The Smarter Net Firm (AQUIS: SWC | OTCQB: TSWCF) introduced it has acquired an extra 104.28 Bitcoin at a mean value of £77,751 ($104,451) per Bitcoin, totaling £8.1 million.

“Since 2023 The Smarter Net Firm has adopted a coverage of accepting fee in Bitcoin,” the corporate said. “The Firm believes that Bitcoin varieties a core a part of the way forward for the worldwide monetary system and because the Firm explores alternatives by means of natural development and company acquisitions is pioneering the adoption of a Bitcoin Treasury Coverage into its technique.”

This newest buy brings the corporate’s complete Bitcoin holdings to 346.63 Bitcoin, now valued at £27.2 million, with a complete common buy value of £78,480 ($105,430) per Bitcoin. The buildup varieties a part of the corporate’s long-term Bitcoin technique beneath its “10 12 months Plan.”

“I’m wanting ahead to working with our advisors on evaluating the effectiveness and maybe we are able to then encourage different UK corporations to adapt an analogous mechanism, as we’ve seen with our pioneering strategy to treasury administration utilizing Bitcoin,” said the CEO of The Smarter Net Firm Andrew Webley.

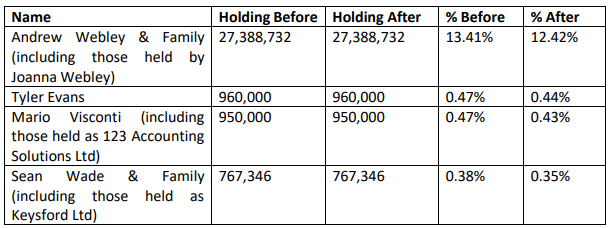

Following a profitable fundraise, the corporate confirmed up to date director shareholdings following a £29.3 million capital elevate introduced on 16 June 2025, which resulted in a 7.39% dilution for present shareholders.

Andrew Webley & Household maintained 27,388,732 shares, with their possession lowering from 13.41% to 12.42%. Tyler Evans retained 960,000 shares, down from 0.47% to 0.44%. Mario Visconti held 950,000 shares, along with his shares going from 0.47% to 0.43%. Sean Wade & Household stored 767,346 shares, with their holding falling from 0.38% to 0.35%.

“We’ve spent the previous few weeks working with our advisors to implement this as we consider that our shareholders need us to generate capital and transfer the enterprise ahead,” mentioned Webley.

As well as, The Smarter Net Firm has signed a Subscription Settlement for as much as 21 million new Strange Shares. The settlement permits for the issuance of shares in phases, with an preliminary tranche of seven million shares being made accessible instantly. Additional tranches might comply with within the coming months.

“Shard shall use cheap endeavours to put a primary tranche of seven million new Strange Shares inside 1 month from signing of the Subscription Settlement and, for every tranche of recent Strange Shares thereafter, inside 3 months from subscribing for them,” mentioned the corporate.