Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

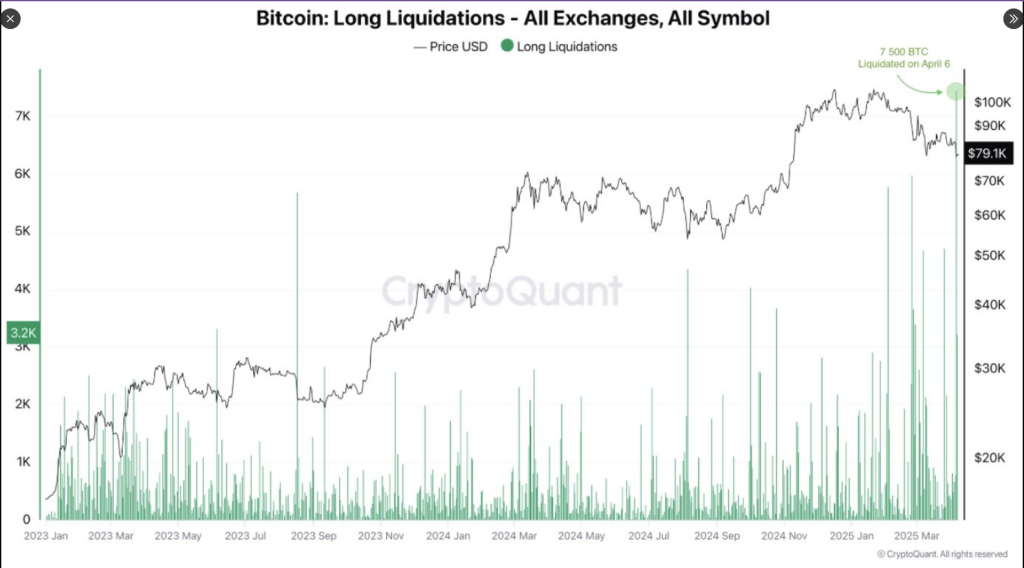

Bitcoin traders recorded heavy losses this week following the most important lengthy place liquidation within the present bull market. On April 6, greater than 7,500 BTC with a price exceeding $500 million have been erased throughout outstanding buying and selling exchanges as costs dropped from $83,000 to $74,000.

Associated Studying

Report-Breaking Liquidation Occasion Hits Crypto Market

As CryptoQuant analyst Darkfost famous, this liquidation was the very best of all because the 2023 bull rally started. The pressured promoting was prompted by Bitcoin’s value dropping sharply on spot markets earlier than stabilizing across the $78,000 degree after the preliminary collapse. Restoration since then has been negligible with costs remaining round that degree.

The statistics point out that though comparable liquidations have occurred beforehand during the last two years, none have been of Monday’s magnitude. This speedy market shift took most merchants unexpectedly, notably those that had opted to leverage their potential positive factors.

The most important Bitcoin lengthy liquidation occasion of this bull cycle

“On April 6, roughly 7,500 Bitcoin in lengthy positions have been liquidated, marking the largest single-day lengthy wipeout of the whole bull run thus far.” – By @Darkfost_Coc

Learn extra https://t.co/eqW2JE8TWD pic.twitter.com/IEthwRDRVz

— CryptoQuant.com (@cryptoquant_com) April 9, 2025

Trump Financial Insurance policies Linked To Market Volatility

Darkfost refers to growing fears relating to US President Donald Trump’s financial coverage as a predominant driver of the market volatility. His plans to implement tariffs have generated broader monetary uncertainty that spreads past cryptocurrency markets.

Reviews present the American inventory market has suffered multi-trillion-dollar losses for a number of consecutive buying and selling days this month. A report mentioned US shares misplaced $10 trillion in worth simply three months since Trump grew to become president in January 2025.

Specialists Warn Merchants About Danger Administration

The prevailing market situations have seen analysts problem warnings relating to the dangers of buying and selling throughout occasions of volatility. Darkfost highlighted the necessity to safeguard capital when markets are unstable, urging merchants to avoid high-risk or leveraged positions.

For crypto traders, the message is one among warning fairly than aggressive buying and selling techniques. The swift value motion illustrates how quickly market situations can shift, leaving unsuspecting merchants with big losses.

Lengthy-Time period Bitcoin Prognosis Is Nonetheless Combined

Sure market observers foresee bearish patterns could also be round for so long as 12 months due to continued international financial uncertainty. Ki Younger Ju, the founding father of CryptoQuant, noticed that below unsure situations, extra typical safe-haven assets similar to gold are higher than cryptocurrency.

Associated Studying

Ju famous that since Trump’s return to the presidency, gold has risen 11% in worth whereas Bitcoin has fallen 25%. He contends this pattern signifies Bitcoin hasn’t but reached the standing of true “digital gold” as a secure retailer of worth.

Despite these near-term worries, Ju is bullish on Bitcoin’s long-term prospects. He was assured that ultimately, Bitcoin will achieve a share of gold’s $20 trillion market cap, implying potential for long-term progress despite current adversity.

On the time of writing, Bitcoin was in a position to reclaim the $81k degree. BTC was up 7% within the final 24 hours, however sustained a 2% drop within the final week.

Featured picture from Gemini Imagen, chart from TradingView