On-chain knowledge reveals the cryptocurrency market as a complete has witnessed capital inflows of almost $19 billion whereas Bitcoin and others have gone by way of their restoration.

Crypto Market Has Loved Internet Capital Inflows Over The Previous Month

In a brand new submit on X, analyst Ali Martinez has talked in regards to the newest development within the capital inflows for cryptocurrencies. Within the digital asset sector, capital primarily flows out and in by way of three asset lessons: Bitcoin, Ethereum, and the stablecoins. The altcoins often solely see a secondary rotation of capital from these cash.

As such, the netflows associated to the three of BTC, ETH and the stables can present a sufficient-enough estimation for the state of affairs of all the cryptocurrency market.

For calculating the capital inflows/outflows associated to Bitcoin and Ethereum, the “Realized Cap” indicator can be utilized. The Realized Cap is an on-chain capitalization mannequin that finds the full worth of any asset’s provide by assuming the worth of every particular person token as the identical as its final transaction worth. That is totally different from the standard Market Cap, which simply sums up the availability on the present spot worth.

Briefly, what the Realized Cap displays is the quantity of capital that the traders of the cryptocurrency as a complete have put into it. Modifications associated to the metric, subsequently, mirror the influx or outflow of capital.

Within the case of the stablecoins, the change within the Market Cap is sufficient to gauge the capital netflow. That is right down to the truth that the Realized Cap is not any totally different from the Market Cap for them, on account of their worth by no means various from the fiat foreign money that they’re pegged to.

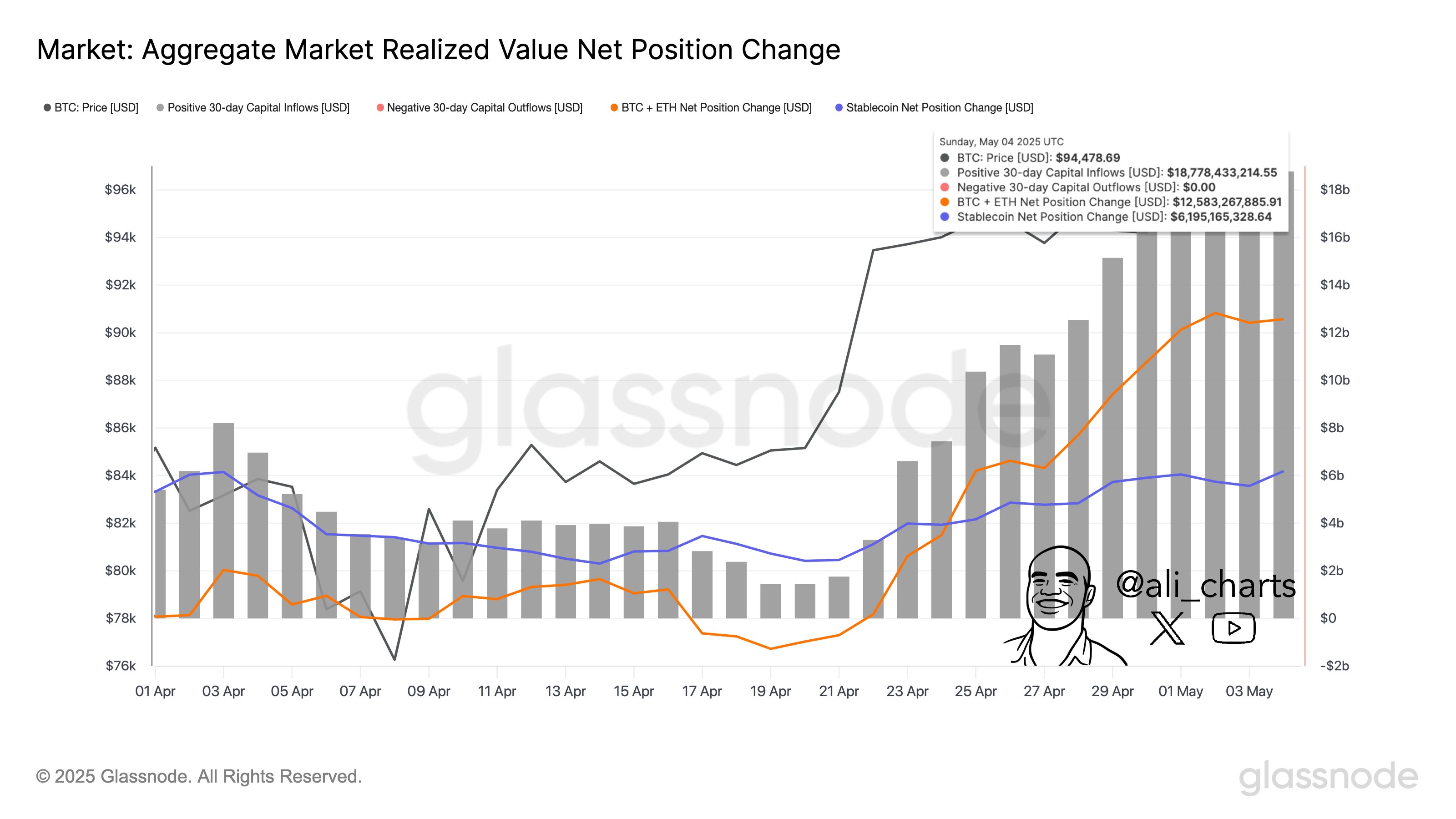

Now, right here is the chart shared by the analyst that reveals the development within the 30-day mixture cryptocurrency market netflow primarily based on these indicators over the previous month:

As displayed within the above graph, the mixed 30-day Bitcoin and Ethereum Realized Cap change is at present at a constructive $12.58 billion. Which means that these two cryptocurrencies have loved a notable internet capital influx throughout the previous month.

Equally, the stablecoins have seen a internet influx of $6.19 billion in the identical interval. Thus, it appears the digital asset sector as a complete has witnessed the incoming of $18.77 billion in capital.

Whereas this development has occurred, Bitcoin and the opposite property have gone by way of their worth restoration runs, so it’s potential that so long as these inflows sustain, the rallies may very well be sustainable.

It solely stays to be seen how the traders will behave within the coming days, nonetheless, because it typically doesn’t take a lot for sentiment to shift within the cryptocurrency sector.

Bitcoin Value

On the time of writing, Bitcoin is buying and selling round $94,200, down 1% within the final seven days.