Este artículo también está disponible en español.

Ethereum (ETH) seems to have ‘bottomed out,’ based on crypto analyst Mister Crypto. The analyst shared this statement as investor confidence in ETH continues to wane because of the digital asset’s comparatively lackluster value efficiency in 2024.

Is Ethereum Due For A Rally?

Not like Bitcoin (BTC) and Solana (SOL), which have surged previously yr by 146% and 154%, respectively, Ethereum has risen a modest 32% over the identical interval. Because of this, ETH holders are understandably pissed off with the digital asset’s value motion, with some whales liquidating their holdings at losses of as much as $1 million.

Associated Studying

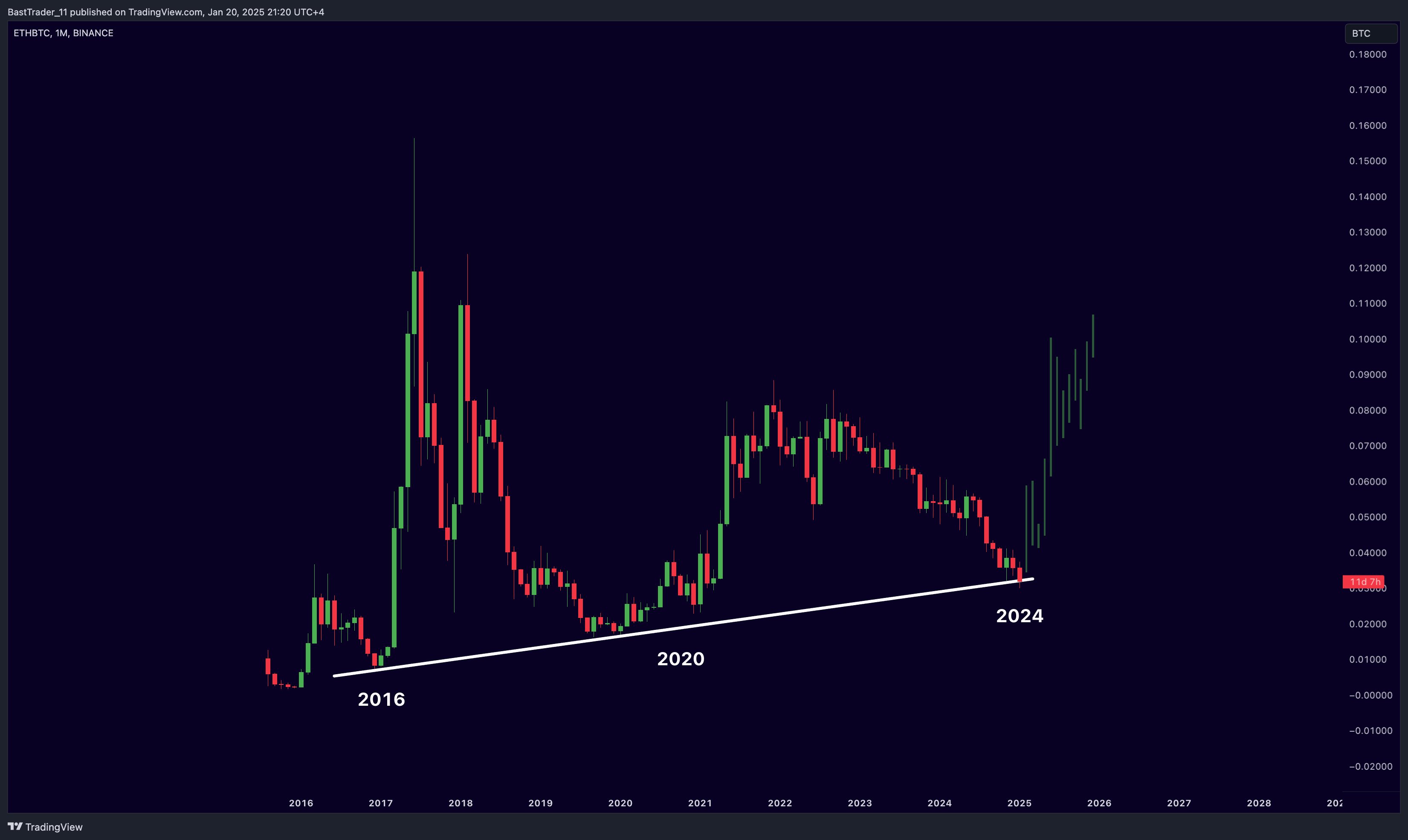

Nonetheless, some analysts now imagine it could lastly be time for Ethereum to interrupt out of its stagnation. Crypto dealer Mister Crypto shared the next ETH/BTC month-to-month chart on X, exhibiting ETH’s value bouncing off a long-standing trendline earlier than getting into a parabolic run.

This evaluation aligns with a latest report highlighting ETH’s four-year low of 0.031 towards BTC on the weekly chart. A possible rebound from this multi-year assist stage may place ETH to outperform BTC within the brief time period.

Crypto analyst Merlijn The Dealer additionally recognized a bullish falling wedge sample forming on Ethereum’s 2-day chart. In line with Merlijn, a breakout to the upside may make Ethereum’s subsequent transfer “legendary.”

For the uninitiated, a bullish falling wedge is a technical chart sample that kinds when an asset’s value consolidates between two downward-sloping, converging trendlines. It sometimes alerts a possible pattern reversal or continuation, with a breakout to the upside anticipated as soon as the worth strikes above the higher trendline.

In Ethereum’s case, its value should decisively break by way of the $3,400 stage to verify the bullish falling wedge sample. Failure to take action may lead to ETH falling to the subsequent main assist ranges at $3,000 and probably $2,400.

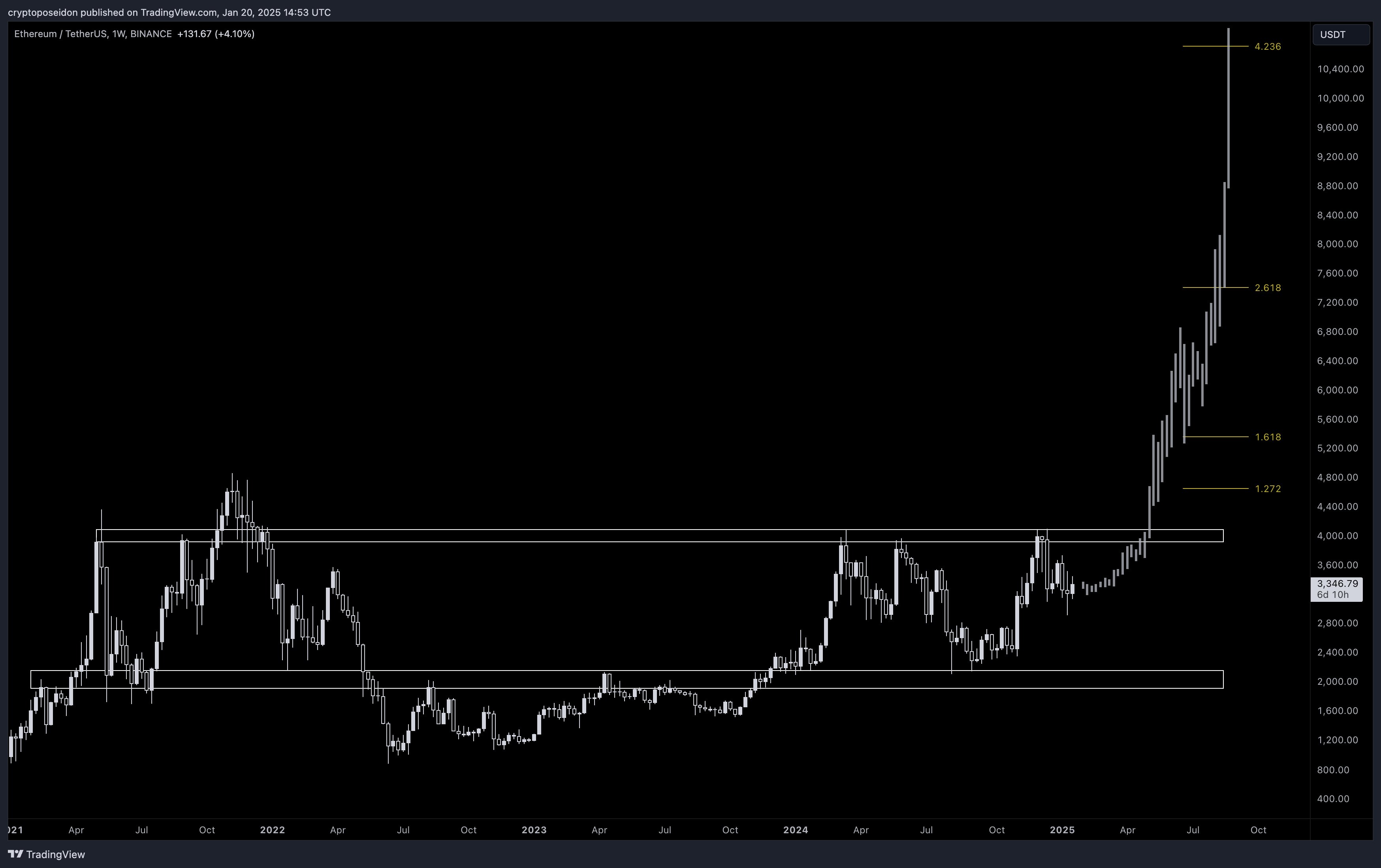

Lastly, seasoned crypto market commentator Poseidon supplied a extra macro perspective on ETH’s value motion. The analyst famous that Ethereum has been buying and selling inside a spread for the previous 4 years. A breakout above the crucial $4,000 resistance stage may propel ETH past $10,000, based mostly on Fibonacci value extensions.

2025: The 12 months Of Altseason?

A full-blown altseason sometimes requires ETH to guide the market. Thus, a robust 2025 for Ethereum may considerably improve the chance of the eagerly anticipated altseason. Luckily, many buyers are optimistic about ETH’s prospects this yr.

Associated Studying

In December 2024, analysts at brokerage agency Bernstein remarked that ETH’s risk-reward ratio has grow to be more and more engaging. Equally, Steno Analysis predicted that ETH may outperform BTC in Q1 2025, with a value goal as excessive as $8,000.

Nonetheless, the $4,000 resistance stage stays ETH’s Achilles’ heel. On the time of writing, ETH is buying and selling at $3,280, down 2.1% previously 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com