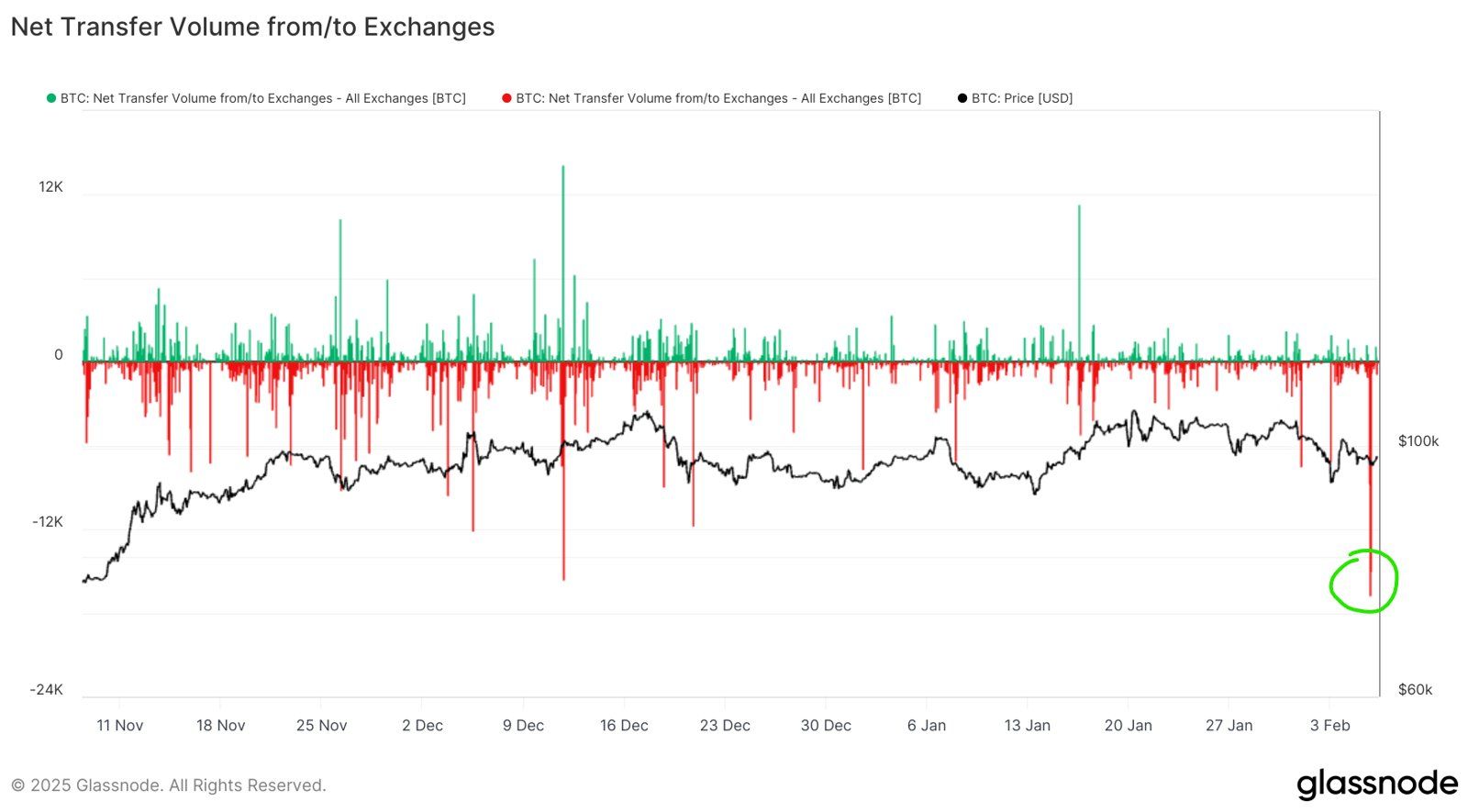

On Wednesday, centralized exchanges registered a web outflow of over 17,000 BTC, price greater than $1.6 billion on the going market worth of $98,600, in keeping with Glassnode information shared by Andrew Dragosch, head of analysis Bitwise.

That is the most important single-day exodus of cash since April 2024.

“Whales are shopping for this dip,” Dragosch mentioned on X, referring to the big outflow of cash. Buyers sometimes take direct custody of cash when planning to carry them for the long run. Therefore, a big outflow of exchanges is taken to characterize bullish sentiment.

Word that blockchain information, although extensively used to evaluate market situations, will be skewed by inner pockets transfers by exchanges.

Coinbase alone processed web withdrawals of over 15,000 BTC, per Dragosch. Evaluation by Timechainindex.com exhibits Coinbase on Wednesday break up 4 addresses totaling over 20K BTC into 60 addresses, which hints at a potential main purchases by ETFs or MicroStrategy this week.

On-chain information compiled by CryptoQuant exhibits that each one crypto exchanges had a cumulative adverse netflow of 47K BTC on Wednesday, with 15.8K of that being attributed to Coinbase.

Bitcoin fell beneath $96,800 throughout Wednesday’s late U.S. buying and selling hours solely to show larger early at present after Eric Trump, the Son of President Donald Trump, inspired the family-linked crypto platform World Liberty Monetary to make its first bitcoin funding.