A pointy pullback throughout crypto markets on Tuesday triggered almost $735 million in liquidations with bulls bearing the brunt.

Ether (ETH) and XRP (XRP) tracked futures bets booked bigger losses than bitcoin in an uncommon transfer, indicative of the upper curiosity towards altcoin merchants up to now week.

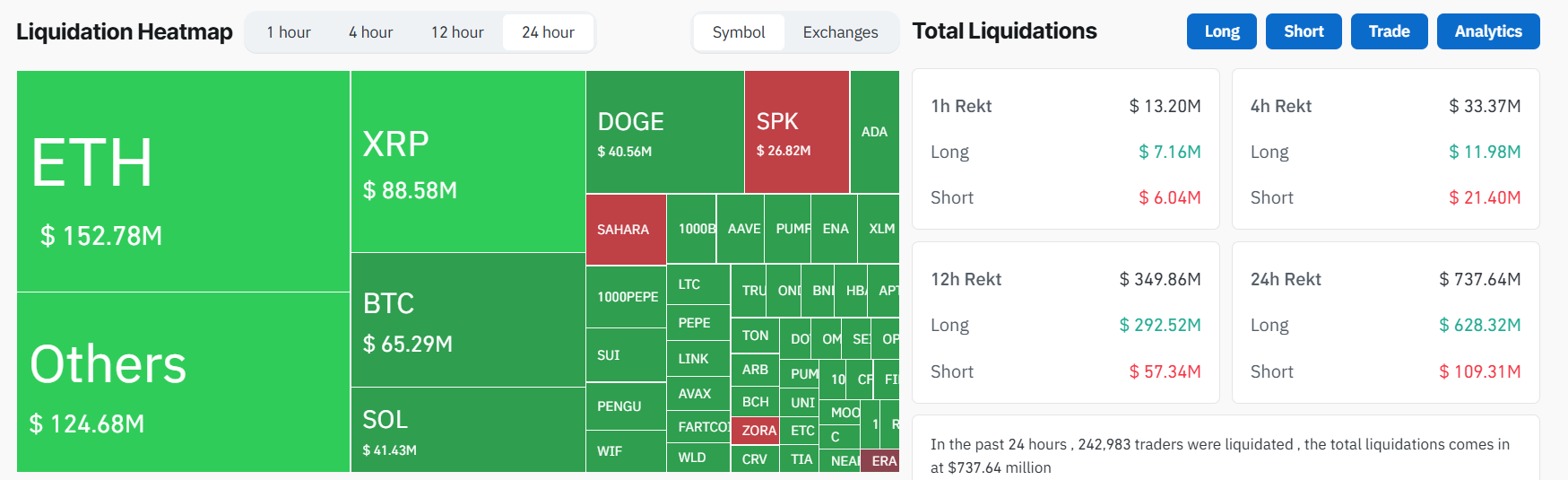

CoinGlass information reveals ETH merchants misplaced $152.78 million, the most important for any asset, adopted by $88.58 million in liquidations for XRP. Bitcoin (BTC) got here in third at $65.29 million, regardless of its bigger market cap and deeper liquidity.

Whereas value motion throughout the majors was largely down by only some proportion factors, the excessive leverage utilized by retail merchants in altcoins possible amplified their losses. In complete, $625.5 million of the liquidations had been on lengthy positions, suggesting the selloff caught many bulls off guard after weeks of upward momentum.

Different closely hit tokens included Solana’s SOL at $41 million, dogecoin (DOGE) at $40 million, and smaller DeFi tokens like SPK and PUMP seeing over $10 million in positions wiped.

The absence of a transparent catalyst and profit-taking close to key resistance ranges could have exacerbated the selloff. Ether had lately flirted with the $4,000 mark whereas Bitcoin traded above $118,000 — ranges that had already prompted revenue reserving from bigger wallets.

As of writing, ETH is down roughly 3.6% on the day to commerce close to $3,540, whereas XRP fell 6% to $3.25, extending its weekly loss to over 12%. Bitcoin fared higher, slipping slightly below 2% to hover round $116,800.

Crypto liquidations happen when leveraged positions are forcibly closed as a consequence of a value transfer past a dealer’s margin threshold. This usually ends in main losses and might set off cascade results throughout risky strikes.

Merchants use liquidation information to gauge market sentiment and positioning. Giant lengthy liquidations usually sign panic bottoms, whereas brief liquidations could precede a squeeze.

Spikes in liquidations additionally assist establish overcrowded trades and potential reversals. When paired with open curiosity and funding charge information, liquidation metrics can supply strategic entry or exit factors, particularly in overleveraged markets susceptible to sudden flushes or rallies.