Bitcoin (BTC)

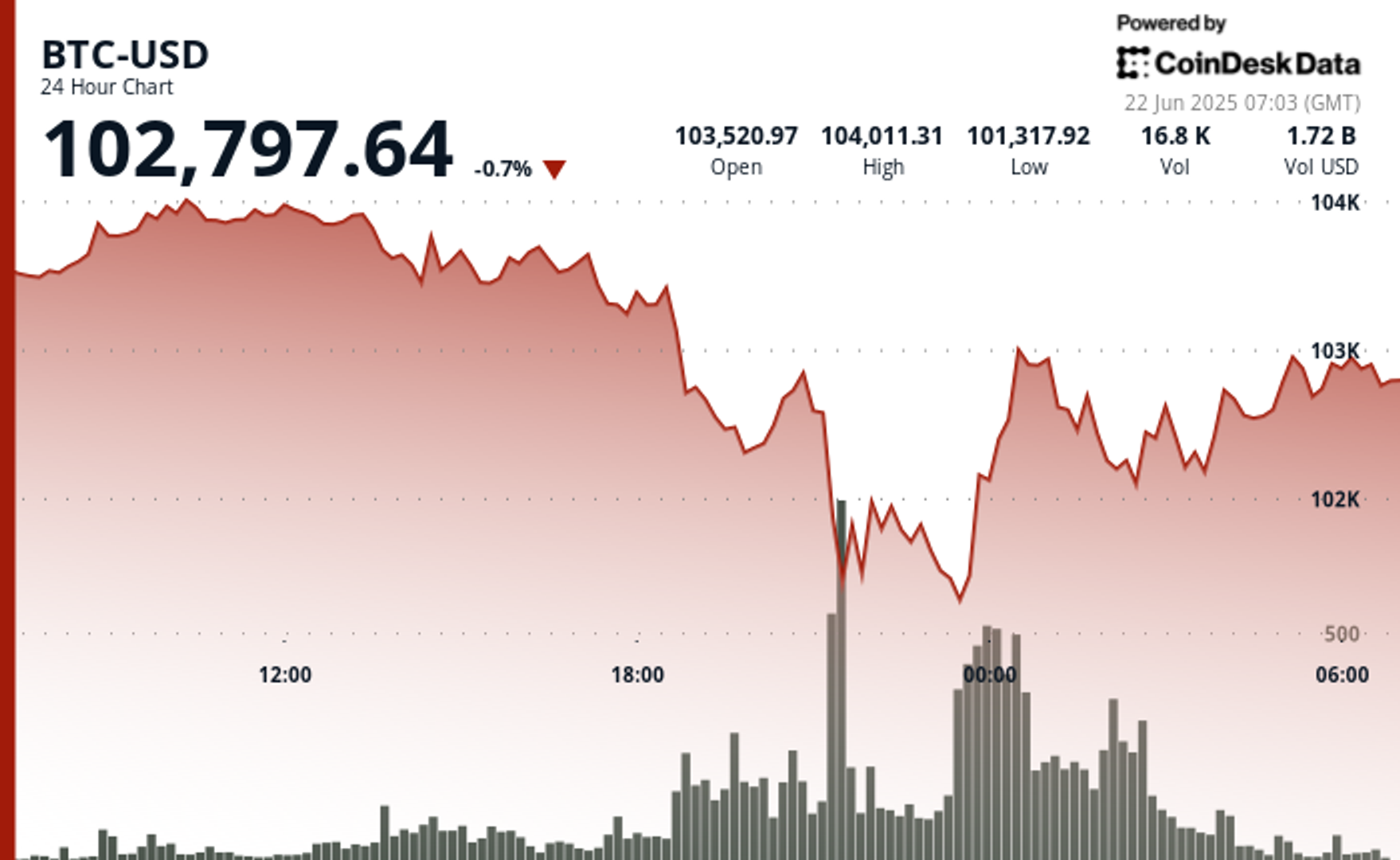

rallied above $102,000 after briefly falling beneath $101,000 in a unstable session marked by unusually heavy buying and selling, in keeping with CoinDesk Analysis’s technical evaluation mannequin.

Market members reacted swiftly to the dip, which pushed BTC close to the underside of its month-long buying and selling vary.

The reversal gained momentum as quantity accelerated, resulting in a robust rebound. The transfer coincided with a sharply worded submit from James Lavish, a Managing Companion of the Bitcoin Alternative Fund, who wrote on X: “In case you are promoting Bitcoin due to the potential for the world going to warfare, you’ve completely no concept what you personal.”

The $100K–$110K vary has contained value motion for practically a month. On-chain metrics counsel a balanced market with neither extreme profit-taking nor aggressive accumulation, whereas derivatives information signifies cautious sentiment with continued demand for draw back safety.

Technical Evaluation Highlights

- A midnight push lifted BTC above $102,800 with buying and selling quantity peaking at 17,906 BTC.

- Between 05:57 and 06:00, BTC climbed from $102,767 to $102,912, supported by quantity spikes over 150 BTC per minute.

- Peak recovery-period quantity hit 184.24 BTC, serving to drive value towards $102,990.

- Minute-level consolidation round $102,680–$102,720 preceded the breakout.

- The next help degree started forming close to $102,870 as volatility decreased.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.