Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Spot Bitcoin ETFs ripped in $2.75 billion this week, and that haul was practically 4.5 instances final week’s $608 million. Costs jumped previous $109,000, a excessive not seen since January. Bitcoin even touched $111,980 on Might 22. Traders piled in because the rally took maintain.

Associated Studying

Spot Bitcoin ETF Inflows Surge

Based on Farside information, spot Bitcoin ETFs drew $2.75 billion this week, up sharply from $608 million the week earlier than. That massive bounce got here as Bitcoin pushed previous its January all-time excessive of $109,000.

On Might 21, traders added $607 million, the identical day Bitcoin hit a brand new peak. Then, on Might 22, the coin soared to $111,980. These strikes present cash chasing contemporary highs.

BlackRock’s IBIT Leads Flows

Based mostly on stories, ETF flows on Might 23 totaled simply $212 million, however BlackRock’s IBIT was the one one within the inexperienced. It introduced in $431 million all by itself, and that stretched its influx streak to eight days straight.

In the meantime, Grayscale’s GBTC noticed $89 million depart, and ARK 21Shares’ ARKB misplaced $74 million. Traders appear to favor the low charges and extensive attain of the largest funds.

Market Sentiment Pulls Again

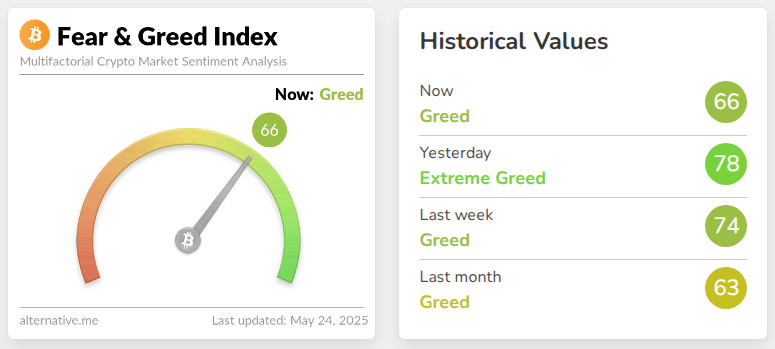

Bitcoin’s climb paused a bit after that. At publication, it traded close to $108,150. The Crypto Worry & Greed Index slid from an “Excessive Greed” studying of 78 right down to 66, or “Greed.” That dip hints at some profit-taking.

CryptoQuant analyst Crypto Dan mentioned on Might 22 that “overheating indicators such because the funding price and short-term capital influx stay low in comparison with earlier peaks, and profit-taking by short-term traders is restricted.” His view is that this rally hasn’t been pushed by dangerous bets.

Associated Studying

File Month-to-month Inflows In Sight

Thus far in Might, spot Bitcoin ETFs have pulled in about $5.40 billion. The earlier month-to-month excessive got here in November 2024, when ETFs took in $6.50 billion.

With 5 buying and selling days left in Might, inflows might set a brand new mark. That regular demand underlines how ETFs have grow to be the go-to means for a lot of to personal Bitcoin with out wrestling with wallets and personal keys.

Demand for spot Bitcoin ETFs has grown quick. Traders like easy, regulated merchandise. The large issuers, led by BlackRock, have the perfect likelihood to remain on prime.

As for Bitcoin itself, if sentiment cools, costs would possibly pull again some. However with institutional flows so robust, many see room to run greater.

Featured picture from Gemini Imagen, chart from TradingView