Crypto-related shares surged on Tuesday, driving the momentum of a broader crypto rally that has reignited danger urge for food throughout digital property with bitcoin (BTC) crossing above $90,000.

Shares of Technique (MSTR), the most important company BTC holder, and crypto change Coinbase (COIN) had been up 8% to 9% throughout the session.

Main the transfer greater had been bitcoin miners, with lots of them posting double-digit features, outpacing BTC’s 5% advance. Bitdeer Applied sciences (BTDR) rallied some 20%, whereas Bitfarms (BITF), CleanSpark (CLSK), Cipher Mining (CIFR), MARA Holdings (MARA), and Riot Platforms (RIOT) soared between 10% and 15% throughout the session.

In the meantime, the broader inventory market additionally rebounded from yesterday’s decline, with the Nasdaq and S&P 500 up 2% and 1.7%, respectively. The rally within the TradFi market got here as reviews of potential de-escalation of U.S.-China tariff rigidity lifted investor sentiment.

Miners and tariff dangers

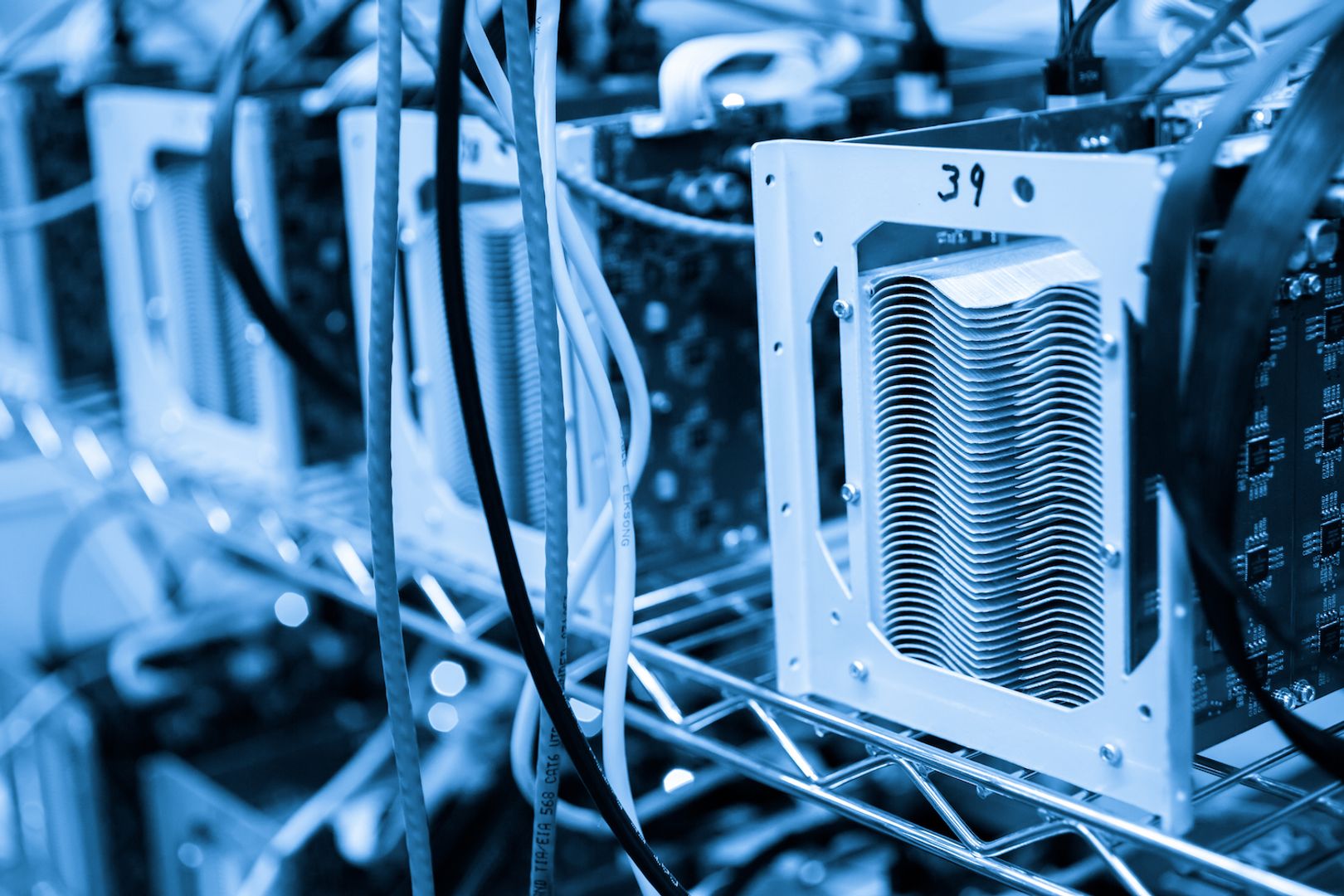

The bounce in mining shares comes after months of underperformance, weighed down by compressed margins, rising hashrate competitors, and tariff-induced difficulties, all of that are mixed with broader market weak point for danger property. Most, if not all, publicly traded miners are nonetheless buying and selling close to multi-month lows.

At problem for U.S.-based mining operations is the Trump administration’s tariff coverage, which threatens to make ASICs (the machines used to mine bitcoin) far more costly to import. That signifies that mining operations within the U.S. will most likely develop at a a lot slower charge and even cease rising altogether.

The tariffs “will materially have an effect on future spending and CapEx within the U.S.,” Taras Kulyk, co-founder and CEO of mining {hardware} supplier Synteq Digital, advised CoinDesk not too long ago.

“Different jurisdictions that had beforehand regarded greater price [will] grow to be wanted targets for brand new infra and capex deployment. Canada particularly, will doubtless be a benefactor to the implementation of the worldwide tariff regime that’s been put in place by the White Home.”

Relatedly, one of many causes behind Bitdeer’s outperformance could also be as a result of the corporate is growing its personal ASIC manufacturing enterprise and not too long ago took the choice to construct out its self-mining capacities as a substitute of promoting its rigs in a slower market. Stablecoin large Tether has additionally been on a shopping for spree of BTDR shares; as of final Thursday, the corporate had invested $32 million in Bitdeer.

Even so, most miner shares have been on the downtrend since December, lengthy earlier than the White Home unveiled its new tariff coverage. Now, with BTC climbing above key technical ranges and liquidity flowing again into the area, miners are most likely catching a bid as a leveraged proxy for BTC’s upside.

Whatever the outperformance at this time, tariffs will proceed to play a key position in miners and most crypto-related shares, together with different danger property. With earnings season beginning quickly, all eyes can be on feedback from CEOs about how the tariff scenario will change the company outlook. Notably, Elon Musk’s Tesla, which additionally holds bitcoin in its treasury, will report its earnings post-market on Tuesday, probably offering some perception into how merchants ought to worth within the commerce battle uncertainties.