Este artículo también está disponible en español.

Though Bitcoin stays the world’s high digital asset, its worth oscillating between $90k and $96k this week, some consultants are trying forward and past Bitcoin.

Associated Studying

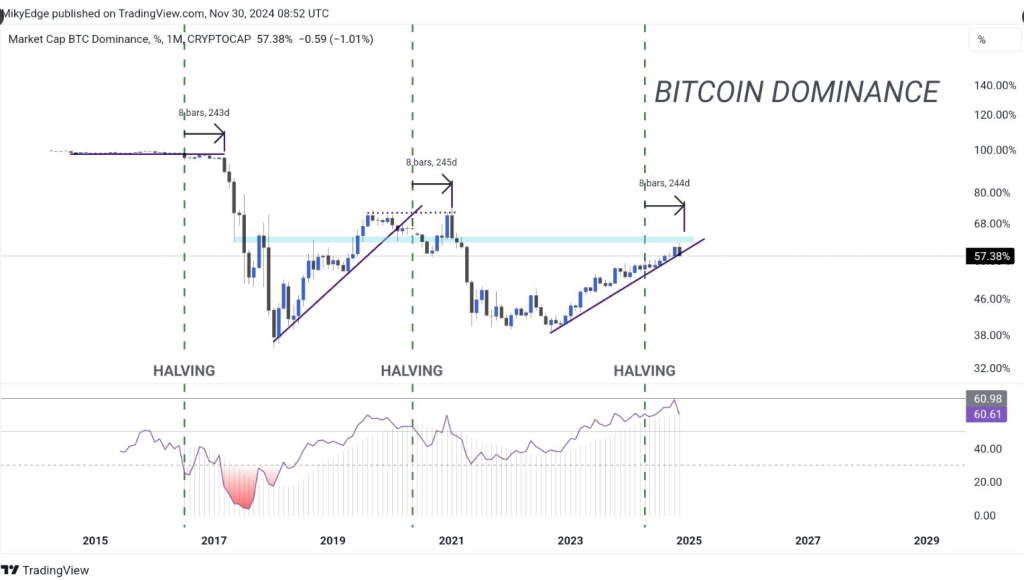

In keeping with some crypto commentators over Twitter/X, Bitcoin’s market dominance is dipping, which implies that altcoin season is about to start out. In a publish by MikyBull Crypto, Bitcoin’s market dominance falls beneath its two-year help line, creating loads of alternatives for holders and merchants.

In keeping with TradingView, Bitcoin’s present dominance is 56.67%, from final week’s 57%, breaking via its help stage for 2 years. Analysts say that the continual dip in Bitcoin’s dominance will influence the final crypto market this December and onwards.

On-chain and market information counsel that altcoins are poised for a market run, with MikyBull Crypto saying that its season began November thirtieth.

Wow, Bitcoin dominance has simply damaged down the 2-year help.

We’re certainly formally in #ALTSEASON people! https://t.co/IYfQF7P7XI pic.twitter.com/fVysBYuOKn

— Mikybull Crypto (@MikybullCrypto) November 30, 2024

A Look At Bitcoin Market Dominance

In crypto, analysts and market members use quite a lot of metrics to evaluate Bitcoin’s efficiency. Bitcoin dominance is one dependable metric used to find out the relative market share of the asset within the crypto sector. The upper the share share of BTC, the higher it’s for holders and buyers.

Nonetheless, Bitcoin’s dominance rating has been dipping in latest weeks. As of December 2nd, it’s at 55.3%, in comparison with 58.9% final month. In keeping with MikyBull Crypto, Bitcoin has dipped beneath its two-year help.

A declining Bitcoin dominance gives insights into the merchants’ and buyers’ methods. One takeaway is that buyers are reallocating their money to different digital property. Many analysts say that a few of these buyers are reallocating funds to altcoins, like XRP, which is now surging.

Analysts say buyers are doubtlessly diversifying their funds and taking a look at different high-growth coin options.

Analysts And Crypto Commentators Provide Differing Insights

A number of altcoins are at the moment main the market surge. Ether is experiencing a spike in worth and elevated demand for leveraged ETH exchange-traded funds. On-chain information reveals the product skilled a 160% improve in demand instantly after the November fifth US elections. Analysts stay bullish on ETH, and lots of anticipate the asset to hit $4k quickly. Then, there’s XRP, which trades above the $2 stage.

Pav Hundal of Swyftx gives a conservative opinion, saying that Bitcoin’s dominance rating should still hit 65%, 67%, and even 70% earlier than it declines. He argues that advanced elements make it unimaginable to select the best date for altcoin’s surge or Bitcoin’s decline.

Associated Studying

Not All Analysts See An Altcoin Surge Quickly

In the meantime, not all crypto commentators agree that altcoins’ surge will are available in days. Ki Younger Ju of CryptoQuant advises warning on instances like this. The CryptoQuant CEO stays bullish on Bitcoin, including that there’s nonetheless institutional help for Bitcoin, and it’s unlikely that they may refocus on speculative property.

The CEO added that for altcoins to achieve all-time excessive market caps, these property want a substantial capital influx to cryptocurrency exchanges. He mentioned that altcoins should develop methods to earn capital as a substitute of counting on Bitcoin’s lack of momentum.

Featured picture from Finimize, chart from TradingView