Bitcoin’s value skilled a pointy pullback following the US Federal Reserve’s latest charge reduce, however market specialists like Bitwise CIO Matt Hougan stay optimistic concerning the asset’s long-term trajectory.

On Dec. 18, the Federal Reserve introduced a 25-basis-point charge reduce, scaling again its outlook for 2024 to 2 cuts as a substitute of the beforehand anticipated 4.

Additionally, and maybe extra considerably for Bitcoin, Chair Jerome Powell added that the Fed can not maintain BTC underneath present rules whereas responding to inquiries about President-elect Donald Trump’s strategic reserve plans.

This triggered important market reactions, with Bitcoin’s value falling to as little as $98,839 earlier than stabilizing at $101,586 earlier in the present day. Equally, different prime digital belongings like Ethereum, XRP, and Solana additionally recorded losses of round 5%, 5.5%, and three%, respectively.

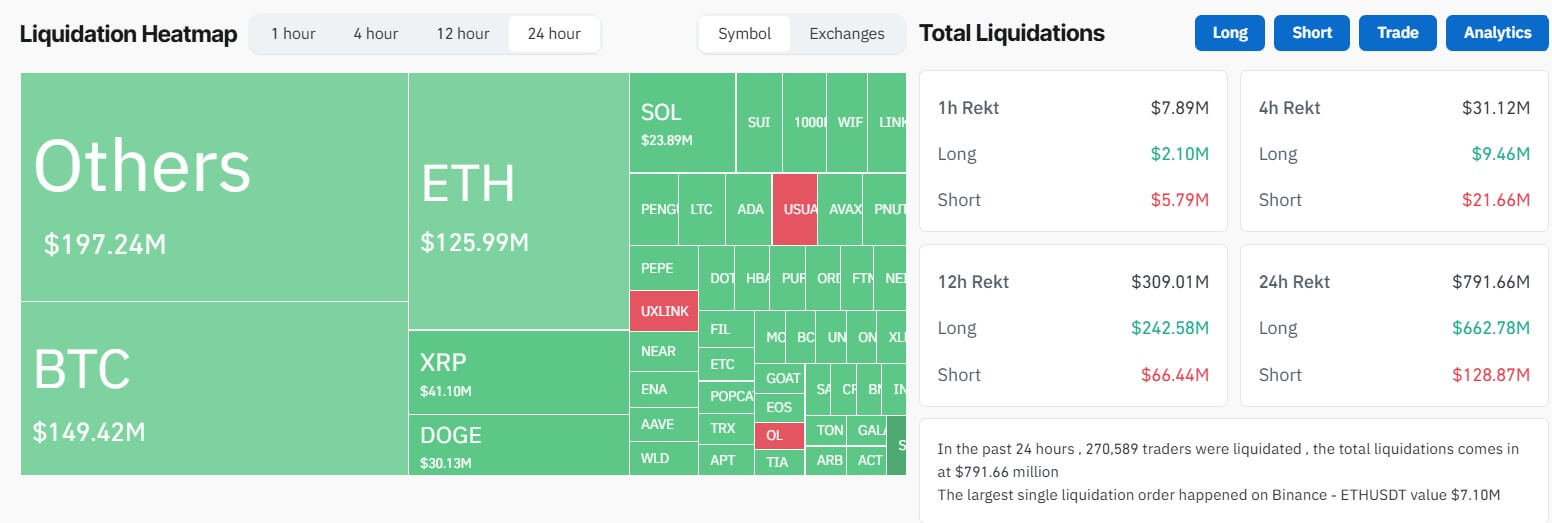

Knowledge from CoinGlass reveals that this purple market efficiency led to round $800 million in liquidation, impacting greater than 270,000 merchants. Merchants speculating on upward value motion suffered probably the most losses, shedding $662 million over the last 24 hours.

Past crypto, conventional markets just like the S&P 500 and the Russell 2000 Index skilled 3% and 4.4% declines, respectively.

Bitcoin’s long-term trajectory

Regardless of this pullback, Hougan reassured traders that Bitcoin’s fundamentals stay robust.

The Bitwise CIO defined that Bitcoin’s latest resilience stems from inner crypto-specific elements, resembling rising institutional adoption, pro-crypto shifts in US coverage, and authorities and company Bitcoin purchases.

He additionally highlighted important blockchain developments and growing ETF flows as further drivers of market power.

Furthermore, Bitcoin’s technical indicators stay favorable, with its 10-day exponential transferring common ($102,000) nonetheless above the 20-day exponential transferring common ($99,000). Hougan views this as a bullish sign, reinforcing his perception that the present dip is a short-term fluctuation somewhat than the tip of the continued bull market.

Regardless of exterior pressures, Hougan predicted that Bitcoin would proceed its multi-year upward trajectory, buoyed by robust adoption traits and technological developments within the crypto area.

He concluded:

“Crypto’s in a multi-year bull market. 50bps of projected charge cuts received’t change that.”