Bitcoin has noticed a plunge underneath the $93,000 stage through the previous day. Right here’s what the development in an indicator suggests about what may very well be behind this downturn.

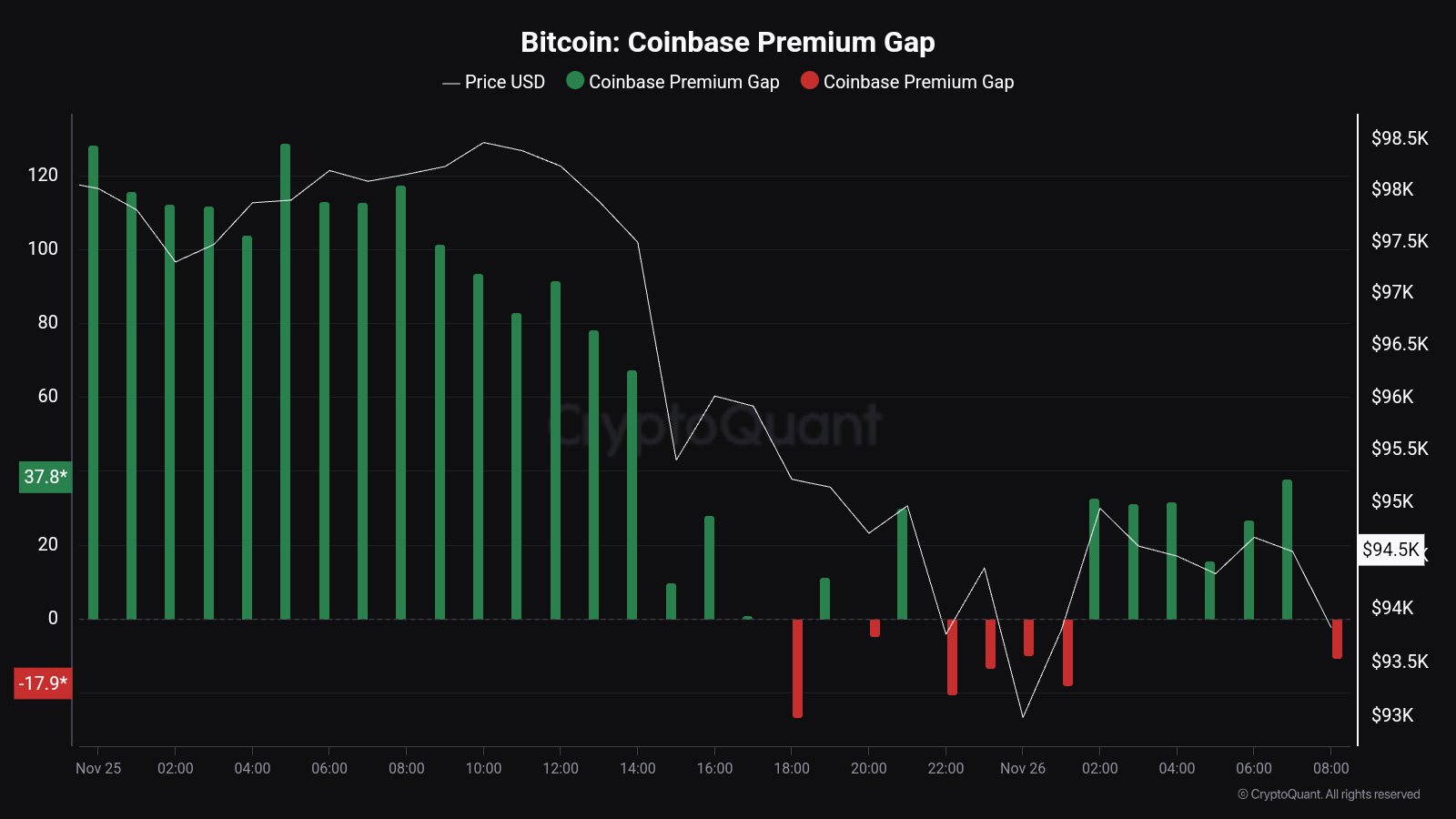

Bitcoin Coinbase Premium Hole Has Gone Chilly

As identified by CryptoQuant group analyst Maartunn in a brand new put up on X, the Coinbase Premium Hole has returned to impartial ranges just lately. The “Coinbase Premium Hole” right here refers to an indicator that retains observe of the distinction between the Bitcoin value listed on Coinbase (USD pair) and that on Binance (USDT pair).

This metric primarily tells us about how the shopping for or promoting behaviours differ between the person bases of the 2 cryptocurrency exchanges. Coinbase’s primary visitors is made up of American buyers, particularly massive institutional entities, whereas Binance serves buyers around the globe.

When the Coinbase Premium Hole has a optimistic worth, it means the US-based whales are collaborating in a better quantity of shopping for or a decrease quantity of promoting than the Binance customers, which is why the asset is dearer on Coinbase. Equally, it being adverse implies a internet larger shopping for stress on Binance.

Now, here’s a chart that reveals the development within the Bitcoin Coinbase Premium Hole over the previous couple of days:

As displayed within the above graph, the Bitcoin Coinbase Premium Hole had been at notable optimistic ranges earlier, however through the previous day, its worth has declined to the impartial zero mark.

In keeping with Maartunn, the supply of the optimistic premium was Microstrategy’s newest shopping for spree. Certainly, the cooldown within the indicator matches up with the timing of the completion of the $5.4 billion buy by Michael Saylor’s agency. The numerous accumulation from the corporate had helped the cryptocurrency keep its latest highs, however with the shopping for stress depleted, Bitcoin has retraced to cost ranges underneath $93,000.

BTC and the Coinbase Premium Hole have held a detailed relationship all through 2024, so the metric may very well be to keep watch over within the close to future, as the place it goes subsequent could as soon as once more foreshadow the asset’s subsequent vacation spot. Naturally, a decline into the adverse area may spell additional bearish motion for its value.

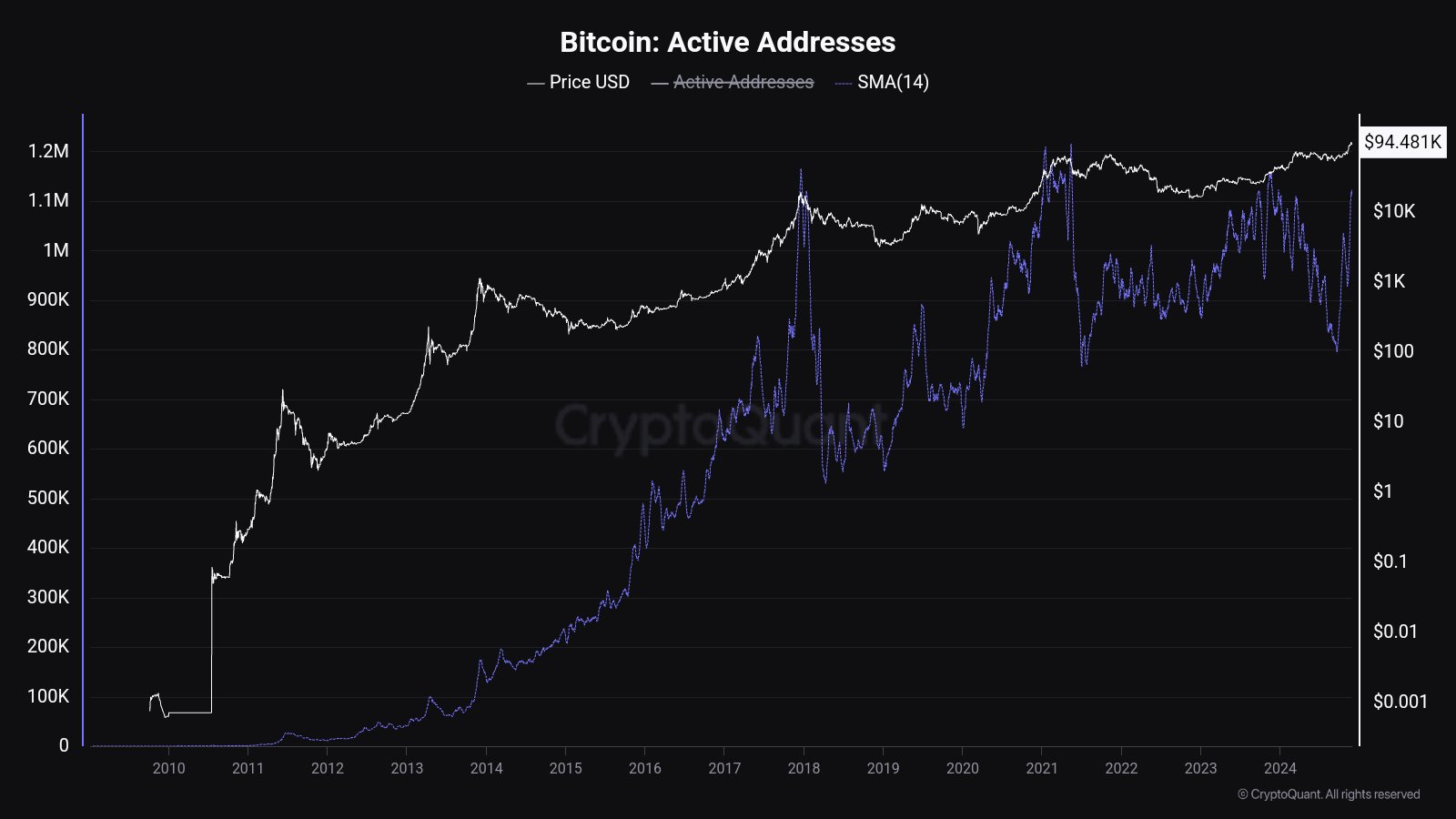

In another information, the Bitcoin Lively Addresses indicator has noticed a pointy soar just lately, as Maartunn has shared in one other X put up. This metric retains observe of the every day variety of addresses which can be collaborating in some type of transaction exercise on the community.

Beneath is the chart shared by the CryptoQuant analyst for the 14-day easy transferring common (SMA) of the Lively Addresses:

With this newest surge, the 14-day SMA of the Bitcoin Lively Addresses has reached its highest level in eleven months. This implies that loads of exercise has just lately occurred on the community. On condition that the asset has gone down up to now day, although, the latest person curiosity has definitely not come for purchasing.

BTC Value

On the time of writing, Bitcoin is floating round $92,400, down nearly 6% during the last 24 hours.