Bitcoin’s 2025 journey hasn’t delivered the explosive bull market surge many anticipated. After peaking above $100,000, the 2025 Bitcoin worth retraced sharply to as little as $75,000, sparking debate amongst traders and analysts about the place we stand within the Bitcoin cycle. On this evaluation, we minimize via the noise, leveraging on-chain indicators and macro knowledge to find out if the Bitcoin bull market stays intact or if a deeper Bitcoin correction looms in Q3 2025. Key metrics like MVRV Z-Rating, Worth Days Destroyed (VDD), and Bitcoin capital flows present important insights into the market’s subsequent transfer.

Is Bitcoin’s 2025 Pullback Wholesome or Bull Cycle Finish?

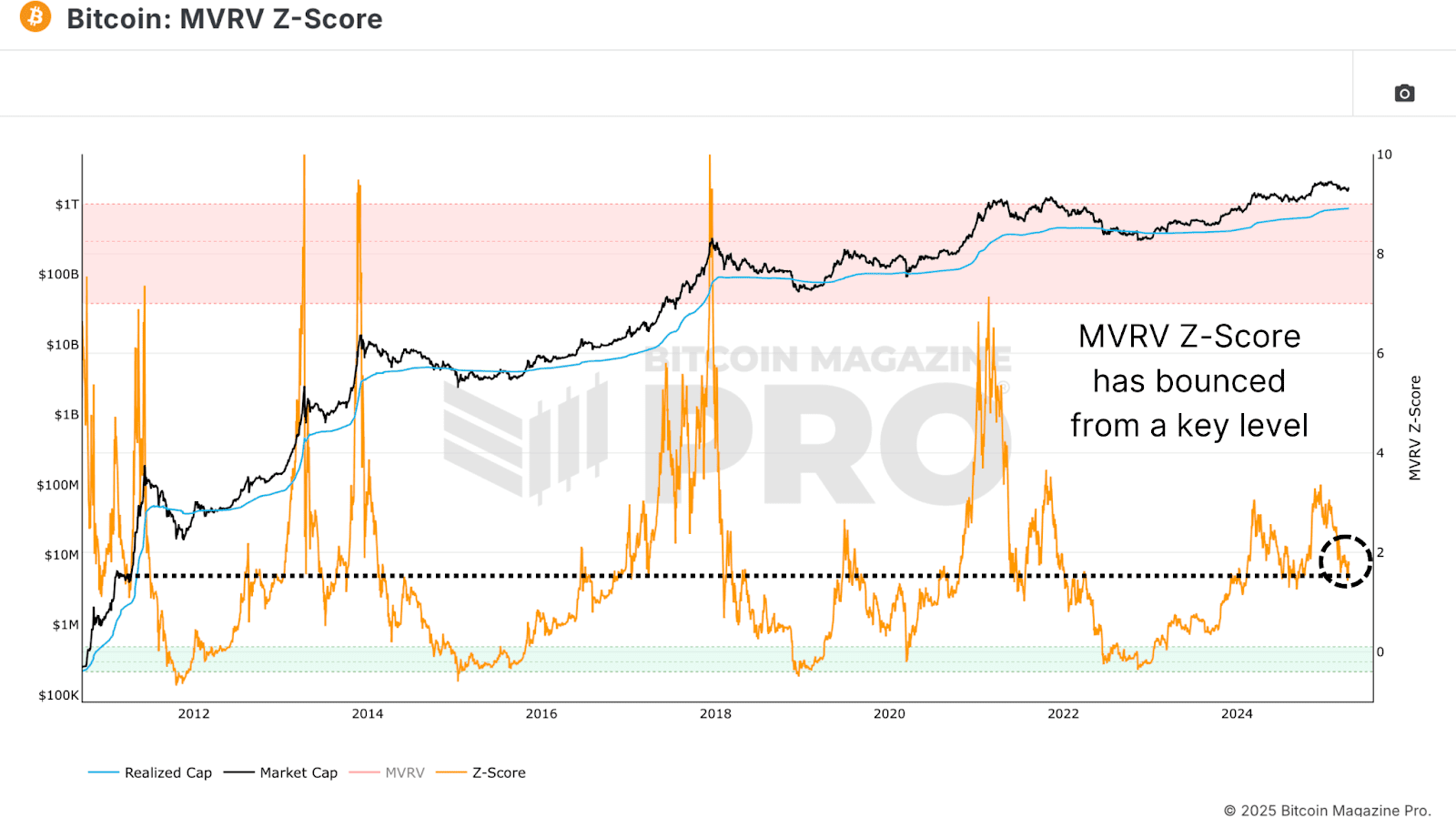

A robust start line for assessing the 2025 Bitcoin cycle is the MVRV Z-Rating, a trusted on-chain indicator that compares market worth to realized worth. After hitting 3.36 at Bitcoin’s $100,000 peak, the MVRV Z-Rating dropped to 1.43, aligning with the 2025 Bitcoin worth decline from $100,000 to $75,000. This 30% Bitcoin correction could seem alarming, however current knowledge exhibits the MVRV Z-Rating rebounding from its 2025 low of 1.43.

Traditionally, MVRV Z-Rating ranges round 1.43 have marked native bottoms, not tops, in prior Bitcoin bull markets (e.g., 2017 and 2021). These Bitcoin pullbacks usually preceded resumed uptrends, suggesting the present correction aligns with wholesome bull cycle dynamics. Whereas investor confidence is shaken, this transfer matches historic patterns of Bitcoin market cycles.

How Sensible Cash Shapes the 2025 Bitcoin Bull Market

The Worth Days Destroyed (VDD) A number of, one other important on-chain indicator, tracks the rate of BTC transactions weighted by holding intervals. Spikes in VDD sign profit-taking by skilled holders, whereas low ranges point out Bitcoin accumulation. At present, VDD is within the “inexperienced zone,” mirroring ranges seen in late bear markets or early bull market recoveries.

Following Bitcoin’s reversal from $100,000, the low VDD suggests the top of a profit-taking part, with long-term holders accumulating in anticipation of upper 2025 Bitcoin costs. The Bitcoin Cycle Capital Flows chart additional illuminates this development, breaking down realized capital by coin age. Close to the $106,000 peak, new market entrants (<1 month) drove a spike in exercise, signaling FOMO-driven shopping for. For the reason that Bitcoin pullback, this group’s exercise has cooled to ranges typical of early-to-mid bull markets.

In distinction, the 1–2 yr cohort—usually macro-savvy Bitcoin traders—is growing exercise, accumulating at decrease costs. This shift mirrors Bitcoin accumulation patterns from 2020 and 2021, the place long-term holders purchased throughout dips, setting the stage for bull cycle rallies.

The place Are We within the 2025 Bitcoin Market Cycle?

Zooming out, the Bitcoin market cycle will be divided into three phases:

- Bear part: Deep Bitcoin corrections of 70–90%.

- Restoration part: Reclaiming prior all-time highs.

- Bull/exponential part: Parabolic Bitcoin worth advances.

Previous bear markets (2015, 2018) lasted 13–14 months, and the latest Bitcoin bear market adopted swimsuit at 14 months. Restoration phases sometimes span 23–26 months, and the present 2025 Bitcoin cycle falls inside this vary. Nonetheless, not like previous bull markets, Bitcoin’s breakout above earlier highs was adopted by a pullback moderately than an instantaneous surge.

This Bitcoin pullback might sign a better low, organising the exponential part of the 2025 bull market. Based mostly on previous cycles’ 9–11-month exponential phases, the Bitcoin worth might peak round September 2025, assuming the bull cycle resumes.

Macro Dangers Impacting Bitcoin Value in Q3 2025

Regardless of bullish on-chain indicators, macro headwinds pose dangers to the 2025 Bitcoin worth. The S&P 500 vs. Bitcoin Correlation chart exhibits Bitcoin stays tightly linked to U.S. equities. With fears of a worldwide recession rising, weak spot in conventional markets might cap Bitcoin’s near-term rally potential.

Monitoring these macro dangers is essential, as a deteriorating fairness market might set off a deeper Bitcoin correction in Q3 2025, even when on-chain knowledge stays supportive.

Conclusion: Bitcoin’s Q3 2025 Outlook

Key on-chain indicators—MVRV Z-Rating, Worth Days Destroyed, and Bitcoin Cycle Capital Flows—level to wholesome, cycle-consistent habits and long-term holder accumulation within the 2025 Bitcoin cycle. Whereas slower and uneven in comparison with previous bull markets, the present cycle aligns with historic Bitcoin market cycle constructions. If macro circumstances stabilize, Bitcoin seems poised for one more leg up, probably peaking in Q3 or This autumn 2025.

Nonetheless, macro dangers, together with fairness market volatility and recession fears, stay important to look at. For a deeper dive, try this YouTube video: The place We Are In This Bitcoin Cycle.

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising neighborhood of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding choices.