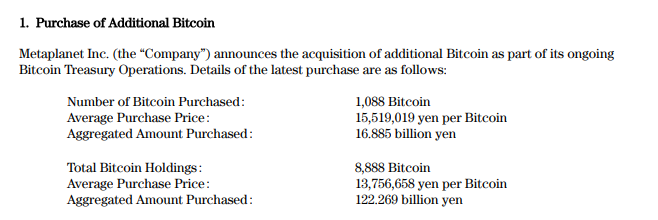

Metaplanet, Japan’s main Bitcoin treasury agency, has bought an extra 1,088 Bitcoin for about ¥16.89 billion at a mean value of ¥15,519,019 per BTC. This acquisition raises the corporate’s complete Bitcoin holdings to eight,888 BTC, with a cumulative buy price of ¥122.27 billion at a mean value of ¥13,756,658 per BTC.

The corporate continues to report beneficial properties beneath its BTC Yield metric, a proprietary KPI that measures Bitcoin accumulation per share. Quarter-to-date (QTD), as of June 2, 2025, Metaplanet’s BTC Yield stands at 66.3%, following earlier QTD yields of 95.6%, 309.8%, and 41.7% over the past three quarters. Whole BTC Achieve for Q2 2025 is 2,684 BTC, translating to a ¥40.54 billion achieve primarily based on a reference Bitcoin value of ¥15.10 million.

Metaplanet’s capital markets exercise has been tightly aligned with its Bitcoin accumulation technique. Since January 28, 2025, the corporate executed a collection of zero-coupon, non-interest-bearing bond issuances and 0% low cost inventory acquisition rights to EVO FUND, elevating over ¥35 billion and USD 121 million. These funds had been used for Bitcoin purchases and bond redemptions.

In Q1 FY2025, Metaplanet reported its strongest monetary outcomes but. Income elevated 8% quarter-over-quarter to ¥877 million, whereas working revenue rose 11% to ¥593 million. Web earnings surged to ¥5.0 billion, complemented by unrealized beneficial properties of ¥13.5 billion from its Bitcoin holdings, additional strengthening the corporate’s stability sheet.

Though Bitcoin costs dipped briefly on the finish of March, inflicting a ¥7.4 billion valuation loss, Metaplanet swiftly recovered as BTC surged to new file ranges. This sturdy reference to Bitcoin’s efficiency has led many traders to make use of Metaplanet as an funding car to get Bitcoin publicity on the Tokyo Inventory Change.

On the similar time, Technique acquired one other 705 Bitcoin for about $75 million, additional increasing its place as the most important company holder of Bitcoin as extra public firms proceed to undertake Bitcoin treasury methods.

In accordance with their SEC submitting on June 2, they purchased Bitcoin at a mean value of $106,495 every between Could 26 and June 1, bringing their complete holdings to 580,955 BTC. The acquisition was funded by promoting a few of their most well-liked shares by way of an at-the-market (ATM) fairness providing.