I. Introduction

Bitcoin is commonly praised as a long-term financial savings expertise, however its position as a medium of change is simply as necessary—particularly for companies. From native cafés to giant companies, extra retailers are contemplating bitcoin as a fee possibility, drawn by its low charges, quick transactions, and skill to achieve a worldwide, younger and tech savvy buyer base.

This information explores how native companies can begin accepting bitcoin, overlaying each the rapid advantages and long-term strategic benefits. As digital funds evolve, understanding Bitcoin’s potential isn’t simply an possibility—it’s turning into important for companies trying to keep forward.

II. Advantages of Accepting Bitcoin for Small Companies

There are three essential causes for a small enterprise to simply accept bitcoin:

- Develop income from energetic, tech-savvy, and doubtlessly vastly loyal clients. Bitcoiners are sometimes delighted to pay and tip in bitcoin, and so they usually journey far and extensive simply to go to and help native companies that settle for bitcoin.

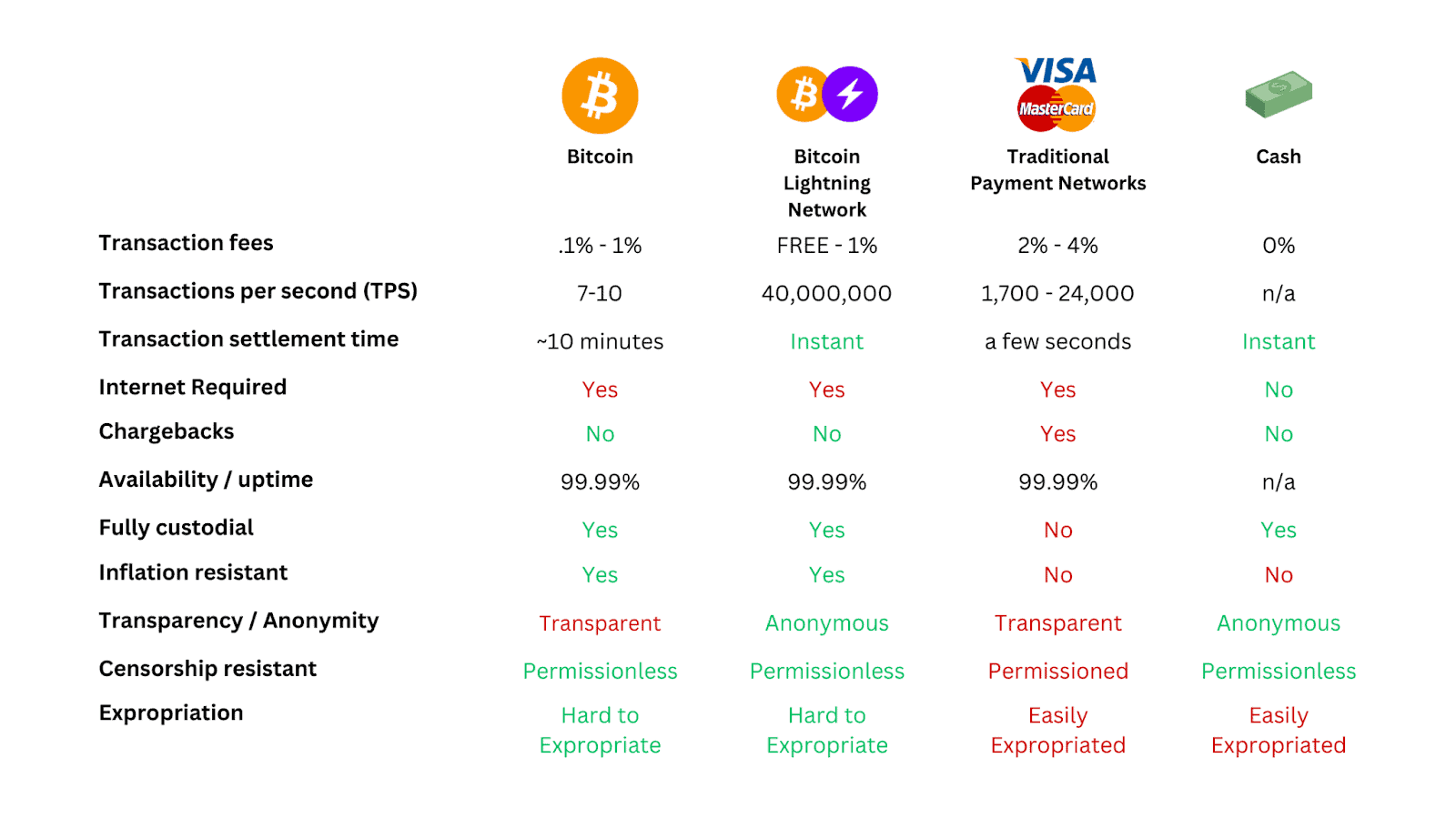

- Save on charges: Charges for bitcoin funds are low and paid by the purchasers, so retailers can save 2-3% in bank card charges by merely accepting funds on one in all Bitcoin’s second layers (e.g., Lightning or Liquid).

- Protect worth: Bitcoin serves as a long-term resolution to inflation, preserving the worth of earnings on account of its fastened provide. Whereas the bitcoin worth is unstable within the quick time period, over numerous years this volatility has been up greater than down, driving the value larger.

Another advantages embody:

- Banks are usually not wanted: Bitcoin offers a worldwide, decentralized banking resolution, enabling safe and reasonably priced transactions for everybody, wherever, anytime.

- Immediate settlement — no danger of chargebacks: On Bitcoin, settlements are remaining, which implies that fees can’t be reversed. On-line commerce now comes with ensures for the enterprise.

- Higher flexibility: Accepting bitcoin offers better flexibility if and when the standard fee system falters. Moreover, many bitcoin fee instruments enable the service provider the choice to bill in {dollars} and obtain both bitcoin or {dollars}.

- Environmental advantages: Opposite to common perception, Bitcoin is a web optimistic for the surroundings as the method of mining enhances power corporations’ effectivity and empowers the expansion of renewables. Because the business leans in the direction of sustainable power sources, the carbon footprint of Bitcoin transactions is ready to lower.

III. Implementing Bitcoin in Enterprise Operations

Each enterprise, whether or not a comfy nook café or a sprawling enterprise, has its personal distinctive wants in terms of accepting funds. For that cause, it’s important to grasp how bitcoin might match into your particular enterprise: A café may discover it completely appropriate to make use of a easy cell Bitcoin pockets for transactions, however bigger companies (or these looking for a elegant {and professional} method) may go for a extra complete integration. No matter your small business dimension or aspirations, this information is tailor-made to offer insights and steps to seamlessly incorporate bitcoin funds.

Step 1: Find out about Bitcoin

Earlier than we dive in, it’s necessary to study Bitcoin and why it ought to grow to be a significant a part of your small business. It’s extra than simply one other fee methodology; it’s a groundbreaking new foreign money and a strong financial community. Adopting Bitcoin gained’t simply increase your fee alternate options however might additionally decrease operational bills.

The Bitcoin community is the world’s most safe pc community. It’s an unchangeable, censorship-resistant, immutable, world community of worth which is past the purview of governments and traditional banking methods. Moreover, it boasts a restricted provide of twenty-one million cash — every divisible into smaller items, marking the appearance of a genuinely restricted and strong foreign money. Notably, bitcoin is a bearer asset, which implies that those that maintain bitcoin possess the precise asset, not only a debt or an IOU as is the case with fiat financial institution accounts.

Learn extra >> What’s Bitcoin & Why Does it Have Worth

Step 2: Perceive Transaction Layers

Layer 1 (Excessive safety and settlement in minutes)

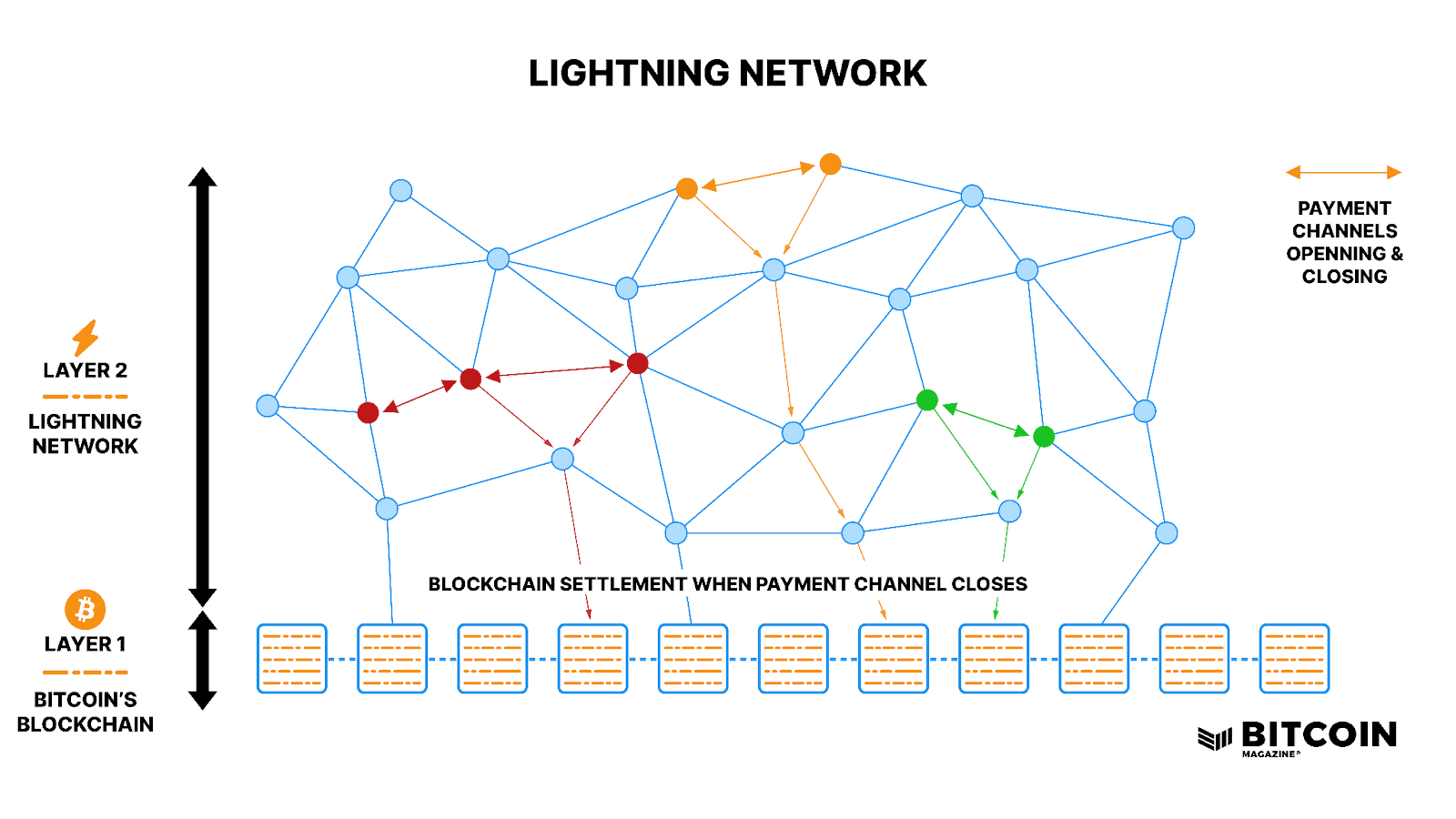

Bitcoin’s base layer is a triple-entry ledger accounting system (timestamp server) the place transactions are timestamped, irreversible, publicly verifiable, and secured by nodes and hash energy. This makes it essentially the most safe monetary settlement community ever created.

With settlement roughly each 10 minutes, Layer 1 is greatest suited to high-value transactions the place on the spot finality isn’t required—similar to shopping for a automotive, settling invoices, or giant enterprise funds.

Layer 2 (Medium safety, with settlement in seconds)

The Lightning Community allows near-instant bitcoin transactions with out compromising the safety of the bottom layer. Working as a second-layer protocol, it permits customers to transact off-chain whereas remaining secured by Bitcoin’s triple-entry accounting system. When a channel is opened, funds are locked into the bottom chain, and from that time, transactions happen off-chain as state updates between channel contributors—much like an abacus retaining monitor of balances. The bottom chain stays unaware of those transactions till a channel is closed, at which level the web result’s settled on-chain. With settlement speeds quicker than Visa or Mastercard, Lightning is good for on a regular basis funds in cafés, retail retailers, and past.

Now that we perceive the layers, let’s speak about wallets.

Step 3: Select a Bitcoin Pockets

Accepting Bitcoin with out correct safety measures is counterproductive. Wallets perform as digital safes for bitcoin, making certain its safety and facilitating transactions by producing Bitcoin addresses.

Companies transacting in Bitcoin ought to prioritize self-custody. Whereas some may think about entrusting their bitcoin to 3rd events, it’s necessary to concentrate on the related dangers. Ought to a 3rd celebration mismanage your bitcoin or grow to be bancrupt, your small business will lose its bitcoin; bitcoin held with a 3rd celebration isn’t your bitcoin.

As a substitute of counting on third events, companies ought to use a cryptographically safe Bitcoin pockets. Numerous wallets help each transaction layers, able to producing distinctive Bitcoin addresses for transactions on both layer.

Companies ought to retailer bitcoin for the long run in a layer-1 {hardware} pockets or a multisig pockets. Sending bitcoin from a Lightning software program pockets to a Bitcoin {hardware} pockets is comparatively easy. We suggest retaining lower than a month’s price of bitcoin in a Lightning or sizzling pockets.

- {Hardware} Wallets can be found for layer 1 solely. They’re usually small {hardware} units related in dimension and kind to a USB drive. They solely hook up with the web when related by way of USB or Bluetooth, subsequently they’re significantly safer.

- Multisig Wallets are a specialised kind of Bitcoin pockets that necessitates the approval of a number of personal keys for transactions. These keys will be distributed amongst senior employees members and administrators. As an illustration, in a 2-of-3 or 3-of-5 setup, the bitcoin can solely be transferred if two out of three (or three out of 5) keys authorize the transaction. This safety measure ensures that no single particular person has unilateral management over the saved bitcoin.

Step 4: Level of Sale (POS) Fee Options

When deciding on a fee resolution for Bitcoin transactions, you need to decide if a easy pockets is satisfactory or if it’s obligatory to make use of a specialised fee app.

Possibility 1: Use a Primary Lightning pockets

Lightning wallets are primarily designed for private use and never for business transactions. That mentioned, some present a light-touch POS resolution and as such function an introductory instrument for companies to familiarize themselves with bitcoin funds.

To proceed, merely obtain a Lightning pockets from the Android or App Retailer.

- Pockets of Satoshi, a widely known Bitcoin Lightning pockets, launched a point-of-sale system in 2023. It’s a easy and handy pockets to make use of, making it accessible to nearly any person. Nevertheless, Pockets of Satoshi is a custodial pockets, so the corporate holds the personal keys on behalf of its customers, which means you don’t have full management of your bitcoin whereas it’s on the app. In case your intention is to make the most of the Lightning community for extra intensive transactions past small suggestions or the occasional $1 bitcoin purchases, choosing a non-custodial Lightning community pockets is a extra prudent selection. (WoS isn’t obtainable within the USA.)

- Blink, one other well-known Bitcoin pockets (previously often called “Bitcoin Seaside Pockets”) has service provider options that make it straightforward and versatile for companies to obtain funds over Lightning and on-chain, together with LN deal with, a Lightning money register, and a printable pay code. Funds will be obtained in bitcoin and stablesats (a proxy for USD). Lastly, transactions will be exported by way of a CSV file for document retaining.

We suggest upgrading from easy Lightning wallets ought to the quantity of bitcoin obtained start to develop, as primary wallets introduce numerous minor challenges which are simply overcome with a extra personalized resolution.

Possibility 2: Use a Bitcoin Level-of-Sale app

Specialised fee apps needs to be the popular resolution for native companies as they supply a plethora of options essential to run a enterprise.

- Labeling: With out labels, funds are obtained with none descriptive context, creating pointless accounting challenges.

Transaction with labeling: “2023-08-24: Espresso – Latte – $3 – Bill #12345”

Transaction with out labeling: 2023-08-24 – XYZ123 – $3”

- Tackle reuse: If a service provider constantly makes use of a single pockets deal with for transactions, savvy clients can hint that deal with on the open Bitcoin community and examine the full funds obtained. To take care of privateness it’s advisable to not reuse addresses, which specialised fee apps can assist with.

Word: Whereas fee processors don’t deal with the dangers related to zero-confirmation transactions, the Lightning community does. Accepting funds with out community confirmations, often called “zeroconf,” can result in potential double-spending points.

All that’s required is a cell phone loaded with one of many following apps, which will be downloaded from the Google Play Retailer or the App Retailer.

- Breez requires nothing greater than a cellphone and is immediately operable as a non-custodial Lightning POS terminal. Retailers can simply add objects within the app, create a supervisor password, print a receipt, and ship funds out to an on-chain deal with if wanted.

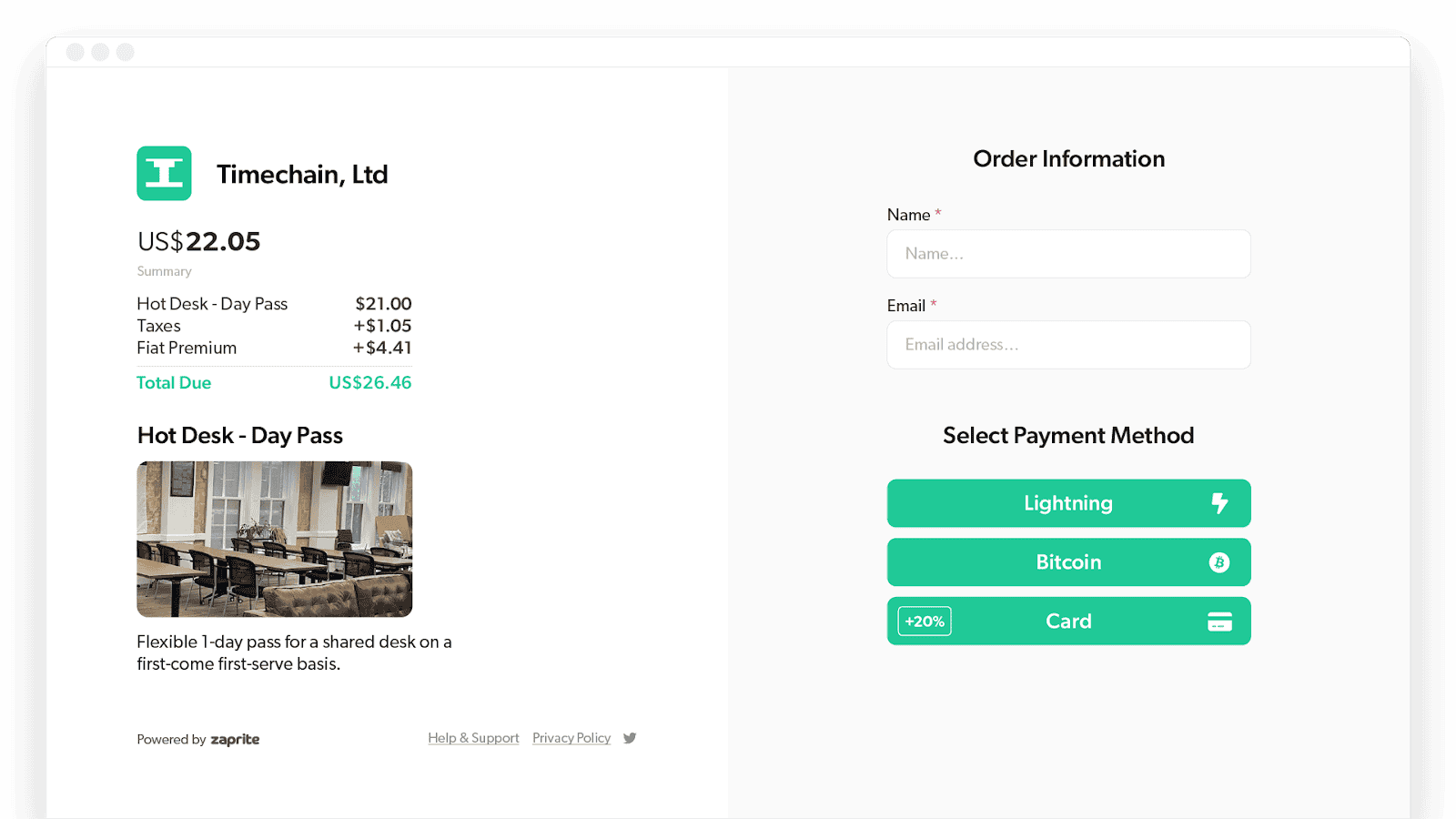

- Zaprite gives a POS-like expertise, permitting retailers to simply accept bitcoin funds in individual with ease. Service-based retailers can arrange tip pages, enabling clients to depart gratuities in bitcoin. Fiat funds are accepted by connecting fee gateways similar to Stripe.

- Coinos is a user-friendly Bitcoin internet pockets designed for each people and retailers. It emphasizes non-custodial options, permitting customers to take care of full management over their funds with the pliability to withdraw anytime. It caters to retailers looking for environment friendly retail transactions.

- Opago permits small retailers world wide to simply accept bitcoin in a quick, straightforward, and safe method by giving entry to the Lightning community in their very own customized POS terminals. Opago offers a service provider dashboard that particulars all transactions and offers a slightly helpful tax reporting characteristic — notably for EU retailers. The payment is 1% for all transactions processed by the POS terminals, which value €99 to purchase.

- Bitcoin Suisse Pay is an easy-to-set-up, KYC-free resolution. Enterprise house owners have the choice to decide on to immediately obtain bitcoin of their most well-liked Bitcoin pockets or to auto-convert bitcoin to euro and obtain the funds the next day within the chosen checking account. Every account has one main system and any variety of “obtain solely” units, which is appropriate for enterprise house owners to permit staff to obtain funds on their telephones, with out with the ability to entry the funds. Watch their 90-second promotional video.

- Coin Nook: Checkout gives a easy Bitcoin fee resolution. With CoinCorner Checkout, companies can settle for bitcoin funds in-store, on-line, or by way of e-mail invoicing. Charges are simply 1% and when accepting bitcoin, retailers can both maintain BTC or convert immediately to EUR which removes any danger of worth volatility. Though CoinCorner can maintain bitcoin on behalf of companies, they do enable recurring Lightning funds to the service provider’s private pockets ought to they want to take custody.

- In VoltPay, retailers can set a tip, however the buyer doesn’t get to decide on. You’ll be able to create a listing of merchandise inside the app, which will be helpful for a small café with a restricted variety of merchandise. All fee invoices are seen within the invoices tab. The app can export a spreadsheet of transactions and withdraw bitcoin to a pockets manually.

- Flash is a streamlined Bitcoin point-of-sale resolution that leverages the Lightning community for fast, safe, and cost-effective transactions. The app encompasses a user-friendly interface that generates detailed, labeled invoices whereas safeguarding privateness by avoiding deal with reuse.

These setups will be enhanced by utilizing a devoted telephone embedded in an NFC-enabled POS terminal, loaded with any of the mandatory apps listed above. These terminals are higher than utilizing only a telephone, because the buyer can see clearly the place to faucet their telephone or Bolt Card to pay for a transaction.

Possibility 3: Use an enterprise POS resolution

- IBEX Pay makes a speciality of providing enterprise fee options over the Lightning community. IBEX Pay permits retailers to assign particular pockets addresses, currencies, and terminals with completely different branches. Every department can then use the related IBEX Pay app to obtain funds. IBEX Pay permits retailers to find out whether or not they want to obtain the fee totally in bitcoin, {dollars}, or a mixture of each.

- BTCPay Server is a self-hosted, open-source cryptocurrency fee processor designed for companies. It emphasizes safety, privateness, and censorship resistance, permitting companies to simply accept bitcoin funds with zero charges and with out counting on third-party companies. The platform gives important built-in apps, together with a POS app for bodily shops and invoicing instruments for smoother bookkeeping. Whereas it integrates with e-commerce platforms, its main worth for retail companies lies in its direct fee processing capabilities and native pockets administration. The onus is on the operator to handle the liquidity of channels (out and in) in an effort to make and obtain funds.

- OpenNode offers a complete Bitcoin fee resolution tailor-made for companies. It facilitates lightning-fast, low-cost Bitcoin transactions by its strong API, e-commerce plugins, and hosted fee pages. Retailers can settle for Bitcoin funds and go for automated conversion to obtain native currencies like EUR, GBP, and USD. OpenNode ensures on the spot settlements by way of the Lightning community and gives safety towards worth fluctuations by permitting automated bitcoin-to-fiat conversions. Moreover, the platform emphasizes safety, eliminating issues of fraud and chargebacks, and promotes world attain with its cross-border fee capabilities.

Possibility 4: Are legacy POS options obtainable?

Most legacy point-of-sale (POS) methods don’t but help native Bitcoin funds, as conventional fee processors stay closely tied to the fiat banking system. Nevertheless, some suppliers are starting to experiment with Bitcoin integration, recognizing the rising demand from companies and customers.

As demand will increase, extra conventional POS suppliers will seemingly combine Bitcoin funds, however for now, retailers should use workarounds or hybrid setups to simply accept Bitcoin whereas nonetheless utilizing their current methods.

Step 5: How you can Course of a Transaction

A. Brick and Mortar Funds

Whether or not you’ve opted for a easy Lightning pockets, or a POS app, the method to simply accept funds is kind of the identical.

1. Buyer locations an order: When a buyer orders a espresso or some other merchandise, tally the full value in your native foreign money as you’ll for some other transaction.

2. Generate a Bitcoin bill: Utilizing your fee app, put within the complete greenback quantity of the order. The app will mechanically convert this quantity into its equal in bitcoin or satoshis (fractions of a Bitcoin) primarily based on the present change charge.

3. Show the fee immediate: As soon as the bill is generated, your app will show a QR code or activate an NFC occasion for the shopper to scan or faucet with their telephone.

4. Buyer initiates fee: The shopper will open their Lightning-enabled pockets app on their telephone. They may then both:

a. Scan the QR code displayed in your system, or

b. Faucet their telephone towards yours if each units help NFC.

c. Alternatively, if the shopper has a Daring Card (Bitcoin NFC card), they’ll faucet that towards your system.

5. Fee verification: As soon as scanned or tapped, the shopper’s pockets app will show the fee particulars, together with the quantity in bitcoin/satoshis and the service provider info (i.e., your café). The shopper ought to confirm that the quantity and particulars are appropriate.

6. Buyer approves the transaction: After verifying the fee particulars, the shopper will probably be prompted to substantiate and settle for the transaction on their app. They’ll click on or faucet the “Settle for” or “Verify” button.

7. Transaction affirmation: Your fee app will immediately obtain the fee and notify you of a profitable transaction. The Lightning community ensures that this course of is fast, typically inside seconds.

B. Invoicing

Zaprite, CoinCorner Checkout, and Bitcoin Suisse Pay are companies that enable anybody to create personalized invoices that may be paid with bitcoin or perhaps a financial institution switch. The great thing about utilizing such options is that the bill will be issued in {dollars}, paid in {dollars}, and nonetheless be obtained in bitcoin. They needn’t ever know that bitcoin is being transacted; the payer needn’t even know the payee obtained bitcoin.

C. E-commerce Integration

For companies with a web-based presence, integrating bitcoin funds will be seamless with options like Zaprite, BTCPay Server, OpenNode, Flash, CoinCorner Checkout, or Bitcoin Suisse Pay.

Shopify additionally helps Bitcoin funds by third-party integrations like BTCPay Server, and OpenNode. Retailers utilizing Shopify can simply add these fee processors to their shops, permitting clients to pay in Bitcoin whereas retaining checkout easy and acquainted.

Step 8: Educate Workers and Stakeholders

Like every new expertise or system adopted by a enterprise, proficiency is essential to leverage its full potential and guarantee seamless integration into current workflows. Stakeholders must study Bitcoin, in order to not make uninformed or rash selections concerning the enterprise and its Bitcoin implementation.

In the meantime, employees members are on the forefront of day by day operations, and their capacity to handle Bitcoin transactions successfully will straight influence buyer satisfaction and the corporate’s popularity. Merely put, satisfactory information safeguards the corporate’s belongings, maintains belief with its clientele, and ensures that the choice to undertake bitcoin yields the specified benefits. Additional, utilizing an answer like Bitwage or CashApp, your employees will be paid in bitcoin, which can cause them to view the corporate as forward-thinking and progressive in nature. It could additionally give them the sense of getting a vested curiosity within the enterprise and worth their work extra.

Step 9: Accounting and Tax Concerns

It’s essential to concentrate on the tax implications and accounting necessities when coping with bitcoin. Often consulting a monetary advisor or accountant accustomed to cryptocurrency can guarantee compliance and correct reporting. Within the USA, the Monetary Accounting Requirements Board (FASB) has allowed truthful worth accounting from 2024. So companies primarily based within the USA can mark their treasury up or down on their books accordingly.

In most jurisdictions, taxation solely applies when the asset is being bought. So an affordable aim for many small companies might be (a minimum of within the early phases) to stack a small share of bitcoin that can respect in worth over time. It’s necessary to maintain a document of transactions in order that capital features will be calculated precisely sooner or later.

Ought to a enterprise have tight money flows, then it will be helpful to maintain the quantity of bitcoin obtained low, which will be accomplished by establishing the fee app to obtain funds principally in {dollars}.

Disclaimer: This text, together with any recommendation and data contained herein, is offered for common informational functions solely and shouldn’t be construed as tax recommendation. Bitcoin Journal and the creator are usually not providing tax recommendation to readers. Tax legal guidelines and rules are complicated and topic to vary, which might materially influence funding outcomes. Readers ought to seek the advice of their very own tax advisor or accountant to grasp the tax implications of their investments and monetary selections.

Step 10: Bitcoin Accepted Right here

Let everybody know you settle for bitcoin. On the very least, show a sticker or signal on the checkout to indicate that bitcoin is a sound fee methodology. Moreover, putting an indication in your store’s window or exterior wall can entice the eye of passers by, particularly Bitcoiners.

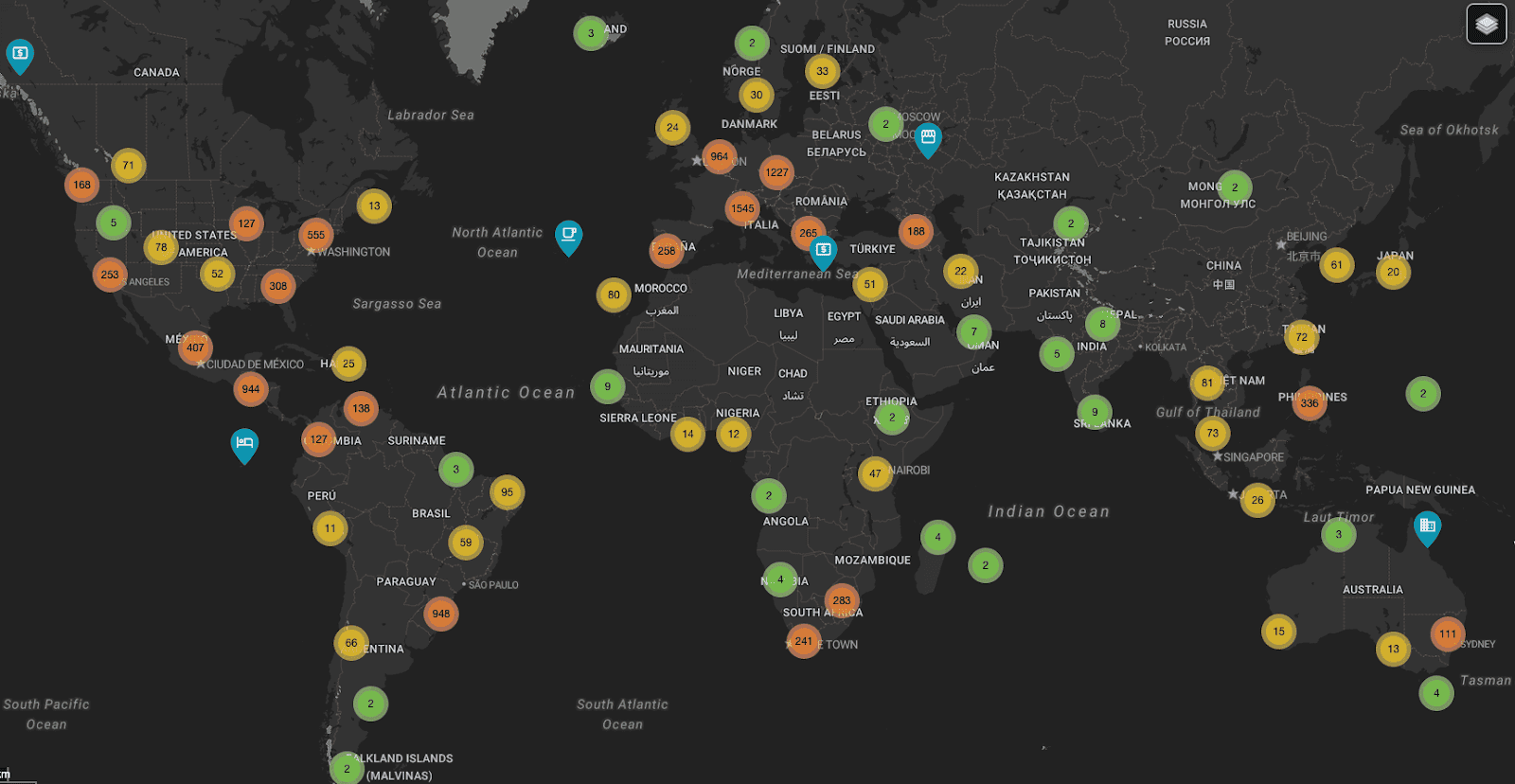

Collaborate with native Bitcoin fanatics and be part of Bitcoin meetups to advertise your companies inside the native Bitcoin group. Contemplate contacting native bloggers and/or media to create a neighborhood PR marketing campaign, which might inform the broader group about this various fee possibility. Making funds in bitcoin extra engaging than {dollars} would even be vastly advantageous to companies, assuming the margins are usually not already too skinny. A enterprise that may construct bitcoin reserves ought to profit vastly from its long-term appreciation.

The above picture is a snapshot of BTC Map, 2024.

In fact, you need to add your small business itemizing to Satmap and BTC Map, in order that your small business is noticeable to potential guests from world wide.

IV. Challenges and Concerns

Bitcoin is younger: Bitcoin continues to be in its nascent phases. Drawing parallels to the early days of enterprise web sites, it needs to be thought-about an addition to conventional fee methods, not a alternative. The advantage of accepting bitcoin early is best than having a enterprise web site within the ’90s. By receiving bitcoin and including it to your organization’s treasury, your small business advantages from its worth appreciation relative to conventional currencies. Corporations like Newegg, Starbucks, Microsoft, Mattress & Past, Tesla and rather more acknowledge the advantages and settle for funds.

POS {hardware} options like Clover, Toast, and Sq. will combine bitcoin sooner or later, in the event that they haven’t already accomplished so. Till then, the onus is upon small companies to study bitcoin and implement a strong resolution for his or her enterprise.

Worth volatility: Bitcoin’s worth will be unstable. Nevertheless, with methods like rapid conversion or fund splitting, companies can mitigate potential dangers.

Safety protocols: Adopting greatest practices for securing bitcoin belongings and transactions is essential to forestall potential breaches.

Regulatory panorama and taxation: Staying up to date with rules and tax legal guidelines is crucial to making sure compliance. In most jurisdictions the taxing authorities deal with bitcoin as an funding topic to capital features tax. We suggest speaking to your accountant or tax advisor on how tax can be utilized to any bitcoin you obtain.