Bitcoin has set a brand new all-time excessive (ATH) round $123,000, however cryptocurrency market inflows are nonetheless removed from the height noticed again in 2024.

Crypto Capital Inflows Are At the moment Sitting At $51 Billion

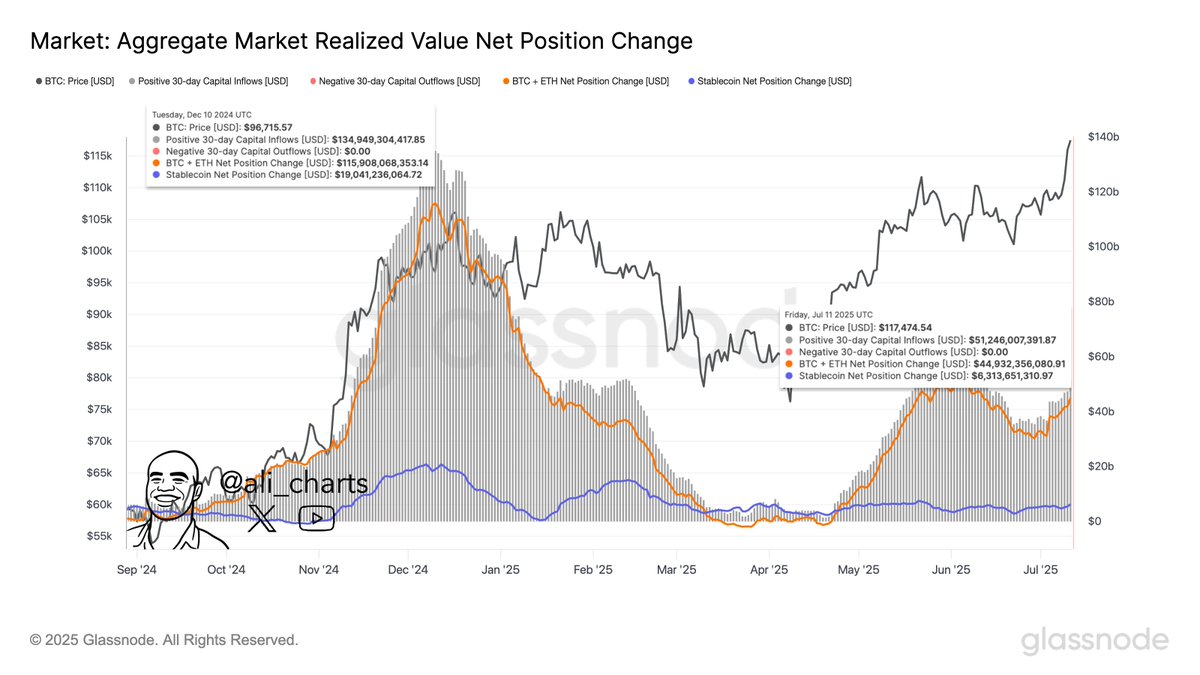

As identified by analyst Ali Martinez in a brand new submit on X, there’s a stark distinction in capital participation between the present Bitcoin rally and the one from December 2024.

Associated Studying

Under is the chart shared by the analyst that compares the 2 bull runs.

The graph captures the 30-day capital flows occurring for Bitcoin, Ethereum, and the stablecoins. For the previous two belongings, it tracks them utilizing the Realized Cap indicator.

The Realized Cap is a capitalization mannequin that calculates a given cryptocurrency’s complete worth by assuming that every coin within the circulating provide has its worth equal to the final time it modified fingers on the community. In brief, what the metric represents is the quantity of capital that buyers of the asset as a complete have put into it.

Modifications on this indicator, due to this fact, correspond to the entry or exit of capital into the community. As is seen within the chart, the 30-day Realized Cap change for Bitcoin and Ethereum (coloured in orange) has gone up alongside the most recent worth rally, indicating that capital has flowed into these cash.

It’s additionally obvious that stablecoin flows (blue) have additionally famous an uptick, though the dimensions has been smaller. For stables, capital stream could be immediately measured utilizing the market cap, since their worth is at all times pegged to $1 signifies that the Realized Cap by no means differs from the market cap.

Within the cryptocurrency sector, capital primarily is available in by three entry factors: Bitcoin, Ethereum, and stablecoins. The altcoins often solely obtain a rotation of capital from these belongings. For the reason that flows associated to the three have just lately been constructive, the market as a complete has been getting an injection of capital.

In complete, the combination capital inflows for the cryptocurrency sector have stood at $51.2 billion for the previous month. That is actually a sizeable determine by itself, however it pales compared to what was witnessed earlier than.

Associated Studying

As Martinez has highlighted within the chart, the month-to-month capital flows peaked at nearly $135 billion within the December 2024 Bitcoin rally above $100,000, greater than double the most recent quantity.

One thing to remember, nonetheless, is the truth that the earlier run was extra explosive, whereas the most recent one has are available in two waves: an preliminary restoration surge above $100,000 that led right into a consolidation section and the present breakout into the $120,000 ranges. This might, a minimum of partly, clarify why the metric has appeared comparatively cool just lately.

Bitcoin Value

On the time of writing, Bitcoin is buying and selling round $121,700, up almost 3% during the last 24 hours.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com