Este artículo también está disponible en español.

On-chain information reveals a Bitcoin indicator is at present retesting a stage that has traditionally acted as a boundary line between bearish and bullish momentum.

Bitcoin Quick-Time period Holder SOPR Is Retesting 1.0 Proper Now

In a brand new publish on X, the on-chain analytics agency Glassnode has mentioned concerning the newest development within the BTC Spent Output Revenue Ratio (SOPR) of the short-term holders.

Associated Studying

The “SOPR” right here refers to an on-chain indicator that tells us about whether or not the Bitcoin traders as an entire are promoting or transferring their cash at a revenue or loss.

When the worth of this metric is bigger than 1, it means the common holder of the asset is promoting at a internet revenue. However, it being underneath this threshold suggests the general market is realizing a internet loss.

Naturally, the SOPR being precisely equal to the 1 stage implies the earnings being realized by the traders are canceling out the losses, so the common holder will be assumed to be simply breaking-even on their transactions.

Within the context of the present subject, the SOPR of solely a particular investor group is of curiosity: the short-term holders (STHs). The STHs embody the Bitcoin traders who bought their tokens throughout the previous 155 days.

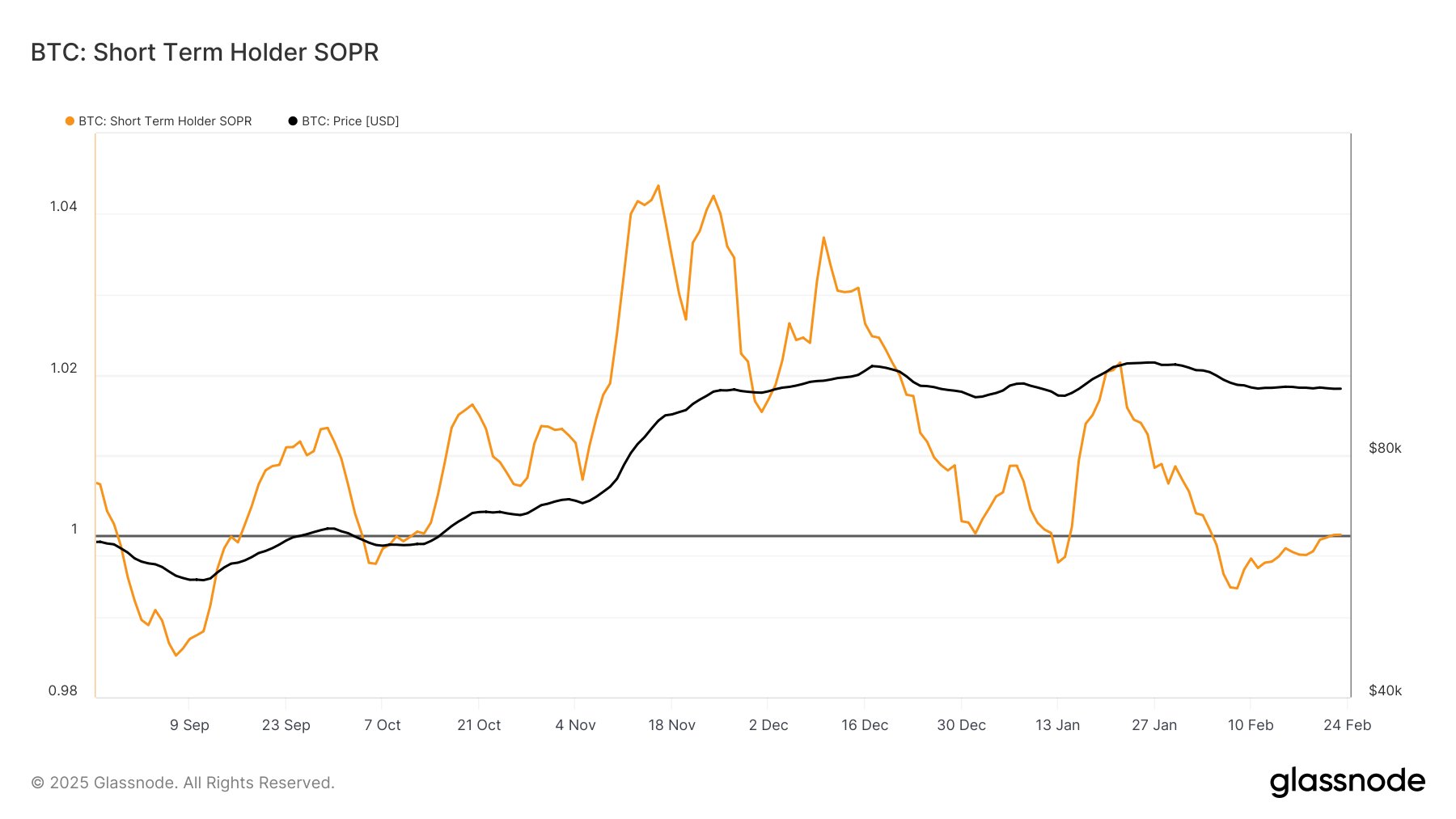

Now, right here is the chart shared by the analytics agency that reveals the development within the 7-day shifting common (MA) of the Bitcoin STH SOPR over the previous couple of months:

As is seen within the above graph, the Bitcoin STH SOPR fell underneath the 1 mark earlier within the 12 months, implying the STHs took to loss-taking as the value of the cryptocurrency moved in a bearish trajectory.

Lately, although, the metric has been making restoration and it’s now again on the break-even stage. “Traditionally, breaking above 1.0 confirms a shift in momentum, whereas failure to take action usually results in renewed promote stress,” explains Glassnode.

Breaking above the extent, nonetheless, is not any easy process, for it serves as a serious psychological stage for the STHs. These traders are by definition the entities who’re both new to the market or simply not resolute sufficient to carry for lengthy intervals, to allow them to be vulnerable to panic selloffs.

When the STH SOPR rises to the 1 mark, it means these traders, who have been pressured into loss promoting earlier, are in a position to break-even once more. Promoting stress can spike when this occurs, as STHs rush to get their cash ‘again.’

Associated Studying

The final time that Bitcoin noticed the indicator make a retest of this stage was again in January. From the chart, it’s obvious that it efficiently discovered a breakout then, though it was solely short-lived.

It now stays to be seen whether or not the metric can surge into the revenue zone this time as effectively or not.

BTC Value

Bitcoin has been slipping down in the course of the previous few days as its value has come right down to the $94,500 stage.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com