On-chain information reveals the Bitcoin Hashrate has seen a setback not too long ago, a possible indication that miners might not consider the asset’s run would final.

Bitcoin Mining Hashrate Has Declined Since Its All-Time Excessive

The “Hashrate” refers to a metric that retains observe of the miners’ whole computing energy presently connected to the Bitcoin community. This indicator’s worth is measured by way of hashes per second (H/s) or the bigger and extra sensible, terahashes per second (TH/s).

When the worth of this metric registers a rise, it means new miners are becoming a member of the community, and previous ones are increasing their farms. Such a development implies that blockchain is a profitable alternative for these chain validators.

However, the declining indicator suggests some miners have determined to disconnect their rigs from the community, doubtlessly as a result of they will’t break even anymore.

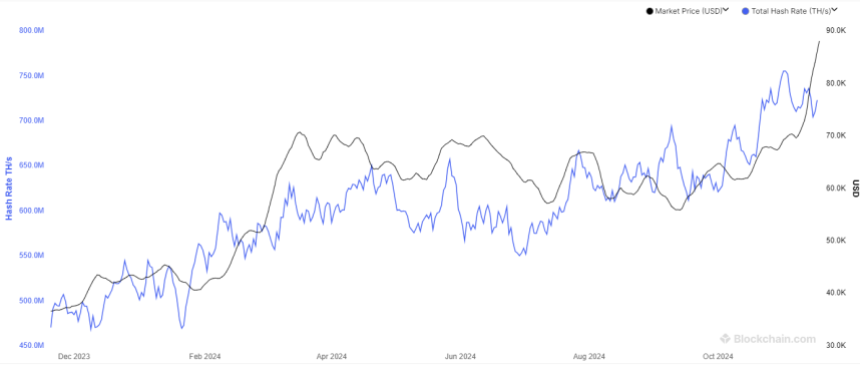

Now, here’s a chart that reveals the development within the 7-day common of the Bitcoin Mining Hashrate over the previous 12 months:

As displayed within the above graph, the 7-day common Bitcoin Hashrate had sharply moved up earlier and set new information. Nonetheless, the metric has dropped since peaking close to the 755 million TH/s mark initially of this month.

The sooner uptrend within the indicator resulted from the constructive value motion that the asset had been having fun with, as the worth is instantly linked to the miners’ income.

There are two ways in which these chain validators make their revenue: the transaction charges and the block subsidy. The previous relies on visitors situations and might drastically change from each day. The latter, then again, has very particular constraints connected to it.

The block subsidy stays mounted in BTC worth for about 4 years, on the finish of which an occasion known as the Halving cuts it precisely in half. These rewards are additionally given out at a roughly fixed price, that means miners’ each day block subsidy revenue in BTC phrases at all times stays fairly predictable.

Nonetheless, one variable is free to alter, and it’s the USD worth of those rewards. Each time the worth rises, so does the block subsidy income of the miners. That is why the Hashrate tends to see development in bullish intervals.

Bitcoin has been exploring new highs not too long ago, however the Hashrate has apparently stayed muted. The indicator is round 723 million, which suggests it has declined by greater than 4% because the peak. This development might sign that the miners count on the present rally to face an impediment.

BTC Worth

On the time of writing, Bitcoin is floating about $91,900, up over 8% within the final seven days.