

In line with Fundstrat’s chief data officer Tom Lee and head of digital asset analysis Sean Farrell, institutional forces and new guidelines are key drivers.

They level to stablecoin work and tokenized initiatives being constructed totally on Ethereum, and so they cite regulatory efforts such because the GENIUS Act and the SEC’s so-called Challenge Crypto as components that might pace Wall Avenue’s transfer onto blockchain rails.

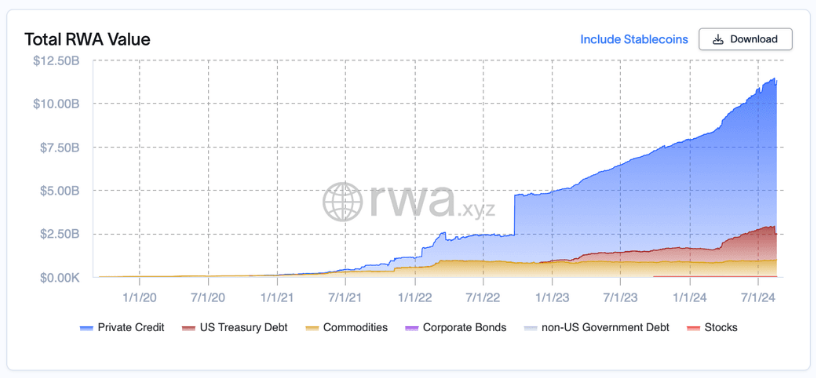

Primarily based on knowledge, Ethereum holds a commanding 55% share of the $25 billion real-world asset tokenization sector, a stat that Fundstrat makes use of to argue for broader institutional adoption.

Institutional Demand And Huge Patrons

Reviews have disclosed large-scale company accumulation that a number of analysts say is taking provide off the market.

BitMine Immersion Applied sciences has reportedly added about 1.2 million ETH since early July, leaving the corporate with roughly $5.5 billion price of Ether on its books. Firm inventory (BMNR) has been unstable, with some protection pointing to a 1,300% leap over a brief interval.

Fundstrat and different observers say these sorts of company treasuries, mixed with recent ETF flows, may create a structural bid for ETH if the shopping for is sustained.

Rachael Lucas, a crypto analyst at BTC Markets, described these positions as strategic and long-term, saying they take away “substantial liquidity” from buying and selling swimming pools.

Market Momentum And Worth Claims

In line with Fundstrat, Ether is outperforming Bitcoin this 12 months. One set of figures put ETH’s year-to-date acquire at 28% towards Bitcoin’s 18%, whereas different stories extra just lately confirmed ETH up 41% YTD and Bitcoin up 30% YTD, with BTC buying and selling close to $121,000 in that snapshot.

Primarily based on stories, Fundstrat’s analysts view ETH as a serious macro commerce for the following 10 to fifteen years if institutional and regulatory traits proceed to push demand greater.

Analysts warning that lofty targets will want sustained, giant inflows to grow to be actuality. Look ahead to the tempo and consistency of ETF flows, company treasury disclosures, and any regulatory strikes round stablecoins and custody guidelines.

Associated Studying

There’s additionally a sensible concern: large, concentrated buys can tighten markets shortly however may reverse if sentiment shifts or liquidity wants change.

In line with evaluation and public feedback from Fundstrat, the bullish case for Ether is obvious and backed by particular numbers: $10,000 to $15,000 targets, company treasuries holding hundreds of thousands of ETH, and fast current positive aspects.

Featured picture from Meta, chart from TradingView