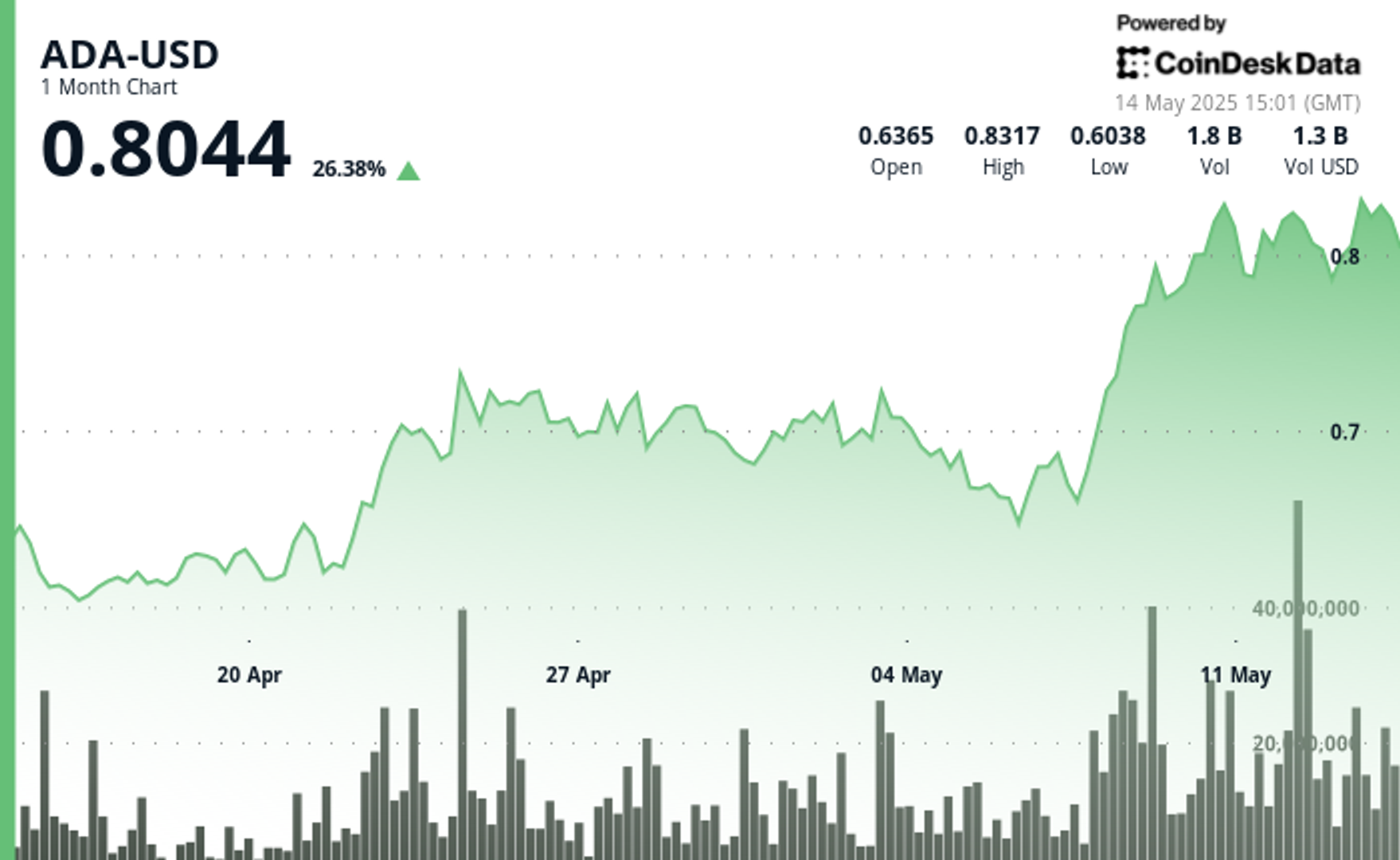

World financial uncertainties are creating ripple results throughout cryptocurrency markets, with Cardano (ADA) demonstrating notable volatility amid shifting investor sentiment.

After rallying 22% weekly, ADA has established a buying and selling vary between $0.795 and $0.841, reflecting each profit-taking and strategic accumulation by bigger traders.

Latest developments have strengthened Cardano’s market place, significantly its addition to Grayscale’s Digital Massive Cap Fund and integration with Courageous browser’s pockets system. These partnerships have considerably expanded ADA’s potential consumer base, with the Courageous integration alone connecting Cardano to over 86 million customers worldwide.

Market information reveals institutional involvement has intensified, with on-chain analytics revealing holders controlling between 100 million and 1 billion ADA accumulating over 40 million tokens in simply two days. This whale exercise coincides with ADA’s breakout from a descending channel sample, suggesting potential for additional upward motion regardless of short-term volatility.

Technical Evaluation Highlights

- ADA exhibited important volatility over the 24-hour interval, establishing a spread of 0.047 (5.9%) between the low of 0.795 and excessive of 0.841.

- The value motion shaped a transparent bullish development in the course of the first half of the interval, with high-volume shopping for on the 0.805 assist degree propelling ADA to its peak.

- A subsequent correction part emerged as profit-taking intensified, with notable promoting stress across the 0.828 resistance degree, significantly in the course of the 08:00 hour when quantity spiked to 90M models.

- The formation of decrease highs because the peak suggests momentum could also be waning, although the worth continues to seek out assist above the 0.810 degree, indicating potential consolidation earlier than the following directional transfer.

- Within the final hour, ADA skilled important volatility with a pointy rally adopted by an abrupt correction.

- Worth motion confirmed robust momentum from 13:06 to 13:33, climbing from 0.816 to a peak of 0.827, representing a 1.3% acquire.

- Nevertheless, promoting stress intensified dramatically round 13:44, triggering a steep 1.5% decline to 0.809 inside minutes.

- The formation of a double backside on the 0.809-0.810 assist zone prompted a reasonable restoration, with worth stabilizing within the 0.813-0.816 vary by session’s finish.

- Quantity evaluation reveals significantly heavy buying and selling in the course of the correction part, with over 2.7M models exchanged in the course of the 13:44 candle, suggesting institutional profit-taking after the sooner uptrend.

Disclaimer: This text was generated with AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage. This text could embrace info from exterior sources, that are listed under when relevant.

Exterior References